Market Update

Last week marked the end of the government shutdown, bringing a brief sense of relief to markets. That optimism faded quickly as several Fed officials pushed back against expectations for a December rate cut, noting that still-solid economic growth could revive inflationary pressures and arguing for keeping rates unchanged. Although the government has reopened, statistical agencies will need time to work through the backlog of delayed data. The Bureau of Labor Statistics is set to release the September jobs report on Thursday, but market attention will be focused on any announcement regarding October’s report where the unemployment rate will be absent because the household survey was not conducted during the shutdown. Still, private-sector data points to a cooling labor market, with companies shedding roughly 11,250 jobs per week in October. The shift in rate-cut expectations has stirred concerns about elevated valuations in AI-related stocks. While most large-cap tech companies have reported results that met or exceeded expectations, the prospect of earlier rate cuts has been a key tailwind for the recent rally. Nvidia’s report is expected on Wednesday, which should offer further clarity on the trajectory of AI investment and growth. Options markets are pricing in a roughly 6.2% move in either direction on the stock, signaling expectations for heightened volatility following the release.

Tariff Cuts

The White House, in response to recent electoral headwinds, is aiming to lower cost pressures on Americans by cutting tariffs and negotiating new trade deals with several Latin American countries. Targeted items by the White House have mainly been coffee, beef, and fruits, as the administration works with countries such as Argentina, Guatemala, El Salvador, and Ecuador to alleviate price pressures for Americans. The trade deals are expected to be finalized within two weeks, with the Argentina framework standing out as the most significant, as it opens a closed economy to U.S. exports, reduces tariffs on certain imports such as pharmaceuticals, and includes a pledge by both countries to improve market access for beef. However, tensions quickly emerged on both sides, with U.S. beef producers warning that increased Argentine imports could undermine their competitiveness. Meanwhile, Argentina faced limits on how broad the agreement could be, as Mercosur, a South American trading bloc, rules restrict member countries from negotiating more than 50 products outside the bloc.

Government Shutdown Aftermath

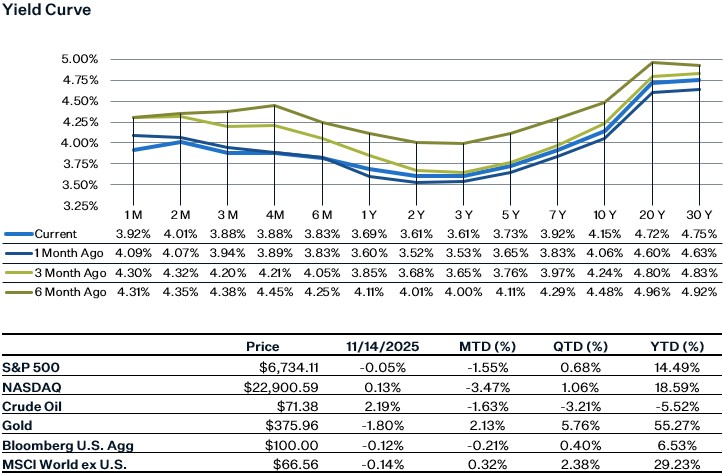

With the longest U.S. government shutdown coming to an end after 43 days, investors are now trying to assess the lingering economic damage that will be felt as we advance. Already, estimates from the CBO indicate that the government shutdown is likely to dampen Q4 GDP by 1 to 2 percentage points and result in a permanent loss of $7 to $14 billion in economic activity. Federal workers have not been paid since October 1st, meaning states such as Virginia and Maryland, with a high percentage of federal employees, have experienced depressed economic activity due to the lack of pay stubs. Secondly, travel disruptions have significantly affected airlines, with over 5,500 flights canceled, resulting in an estimated $2.6 billion in lost revenue over the shutdown and ripple effects on hotels, restaurants, and ridesharing businesses. Consumer sentiment fell 6.2% month-over-month and is down 29.9% year-over-year, reaching its lowest level in three years, as Americans express concerns about personal finances and expectations for future business conditions. Lastly, a lack of economic data has left the U.S. economy more opaque than ever, as the government has missed two monthly jobs reports and the October inflation data, with the latter likely not going to be released. The uncertainty surrounding the economy has made a December interest rate cut less certain than before, with some FOMC members being hesitant to support another cut.

Sources:

https://www.bls.gov/schedule/news_release/empsit.htm

https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html