Market Update

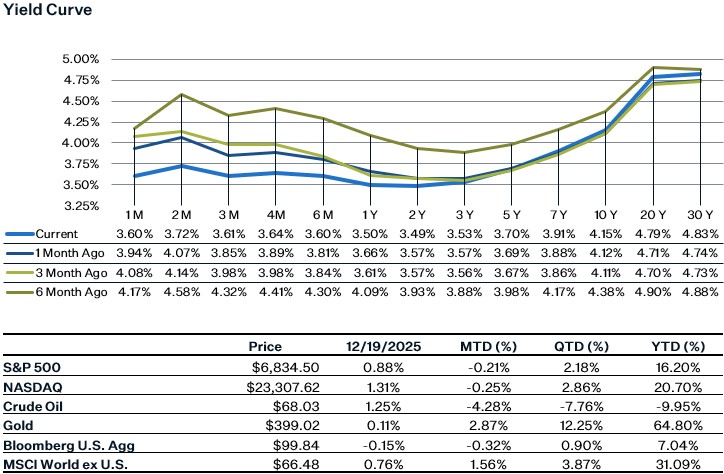

U.S. equities were mixed last week, with the S&P 500 continuing its move down Monday-Wednesday before rebounding higher on Thursday and Friday. The AI scrutiny theme continues to be a main driver. Earnings disappointments from Oracle and Broadcom reignited concerns around the sustainability of AI spending and profits, compounded by reports that Blue Owl will not back a proposed $10bn data center tied to OpenAI raising questions around capital discipline and funding durability. On the economic side, the week was full of noisy data due to the government shutdown. The headline number for the non-farm payrolls report came in higher than expected, but payrolls for August and September both saw downward revisions. Additionally, the unemployment rate rose to 4.6% in November (the highest since 2021), though the increase was due to an increase in the labor force participation rate. While inflation surprised to the downside, the November CPI is likely distorted by shutdown related data issues, including the carry-forward of prices, particularly housing, suggesting true inflation pressures may be understated. This week markets will be watching Tuesday’s release of the advance estimate for U.S. third-quarter GDP. As we approach year-end, this will be our final Monday Minute of the year. Wishing you a wonderful holiday season, and a prosperous 2026.

Inflation CPI

November inflation came in lower than expected, headline CPI slowed to 2.7% yoy and Core CPI to 2.6%, but these figures likely understate true inflation trends. The federal government shutdown disrupted BLS price collection in October, forcing the agency to “carry forward” prior price levels for a large share of CPI components. As a result, roughly one-third of headline CPI and over 40% of core CPI effectively recorded zero price change for October, mechanically biasing reported inflation lower in November. This distortion is particularly pronounced in housing, where rents and owners’ equivalent rent are sampled on a rotating schedule; prices that should have been updated in October were held flat, understating underlying rent inflation and pushing reported housing inflation artificially lower. As a result, the November inflation report should be interpreted cautiously, with both the market and the Fed likely placing greater weight on December’s CPI, when data collection fully resumes. While the inflationary impact of Liberation Day tariffs has been more muted than initially feared, core goods prices have risen, reflecting tariff pass-through. Headline inflation, however, has remained largely range-bound, as higher goods inflation has been offset by continued disinflation in shelter, the largest component of the CPI basket.

November Jobs Report

The details of the November jobs report were mixed – private payroll growth was roughly in line with the 6-month average while average hourly earnings came in weak. Headline employment for November increased by 64k, although job gains continued to be driven by gains in the healthcare and social services sector – adding 64k jobs, in line with the past 12-month average. Manufacturing jobs are now at the lowest level since March 2022, and factory jobs specifically have contracted for the past seven months. Additionally, the number of people employed part time for economic reasons increased to 5.5 million in November, up roughly 20% from September. Another weak point was the average hourly earnings number – which rose only 0.1% for the month, which came in below expectations and is starting to show a downward monthly trend. Annualized figures also show weakness – with annualized average hourly earnings now at 3.5% which is the lowest wage growth since May 2021.

Looking at the unemployment rate, the unemployment rate increased to 4.6% from 4.4% in September, above consensus expectations. While the unemployment rate is now at its highest level September 2021, the increase was due to an increase in the labor force participation rate (from 62.4% to 62.5%). One slightly concerning caveat is that the unemployment rate has now increased for four consecutive months, which is the first time this has happened since June 2009. This month seems to be a particularly noisy month however, so we think the next couple months of data will help provide a better picture. The Fed remaining on pause in January still seems the most likely as of now – job growth in November was tepid but likely not low enough for the Fed to be more concerned than before. The diffusion index also increased to 56.8, meaning that approximately 57% of industries are adding jobs.

Sources:

https://www.bls.gov/news.release/pdf/empsit.pdf

https://markets.jpmorgan.com/jpmm/research.article_page?action=open&doc=GPS-5158595-0

https://www.bls.gov/news.release/pdf/empsit.pdf

https://markets.jpmorgan.com/jpmm/research.article_page?action=open&doc=GPS-5158595-0

https://www.bls.gov/news.release/cpi.nr0.htm

https://markets.jpmorgan.com/jpmm/research.article_page?action=open&doc=GPS-5160321-

https://markets.jpmorgan.com/jpmm/research.article_page?action=open&doc=GPS-5160379-0