Market Update

It was a roller coaster week for the S&P 500 with software monetization concerns being the main story for the week. The broadening theme continued as investors rotated into defensives and cyclicals with the S&P 500 equal weight up 2.3% on the back of capex numbers from Google and Amazon. The launch of Claude Cowork plugins sparked fears that AI could erode traditional software moats by replicating much of the value these companies provide. Investors also grew concerned that software revenue models may need to shift away from per-seat subscriptions, as increased automation could compress margins and reduce the need for human users (you can find a deep dive in the section below). Earnings estimates for next year are still healthy and have not declined, but it is the long-term earnings growth expectations that are being questioned. On top of software business model concerns, earnings results sparked some fears around near-term free cash flow for the mega-cap tech names, as many reported AI capex spending plans significantly higher than consensus expectations. As a result, many of the Mag 7 companies saw a sharp pullback last week – with AMZN, META, and MSFT all falling by over 6% for the week.

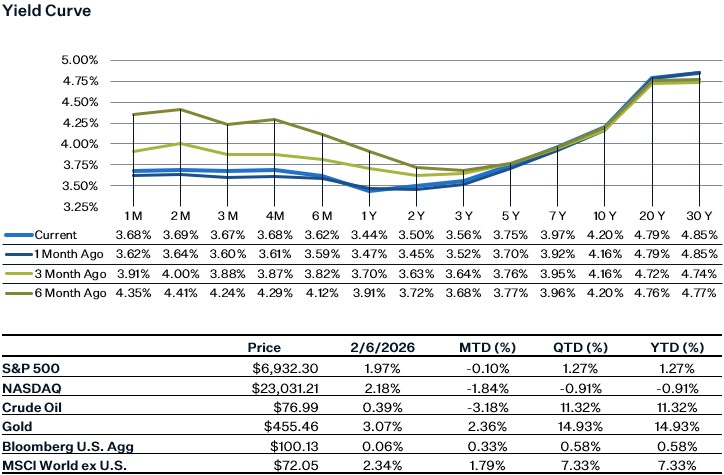

Outside of corporate news, the JOLTS report for December showed a notable drop in job openings. Given signs of labor market weakness that was in the report, the market increased their rate cut probabilities back to 2 cuts this year. Looking to this week, the January jobs report which was delayed because of the shutdown will now be released on Wednesday, and the CPI inflation report comes out on Friday.

SaaS Turmoil

Turbulence right now is ubiquitous in the software industry, with the sector right now being disrupted by the ever increasing presence of AI. A glaring conundrum for the software industry revolves around the seat-per-user business model, as AI-driven productivity gains naturally imply that fewer licenses will need to be issued by these software giants, threatening their top-line growth. Not only is top-line growth being threatened, but these AI tools, especially AI agents, have much higher expenses, as fees must be paid to infrastructure providers, which is now putting pressure on margins. The combination of these two factors, although great for the broader business environment, is a nightmare for companies selling software, as their once-reliable business model and high profitability are now changing. In response to this uncertainty, software companies are either pivoting to a “usage-based model” or charging for both seats and the AI agents used; however, markets are not yet sure how to assess these developments. In addition, large software companies are now adapting by drip-feeding AI features to their customers to prevent them from leaving, and they are also providing the maintenance for the software that would be a headache for customers to solve on their own. In the long term, software companies that offer generic features might be in trouble, but we believe high-quality companies that are dominant in specific tech layers, such as Snowflake in data management or Microsoft in cloud offerings, will continue to be leaders in the space. Lastly, we expect that more of these software firms will begin introducing tools that automate the workflows for employees, and the winners in this segment will be the ones that have models that are both highly accurate and “hallucinate” less than competitors.

JOLTS Report

The JOLTS report for December showed more weakness in the jobs market than anticipated. Job openings for December came in much lower than estimates, with openings falling by over 5% to 6.54 million, the lowest number since September 2020. Job openings fell the most in professional and business services, retail, and finance and insurance industries. On the other hand, elsewhere in the report there wasn’t much of a change. The hiring rate ticked up from 3.2% to 3.3%, while the quits rate and layoffs rate remained unchanged. Given that this data is somewhat stale as it is from December, the January jobs report should provide us with a better picture of the current state of the labor market.

Sources:

https://markets.jpmorgan.com/jpmm/research.article_page?action=open&doc=GPS-5192422-0

https://www.bls.gov/news.release/pdf/jolts.pdf

https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html