Market Update

U.S. equity markets had a volatile week last week, as mixed corporate earnings, combined with Fed news made investors anxious. Tech earnings were mixed - MSFT reported underwhelming Azure growth and guidance, while META reported a much better revenue outlook than expected. AAPL reported substantial iPhone demand, although they noted supply chain issues and component cost increases. Outside of tech, we saw companies still seeing strong AI data center demand – in particular GEV, TT, and CAT which all saw strong earnings results. Additionally, most consumer-related companies noted consumer strength and resilience. In other news, the Fed left rates unchanged on Wednesday, citing economic stability. December PPI came in much higher than expected, although year-over-year it remained unchanged at 3%. The rise was mostly due to higher services prices, while food and energy prices declined. Big news on Friday was Trump’s pick for Fed Chair, Kevin Warsh. Warsh is a previous Fed Governor who served from 2006- 2011, during which he was considered a more hawkish-leaning member. However, some of his comments in recent interviews have skewed more dovish, so it’s unclear how he will lean when he becomes Fed Chair. This week we have more Mag 7 reporting, with GOOGL reporting on Wednesday and AMZN on Thursday. On Friday, we have the BLS jobs report for January, where the unemployment rate is expected to hold steady at 4.4%.

FOMC Meeting

The Federal Reserve left rates unchanged on Wednesday, with the post-meeting statement referring to economic stability as their rationale. Specifically, the statement came across as a somewhat more upbeat and hawkish tone than before – citing economic activity as “solid” and that the unemployment rate has stabilized (compared to the previous statement which mentioned downside risks to employment). There were two dissents however, with both Governor Miran and Governor Waller preferring a 25bp cut. During the press conference, Powell again said that he believes tariffs will be mostly a one-time price increase, and that the services disinflation trend should continue.

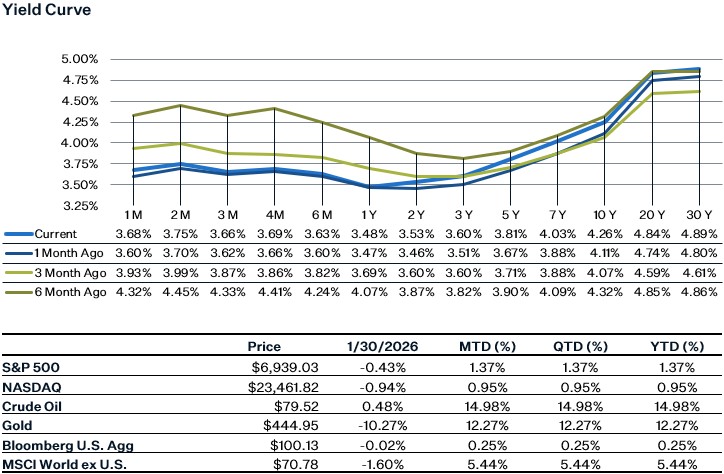

Given the meeting outcome and statements from the Fed, keeping rates on hold for the next couple meetings seems the most likely scenario. Right now, the market is anticipating the first cut for 2026 to be in June. What seems to be more top of mind for investors than the Fed policy rate are the legal challenges and political pressures surrounding the Fed. Several questions during the press conference were aimed at Powell providing some insight into whether he will remain on as a Fed member after his chair term ends, which he continuously declined to comment on. Additionally, the Lisa Cook Supreme Court case is another unknown, although as of now it appears likely that the Supreme Court will reject President Trump’s request to remove her. And don’t forget there is also the DOJ investigation into Chair Powell. Even if nothing comes from these pressures, it still raises the concern that the Federal Reserve may be more susceptible to outside forces than it has been previously.

Producer Price Index (PPI)

December inflation data remained firmer than expected at the producer level. Headline PPI rose 0.5% month over month (3.0% year-over-year), while core PPI increased a strong 0.7% (3.3% year-over-year), marking one of the largest monthly gains in recent years. Based on the combined CPI and PPI data, core PCE inflation for December is now tracking at approximately 0.38% month over month (3.0% year-over-year), keeping inflation meaningfully above the Fed’s target. The strength in PPI reflects continued upward pressure from both goods and services. Core goods prices showed signs of tariff pass-through, while higher margins in services suggest businesses are increasingly able to pass higher costs on to consumers. Together, these trends point to persistent pipeline inflation and support the Federal Reserve’s cautious stance, reinforcing expectations that policy is likely to remain on hold in the near term.

Sources:

https://markets.jpmorgan.com/jpmm/research.article_page?action=open&doc=GPS-5192298-0

https://markets.jpmorgan.com/jpmm/research.article_page?action=open&doc=GPS-5192165-0

https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html

https://www.federalreserve.gov/newsevents/pressreleases/monetary20260128a.htm