Market Update

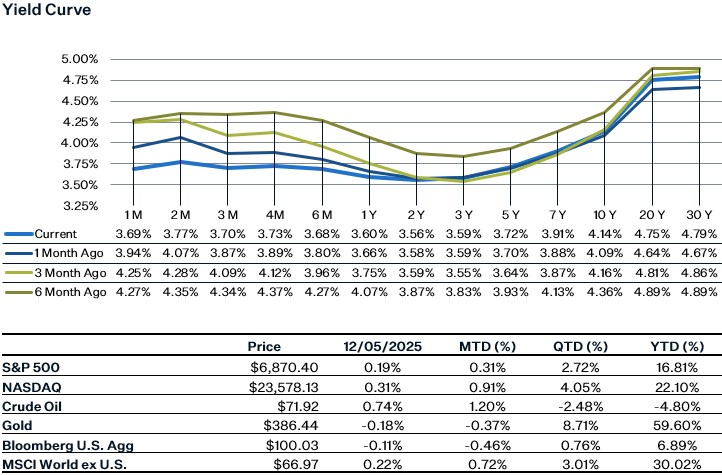

Last week the S&P 500 rose 85bps, moving close to October’s record high of 6,890. Markets were driven by expectations of a rate cut at this week’s December FOMC meeting and growing speculation about a new Fed chair. While not confirmed, Kevin Hassett appears to be the frontrunner, and his support for continued easing into 2026 has added to market optimism. The open question is whether a new chair could build enough consensus within the Board for deeper cuts next year. The September PCE report showed flat real consumer spending (0% month-over-month), reinforcing the view that households were already stretched entering the government shutdown and still contending with sticky inflation. Income data, however, came in firmer: wages, total compensation, and personal

income all rose 0.4%, with wage growth running 5.3% annualized over the past three months. More recent data, solid Black Friday activity and improving sentiment, however, pointed to ongoing consumer resilience despite lingering labor-market concerns. On the jobs front, initial claims fell to 191,000, the lowest in more than three years, indicating employers continue to hold onto workers despite headline layoff announcements. The low-hire, low-fire dynamic persists: layoffs remain limited, but continuing claims near 1.94M highlight that finding a new job is becoming more difficult. Taken together, soft spending, moderating inflation, and a labor market that is cooling rather than cracking strengthen the case for a rate cut this week.

Personal Consumption Expenditure (PCE) September

Core PCE came in exactly as expected at 0.2% month-over-month (MoM) or 2.8% year-over-year (YoY), but the weak spot in the report was flat consumer spending in September, highlighting a stretched household sector heading into the government shutdown. The income data, however, told a different story: wages, total compensation, and personal income all rose 0.4%, with disposable income up 0.3%. Despite labor-market concerns, aggregate wage income has held steady at a 5.3% annualized pace over the past three months, the fastest since May. The savings rate remained at 4.7%, continuing its gradual drift lower. Inflation dynamics were mixed. Headline PCE rose 0.3% MoM (2.8% YoY), and core inflation remains stuck near 3%, where it has hovered for much of the past 18 months. Goods inflation accelerated to 1.2% YoY as tariffs flowed through, the fastest non-COVID increases in decades, though the three-month pace is a more modest 0.3% saar. Services inflation remains elevated at 3.4% YoY, roughly in line with pre–Great Recession norms but still about a percentage point above pre-COVID levels. Supercore (services ex housing) has eased to 3.3% YoY, but its three-month pace has re-accelerated to 3.5% saar, underscoring the persistent stickiness in underlying inflation.

ADP November Employment Report

The November ADP jobs report showed a softening labor market, as the private sector shed 32,000 jobs and wage gains slowed from the previous month. The theme of the K-shaped economy continued in November, as job losses were heavily concentrated among small firms, cutting 120,000 jobs; in contrast, large firms continued hiring, adding 39,000 jobs. The goods-producing sector was particularly hard hit, as manufacturing and construction combined lost 27,000 jobs. However, services fared better, with job losses at 13,000, notable weakness in the IT and pr

ofessional services sectors, while Education and Health services remained resilient. Pay growth eased to 4.4% for job stayers, down from 4.5% in October, while job changers saw their wage gains fall from 6.7% to 6.3%. All of this suggests a continued cooldown in the labor market, but nothing of grave concern as of yet, since unemployment insurance claims remain moderate and initial claims have recently come down.

Challenger November Jobs Cut Report

Announced job cuts cooled in November to 71,321, a 53% decrease from last month's unusually high number, yet the sustained trend throughout this year remains elevated. Year-to-date (YTD) job cuts remain at 1.17 million, which is 54% higher than last year's 11-month time frame, and this marks only the sixth time job cuts have surpassed 1.1 million since 2023. Leading reasons for the job cuts YTD have been DOGE and poor economic conditions, collectively responsible for 538,839 job cuts, but AI, although it has gotten all the attention recently, has been responsible for only 54,694 job cuts. Industries hemorrhaging the most workers continue to be government and technology, with government in particular seeing an eightfold increase from the previous year. Looking ahead, the more concerning trend is the softening in hiring plans, with employers cutting planned additions by 35% from a year ago, bringing them to their lowest level at this point in the year since 2010.

Sources:

https://markets.jpmorgan.com/jpmm/research.article_page?action=open&doc=GPS-5151121-0

https://adpemploymentreport.com/

https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html

https://www.dol.gov/ui/data.pdf