Market Update

The volatile month of October ended with a positive note with the S&P 500 gaining 2.38%. The rally was driven by growing expectations of rate cuts, a one-year tariff truce between the U.S. and China, and stronger-than-expected corporate earnings, particularly from companies benefiting from AI-related growth. Technology led the advance as firms announced new AI partnerships and infrastructure investments, reflected in robust Q3 earnings results. So far, 64% of S&P 500 companies have reported, with 83% beating EPS estimates and overall earnings growing 16% year over year. The strongest contributions came from Technology and Financials, while Consumer Discretionary and Staples lagged with flat or negative growth.

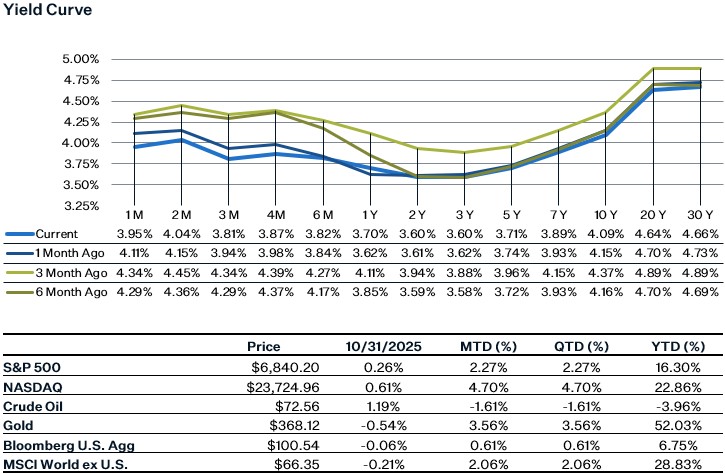

The FOMC lowered the target range for the funds rate by 25bp to 3.75-4% at the meeting last week. In addition, they announced that balance sheet runoff would end at the start of December. The press conference was a bit hawkish as Powell indicated that the policy is not on a preset course, bringing down the probability of a December cut from 90% to 70%. This week several key U.S. economic reports, including construction spending, factory orders, job openings, and nonfarm payrolls, will be delayed due to the government shutdown, however investors will look at private economic data such as ADP on Wednesday for clues on the health of the labor market.

FOMC Meeting

Last week the Fed cut rates by 25 bps to 3.75–4.00%, citing signs of labor market softening. Chair Powell struck a cautious tone, signaling that another rate cut in December is not guaranteed, a shift that pushed market expectations for a follow-up cut from 90% to about 60% by the end of the Q&A session. Despite the ongoing government data blackout, Powell noted that private indicators show little change in inflation or labor market trends over the past month.

The most significant development is the approaching end of QT. Funding pressures have intensified in the repo market, with the Secured Overnight Financing Rate (SOFR) rising to 4.23%, above the Interest on Reserve Balances (IORB) rate of 4.15% over the past month. This reflects a growing shortage of cash relative to the demand for collateral, as banks and money-market funds have become less willing to lend reserves. While the end of QT should help prevent further liquidity drainage, money-market friction may persist. As a result, there are expectations that the Fed could soon introduce Temporary Open Market Operations (TOMO), the same way they did in 2019, to inject short-term liquidity and stabilize funding conditions.

Q3 Earnings – Deep Dive

More than halfway through the Q3 2025 earnings season, S&P 500 results show broad strength but smaller beats than usual. So far, 64% of companies have reported, with 83% exceeding EPS estimates, the highest since 2021, but the average surprise of +5.3% is below historical norms. The blended earnings growth rate has risen to 10.7% year over year, marking the fourth straight quarter of double-digit growth, led by Information Technology, Financials, Utilities, and Materials, while Communication Services remains the main drag. Revenues have also been strong, with 79% of companies beating estimates and overall growth up 7.9%, the fastest since Q3 2022. Tech, Health Care, and Consumer Discretionary are driving most of the upside, while Energy is the only sector in decline. Looking ahead, analysts expect earnings growth of 7.6% in Q4 and to accelerate above 11% in early 2026, with full-year 2025 earnings projected to rise 11.2%. The forward 12-month P/E of 22.9× remains above historical averages, suggesting valuations are rich but supported by continued double-digit earnings momentum.

Jobless Claims

The most recent jobless claims numbers show that layoffs likely remain low but hiring continues to stall out. According to estimates from JP Morgan, initial jobless claims fell to 219k for the week ending October 25th, down from 232k. Despite the overall drop, Maryland has seen initial claims rise, which might be due to the government shutdown. Continuing claims on the other hand increased to 1.96 million from 1.945 million. It’s important to note that while most states have been reporting their jobless claims data during the shutdown, two states (Arizona and Massachusetts) and Washington DC have not been reporting data so these figures are aggregated estimates using assumptions for those geographies.

October Consumer Confidence

The consumer confidence index slipped from 95.6 in September to 94.6 in October, yet the drop was still a positive surprise, as expectations for the index were for it to fall to 93.2. The data shows the so-called "K-shaped" economy, as sentiment weakened notably among consumers under 35 and those earning below $75k, while strengthening among the 35–54 age group and higher-income earners making over $200k. Consumers' central point of concern remained inflation, with 12-month inflation expectations rising to 5.9% this month, up from 5.8% in September. Job concerns persisted for the month, with an uptick in the number of people saying jobs are "hard to get" and expectations that jobs will become harder to get in the next six months. Yet there are signs of optimism, as consumers report improvements in both their current and expected financial situations compared with last month, remaining at relatively high levels throughout 2025 data. In addition, spending plans rose for the month, with consumers stating they plan to buy used cars, travel, and other big-ticket items.

Sources:

https://insight.factset.com/sp-500-earnings-season-update-october-31-2025

https://markets.jpmorgan.com/jpmm/research.article_page?action=open&doc=GPS-5112596-0

https://markets.jpmorgan.com/jpmm/research.article_page?action=open&doc=GPS-5115961-0

https://markets.jpmorgan.com/jpmm/research.article_page?action=open&doc=GPS-5120233-0

https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html

https://www.conference-board.org/topics/consumer-confidence/