Market Update

The S&P 500 ended the week lower as renewed concerns around AI investments resurfaced following earnings from Oracle and Broadcom. Investor unease stemmed from rising capital outlay forecasts, longer timelines for AI investments to translate into revenue, and the increasingly circular nature of some AI-related arrangements. Oracle announced delays in the completion of certain data centers, raising doubts about the timing and magnitude of future AI-driven profits. Looking at the week as a whole, there was a rotation into more cyclical parts of the market, with Materials and Financials sectors the top two performers for the week. Part of the rotation may be due to the Fed’s FOMC meeting on Wednesday, which was slightly less hawkish than some had feared. As expected, the Federal Reserve cut rates by 25bp on Wednesday to 3.5-3.75%. However Powell pointed out several times during the press conference that the labor market is likely weaker than what the data is showing. The committee remains divided amid conflicting data: persistent inflation above the 2% target, a cooling labor market, and growing uncertainty around future Fed leadership and its independence. Looking ahead, this week brings a full slate of economic data, finally. On Tuesday, we have the November non-farm payrolls report where unemployment is expected to remain at 4.4% and retail sales data, followed by key inflation on data on Thursday with the November CPI report.

December FOMC Meeting

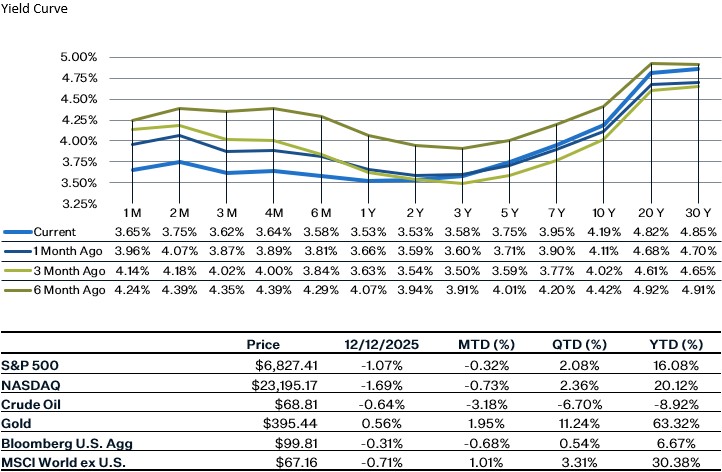

The Federal Reserve cut rates by 25bp for a third consecutive meeting, lowering the policy rate to 3.50–3.75%, but signaled a slower and more uncertain easing path ahead. The decision passed 9-3, highlighting how uncertain the path of interest rates has become. Two members preferred no cut, while one dissented in favor of a larger move, highlighting the challenge of building consensus for deeper easing amid mixed data. The Summary of Economic Projections (SEP) showed only one rate cut in 2026 and another in 2027, highlighting slower easing path. The views among officials remain split - with seven preferring to keep rates unchanged throughout 2026, while eight supported for two rate cuts. Overall, this cut likely sets up the Fed for an extended pause, supported by Powell’s comments and the Fed’s dot plot from their (SEP). Post-press conference, the market’s expectations for rate cuts didn’t change that much, with the market expecting the Fed Funds rate to be between 3-3.25% by year end 2026, a little more dovish than the Fed’s dot plot.

US Labor Cost Growth Slows Down

The annual growth in US labor costs cooled to its slowest pace in four years, with the Employment Cost Index (ECI) rising 3.5% over the 12 months ending in September. Adjusted for inflation, private-sector compensation grew only 0.5%, the slowest pace since 2023, and the public sector not only suffers from similarly slow wage growth but has also been continuously shrinking in size as the administration downsizes the federal workforce. The ECI confirms a softer jobs market, marked by slower hiring and rising layoffs, with workers now pessimistic about future job prospects as the voluntary quits rate reached its lowest level since 2020. From the Fed’s point of view, however, this report might be a positive sign, as it suggests inflation may continue to cool, carving an easier path toward future rate cuts.

Monthly Tariff Revenue Declined for the First Time this Year

In November, government import duties collected totaled $30.75 billion, down from $31.35 billion in October. The decline appears to have been driven by the Trump Administration’s decision to cut import duties on foods not widely produced in the US, such as coffee and bananas, with reductions in beef tariffs also playing a significant role. Although a drop in tariff revenue usually wouldn’t attract much attention, reciprocal tariffs have been a centerpiece of the current administration's policies, as they have proposed using tariff revenue to eliminate income taxes and reduce the national debt. At the moment, tariff revenues have come nowhere close to solving our fiscal issues, with year-to-date tariffs of $236 billion barely covering interest on our national debt, but they have reduced our trade deficit, halving the deficit from one year ago. The Supreme Court challenge on the administration's use of IEEEPA is also threatening future tariff revenue. Although a ruling against the administration would likely prompt a Section 122 pivot to continue tariff collection, it could still threaten trade agreement frameworks already negotiated with other nations.

Sources:

https://www.nbcnews.com/business/economy/trump-tariff-revenue-falls-rcna248671

https://www.federalreserve.gov/newsevents/pressreleases/monetary20251210a.htm

https://www.federalreserve.gov/monetarypolicy/files/fomcprojtabl20251210.pdf