Market Update

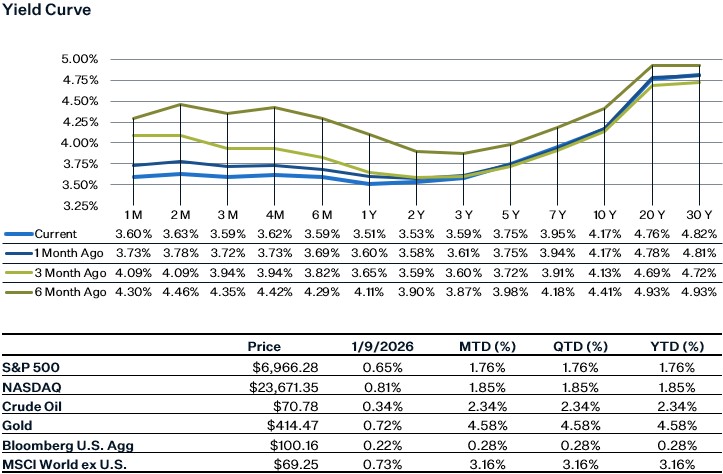

All major US indices ended the first full week of 2026 on a strong note with increased market breadth, as the equal-weighted S&P index outperformed the market cap-weighted index. The rally reflects growing investor optimism as incoming economic data such as the ISM Services Survey climbed to its highest level since October 2024, signaling accelerating business activity. In the beginning of the week, geopolitical tensions were in the forefront due to the U.S.’s capture of Venezuela’s president Nicolás Maduro, however the market’s reaction was mostly subdued as near-term economic impacts are likely to be limited. The December jobs report reinforced the notion that the labor market remains sluggish but still healthy enough for the Federal Reserve to keep rates on hold during their January meeting. As of now, the market is pricing in approximately 50bp of rate cuts by year end, with the first cut in June. This week all eyes will be on the CPI inflation report for December, which comes out on Tuesday.

December Jobs Report

The December jobs report was relatively unexciting, with payroll growth coming in at the low-end while the unemployment rate ticked down a notch. Headline payroll growth for December was 50k, below consensus estimates of ~57k. Additionally, payrolls for October and November were both revised down, for a combined adjustment of -76k. Job growth remains concentrated in healthcare/social assistance and leisure & hospitality industries. The retail trade industry showed weakness all quarter long, declining by 25k in December and 66k total for Q4. The diffusion index (% of industries that are hiring) fell notably, from 55.6 in November to 50.8 in December. Federal employment has weighed on total average payroll growth for the past few months; given that most of the federal job layoffs are likely behind us it should be less of a drag going forward. On a separate note, average hourly earnings rose a trend-like 0.3% for the month, with the year-over-year rate at a healthy 3.8% level.

The most eye-catching data point is likely the unemployment rate, which ticked down to 4.4% from 4.5% in November (which was revised down from the original 4.6% number in the initial release). The main reason for the decline in the unemployment rate however was due to a decline in the labor force participation rate, which fell to 62.4% from 62.5%. One quick additional note on the household survey – response rates for economic surveys have been struggling lately, and the BLS’s household survey hasn’t been immune of this issue. The response rates for the household survey for both November and December were the two lowest response rates ever recorded. While additional responses likely wouldn’t change the overarching story that the data is indicating, it is something to keep in mind and be aware of. Overall, the data for December reinforces the “low hiring, low firing” situation, which likely strengthens the Fed’s justification to keep rates on hold during their January meeting.

Venezuela

The events over the past weekend have heightened both uncertainty and opportunity in the oil market. Although Venezuela holds the world’s largest proven crude reserves its output remains a small fraction of the global market, producing roughly 0.8–1.1 million barrels per day (mbpd), or less than 1% of world supply. Global oil production is about 105 mbpd, with the United States producing around 20 mbpd. Years of sanctions, underinvestment, and decaying infrastructure mean that any meaningful increase in Venezuelan output will take years rather than quarters, even under improved political conditions. Major U.S. and international oil companies, such as Chevron and Exxon Mobil, may benefit from future recovery, but they are likely to remain cautious about committing significant capital until durable political stability, clear legal frameworks, and enforceable contracts are in place. A shift in Venezuela’s political landscape represents a material upside risk to future oil supply. Should stability be achieved and sanctions eased, production could potentially climb well above current levels over time, exerting downward pressure on oil prices. In this context, Venezuela is unlikely to deliver a near-term supply shock, but it remains a significant medium-to-long-term bearish optionality for global oil markets if and when investment and political clarity unlock its reserve potential.

Trump Administration Tackles Housing Unaffordability

The Trump Administration is planning to address housing affordability through a two-pronged strategy: banning financial institutions from purchasing single-family residences (SFRs) and increasing GSE purchases of mortgage bonds by $200 billion. The impact of an institutional ban is likely to be limited in scope, as institutional ownership of SFRs accounts for only 2% to 3% nationwide; however, in large Sun Belt cities such as Atlanta and Charlotte, institutional ownership represents roughly 25% and 18% of all rental homes, respectively. While such a ban would be difficult to implement without congressional approval, rising voter frustration over housing affordability could generate bipartisan support for the legislation. Meanwhile, through increased purchases of mortgage bonds, the administration aims to lower mortgage rates, with the resulting boost in demand potentially leading to a quarter- to half-percentage-point decline. However, unintended consequences could emerge, such as rising home prices fully offsetting the benefit of lower rates, and the depletion of cash reserves, removing the financial buffer these entities have in the event of a financial crisis. Ultimately, although housing affordability may be marginally improved, especially in the Sun Belt cities, these actions do not address the central issue of insufficient housing supply.

October Trade Deficit Falls to the Lowest Level Since 2009

The trade deficit narrowed in October to $29.4 billion, as imports continued their downward trend to the lowest level in nearly two years, while exports maintained a strong upward trajectory. The contraction in the trade deficit can largely be attributed to a surge in gold exports to foreign buyers and a sharp decline in pharmaceutical imports following the administration’s threat of a 100% tariff on overseas drug makers. The administration’s tariffs are clearly influencing how companies allocate capital; however, it remains to be seen whether they will lead to permanent changes in supply chains, as these measures are currently implemented under the International Emergency Economic Powers Act (IEEPA). With the Supreme Court expected to rule on the use of IEEPA in the near future, the administration would likely pivot to other emergency authorities to maintain tariffs if necessary. Nevertheless, a potential strike down of IEEPA would highlight the fraught nature of these tariffs and may prompt companies to delay making permanent investments in the US, as nothing has yet been cemented in Congress. In short, the shrinking trade deficit may provide a short-term boost to GDP growth, but factors such as a weakening dollar driven by decreased capital inflows could pose inflation risks going forward.

Sources:

https://markets.jpmorgan.com/jpmm/research.article_page?action=open&doc=GPS-5172238-0

https://www.bls.gov/news.release/pdf/empsit.pdf

https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html

https://markets.jpmorgan.com/jpmm/research.article_page?action=open&doc=GPS-5166762-0