Market Update

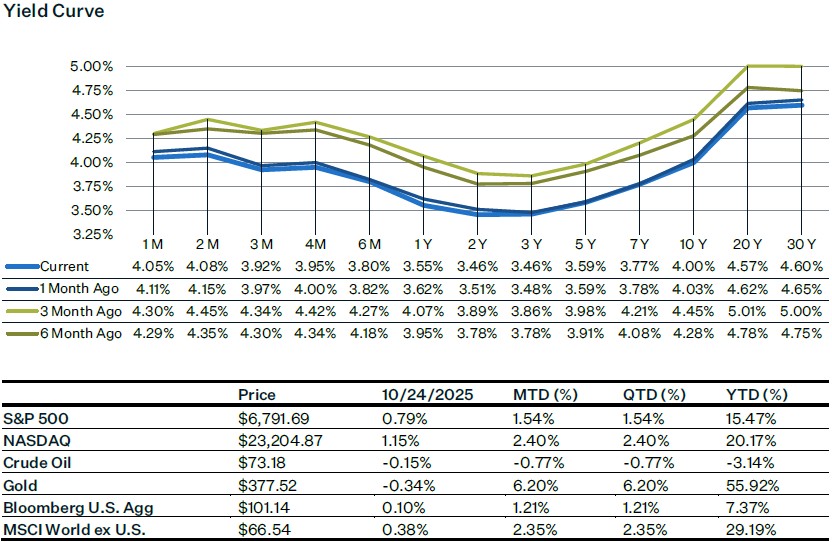

U.S. equity markets had another strong week, with the S&P 500 ending the week up 1.92%. Investors seemed to focus on strong Q3 earnings and cooler than expected inflation, and dismiss volatile trade headlines such as President Trump’s announcement that the U.S. is ending trade negotiations with Canada. Main takeaway from the September inflation report is that Core CPI came in lower than estimated, increasing 0.2% for the month (versus a 0.3% estimate), which brings the year-over-year number down to 3% (from 3.1% the previous month). This all but confirms that the Fed will cut rates by 25bp this week, and for now it is extremely likely that they will cut rates again in December. What is now the bigger question is how many cuts the Federal Reserve will make in 2026. The market is currently pricing in 100bp of easing, which could mean four 25bp rate cuts for 2026. Of course, the economic backdrop going into 2026 is still fragile and uncertain, so easing expectations could significantly change next year. This week expect markets to be focused on the “Magnificent 7” earnings, with AAPL, AMZN, GOOGL, META, and MSFT all reporting this week.

Q3 Earnings – So Far

The Q3 earnings season is entering its peak, with 44% of the S&P 500’s market cap reporting this week, including major AIand hyperscaler names such as Microsoft, Google, Amazon, Meta, and Apple. Investor focus will center on AI-related capital expenditure guidance, which is expected to be revised higher from the current 35% next-12 months consensus. So far overall earnings results have exceeded expectations: 83% of companies have beaten earnings estimates and 77% have surpassed revenue forecasts, with two-thirds delivering double beats. Earnings surprises are averaging 9.6%, led by strong performance in Technology, Financials, and Healthcare. AI-related firms continue to stand out, posting earnings growth of 52% and revenue growth of 13%, compared to 13% and 7% for the rest of the S&P 470. Guidance trends remain constructive, with 55% of companies raising full-year outlooks and only 13% lowering them, a notable improvement from Q1. Within sectors, Financials have seen 86% of firms beat EPS despite lingering concerns over NDFI (Non-Depository Financial Institutions) loan exposure, while tariff-sensitive industries such as autos have benefited from reduced tariff headwinds, with GM and Ford both lifting guidance.

CPI September 2025

Main takeaway is that Core CPI came in below consensus, increasing 0.2% for the month (versus 0.3% expectations), which brings the year-over-year rate (YoY) down to 3%. Headline inflation numbers came in cooler as well, increasing 0.3% for the month with the YoY headline figure at 3.0%. The primary contributors to the headline CPI increase were higher gasoline prices, which rose 4.1% for the month. Goods prices were tame, mainly due to a slowdown in used-car prices, but on the other hand, certain tariff-sensitive areas such as apparel increased at their fastest rate in over a year. Of particular note in Core was the ongoing slowing in shelter inflation, especially in owners equivalent rent, which rose just 0.1% for the month, the lowest since 2020. Rent inflation slowed as well to 0.2%, the slowest pace since early 2021. The report strengthens the case for additional rate cuts from the Fed to support a softening labor market.

US – Australia Rare Earths Deal

On Monday October 20th, the U.S. and Australia announced a joint effort to increase production of rare earths and other critical minerals, aiming to reduce China's dominance in the market. These minerals are essential for technologies such as semiconductors, defense equipment, and electric vehicles. The agreement aims to expand mining and processing operations in Australia, home to the world's fourth-largest reserves, with the U.S. pursuing equity-like stakes in the beneficiaries. At the same time, the two countries have been closer in linking their military alliances, with Australia agreeing to purchase $1.2 billion worth of underwater drones and $2.6 billion worth of Apache helicopters. Friction persists however as the U.S. continues to impose a 10% tariff on Australian goods, and Australia maneuvers its ties with China, its largest trading partner.

Sources:

https://markets.jpmorgan.com/jpmm/research.article_page?action=open&doc=GPS-5113918-0

https://markets.jpmorgan.com/jpmm/research.article_page?action=open&doc=GPS-5111573-0

https://markets.jpmorgan.com/jpmm/research.article_page?action=open&doc=GPS-5111388-0

https://www.bls.gov/news.release/pdf/cpi.pdf

https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html

https://www.bloomberg.com/news/articles/2025-10-20/trump-signs-agreement-on-critical-minerals-with-australia?embedded-checkout=true