Market Update

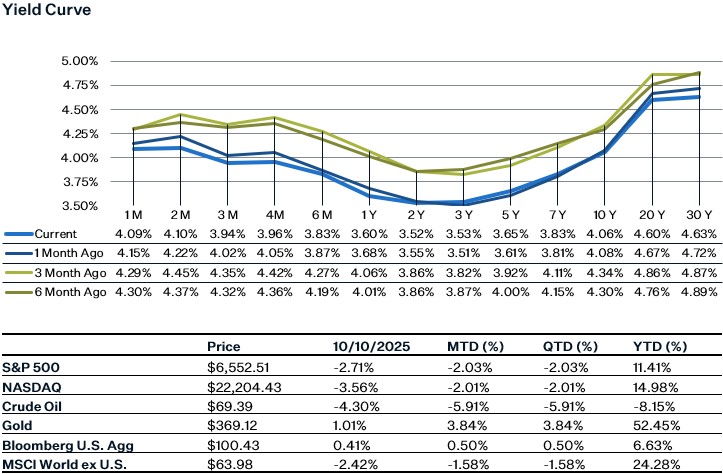

U.S. equity markets ended the week down and experienced a sharp pullback on Friday, as there was a sharp escalation in trade tensions between the U.S. and China which caught investors off guard. The S&P 500 had its worst day since early April when the “Liberation Day” tariffs were revealed. The sudden rise in tensions came Friday morning as President Trump declared that China is being “hostile” regarding rare earth export controls and threatened to impose massive tariffs on China. Trump further intensified the tensions in the afternoon when he announced 100% tariffs on Chinese products beginning November 1st or sooner. On top of this shock, the government shutdown continues with little progress towards a resolution. This is starting to worry investors as they have been forced to rely on alternative data sources to get a gauge of the economy, and many of them are not great substitutes for federal data. The BLS announced that they plan to release the CPI report for September on October 25th, which would give the Fed time to analyze inflation data before their FOMC meeting on the 29th. Q3 earnings season kicks off this week on Tuesday when many of the large banks report.

Q3 Earnings

For Q3, the estimated year-over-year earnings growth rate for the S&P 500 is 8%, with the Information Technology and Utilities sectors projected to deliver the strongest earnings growth. Tariffs were likely a bigger headwind to earnings in Q3 than Q2, so that will likely be a main focus on earnings calls as investors try to get companies to quantify the impact. Consensus is expecting the “Magnificent 7” earnings growth to slow dramatically compared to Q2, giving these companies a low bar to beat expectations. Besides tariffs, the recurring themes of consumer resilience and AI spend/monetization will likely remain as the main drivers of sentiment.

Gold

Gold has extended its rally as investors seek safety amid mounting macro and geopolitical uncertainty. Renewed U.S. and China trade tensions, the ongoing government shutdown, and rising political risks across Europe and Asia have fueled a flight to quality, sustaining strong safe-haven demand. Over recent years, much of the support has come from central-bank accumulation, particularly from countries like China aiming to diversify away from the U.S. dollar. Global central-bank reserves have now surpassed 36,000 tons, highlighting this structural trend.

While purchases have moderated to 700–800 tons annually (down from 1,000 tons in 2024 but still well above the ~400-tonne pre-2022 average), central banks continue to provide a firm floor for gold prices. Near-term performance, however, is increasingly driven by investor demand, especially through ETF inflows, underpinned by lower real yields, dollar weakness, and persistent inflation-hedging demand. These forces reinforce gold’s appeal as a long-term store of value, though with positioning now elevated, short-term consolidation risks remain, particularly if upcoming inflation data or Fed communications temper expectations for policy easing.

US Consumer Sentiment

The consumer sentiment index fell slightly from a reading of 55.1 in September to 55.0 in October, which marked the lowest figure in five months. Annual Inflation expectations changed little, going from 4.7% in September to 4.6% this month, and long-term inflation expectations remained steady at 3.7%. At the top of consumers’ minds remains the issue of high prices and weakening job prospects, as 63% of consumers expect a rise in unemployment compared to just 37% at the same time last year. High prices have been weighing heavily on durable goods, as buying conditions for them remained at their lowest point since 2022 due to tariff worries.

US Weekly Jobs Claims

Initial claims for state unemployment, excluding Hawaii and Massachusetts, reported an increase in the week ending October 4th, going to 235K from 224K the week prior. Meanwhile, continuing jobless claims increased from 1.92 million to 1.93 million, which may provide insight into the possible spillovers from the government shutdown. For context, during the first week of the 2013 and 2018 government shutdowns, initial jobless claims increased by about 15,000 and 10,000, respectively. This means that the 11K increase experienced during the current shutdown is roughly in line with previous figures, and nothing alarming has yet occurred. Historically, claims related to the shutdown are quickly reversed once the government reopens.

Sources:

https://markets.jpmorgan.com/jpmm/research.article_page?action=open&doc=GPS-5076346-0

https://www.sca.isr.umich.edu/

https://markets.jpmorgan.com/jpmm/research.article_page?action=open&doc=GPS-5101345-0