Market Update

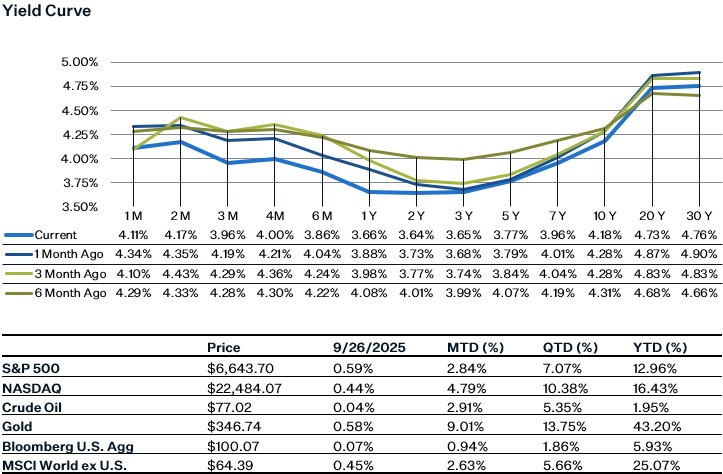

U.S. equity markets ended the week lower, as the rally we saw on Friday wasn’t enough to recoup the losses from earlier in the week. Major indices declined for three straight days last week despite solid economic data (upward GDP revision via boost from consumer spending and another pullback in jobless claims). The better than anticipated data prompted investors to worry that the current economic environment might not need two additional cuts from the Fed this year. We saw this being reflected in the Fed Funds futures prices, with odds of two more rate cuts by year-end falling to 60% on Thursday (from 80% the prior week) before an inline core PCE number on Friday increased the odds to 65% by the end of the day. But, if growth remains strong, it is likely that the 10-year yield will stay close to 4% and the valuation tailwind from the Fed cutting cycle may be less pronounced going forward. After a relatively quiet period on the trade front, President Trump announced last week a set of sectoral tariffs on imports of patented drugs, heavy trucks, and select furniture products effective October 1st. This week we have the September jobs report on Friday, however a possible government shutdown could impact the release date of the report. This jobs report will play a crucial role in the Fed’s decision on whether to cut interest rates at the October FOMC meeting.

US Economy

The U.S. economy expanded at a revised 3.8% annualized pace in Q2, above the initial 3.3% estimate and a strong rebound from the prior quarter’s contraction. Growth was driven by resilient consumer spending of 2.5% and a 7.3% surge in business investment, led by record data center outlays and the strongest intellectual property spending since 1999. Additional support came from rising business equipment orders, while the labor market remained firm as jobless claims fell to their lowest level since mid-July, signaling limited layoffs despite softer hiring trends. Corporate profits, however, rose just 0.2% in the quarter, underscoring a weaker earnings backdrop than earlier estimates. This dynamic highlights how companies have, for now, largely absorbed higher costs from tariffs rather than passing them on to consumers.

PCE

Core PCE rose 0.23% month-over-month in August, keeping the year-over-year (YoY) pace at 2.9%, the highest since February and stuck in the high-2% range seen since early 2024. Goods prices turned positive (up 1.1% YoY), largely reflecting tariff effects, while services inflation stabilized at 3.5% YoY after drifting lower earlier in the year. On the demand side, real consumer spending rose 0.4% month-over-month in August, supported by durable goods (+0.9%, including an 8% surge in software sales) and steady services (+0.2%). This implies a 3% annual growth rate for 3Q, above prior forecasts. However, spending is rising faster than income, nominal spending grew at a 7.1% annual rate over the past three months versus 3.6% for wages, pushing the savings rate down to 4.6%, near multi-year lows. This divergence signals that while consumption is currently strong, its sustainability hinges on an improvement in job growth.

New Home Sales

August new home sales posted a huge surge for the month, up over 20% month-over-month reaching 800k. This monthly gain is way above the average that we’ve seen the past few years and the highest sales we’ve seen since January 2022. Sales were particularly strong in the Northeast (+72%) and South (+25%) regions. New home sales were also revised up slightly for June and July. The main driver behind the large surge in new home sales is unclear. Mortgage rates have been declining, but most of the decline has been in September. Given that we saw such strength in August and that rates have fallen this month, we’ll likely see another strong sales number in September.

Sources:

https://www.census.gov/construction/nrs/pdf/newressales.pdf

https://markets.jpmorgan.com/jpmm/research.article_page?action=open&doc=GPS-5091190-0