Market Update

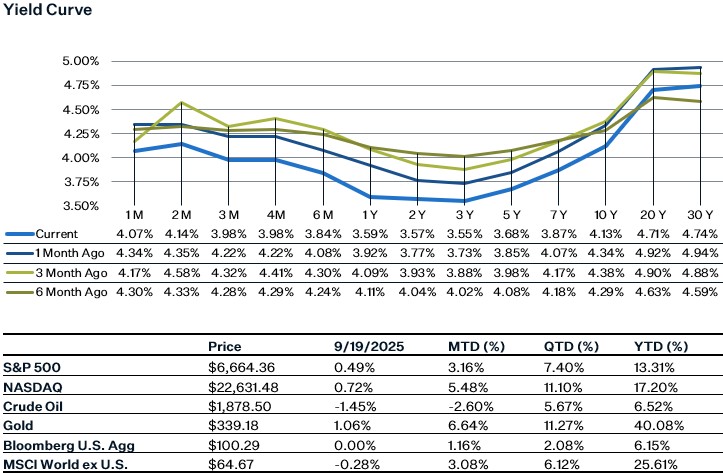

U.S. equities posted strong gains again last week as the resumption of monetary policy easing and encouraging economic data (healthy retail sales and lower jobless claims) were the main positive tailwinds. On Wednesday, the Federal Reserve cut rates by 25bp, with Powell focusing on the weakening labor market. This cut is likely the first in a series of cuts given the median dot shows three cuts this year. Despite the rate cut, Treasury yields increased across the curve in response to better growth expectations. Optimism appears to be running high in the market given the increase in valuations across the market. Expectations of only temporary labor market softening are likely part of the reason for the overall positive sentiment. Initial jobless claims fell by 33k, but one week of decline isn’t the same as a downward trend. Besides continued labor market weakening, the biggest potential risks to the market right now are AI monetization/productivity skepticism and a prolonged pick-up in goods inflation.

Retail Sales

Retail sales rose 0.6% month-over-month (MoM) in August, above expectations and matching July’s growth. Sales ex-autos were up 0.7% MoM as vehicle sales came in softer in August than July. Overall, the report suggested a healthy consumer as there was broad strength across categories. Specific categories worth highlighting include nonstore/online sales which increased 2% for the month and was the strongest increase since September 2024 as well as a 0.7% increase in food/drinking places. Some caution that this strength could be temporary due to favorable weather and a strong back to school shopping season, but regardless the latest retail data isn’t showing weakness.

September FOMC Meeting

As expected, the Federal Reserve cut their policy rate on Wednesday by 25bp, to 4-4.25%. The main reason for lowering rates was the fact that downside risks to employment are rising while inflation is relatively stable. Looking at the updated Summary of Economic Projections (SEP), the changes made for 2025 were an increase in real GDP from 1.4 to 1.6% and a change to their rate cut forecast. The SEP added one more rate cut for 2025, lowering the projected year-end range to 3.5–3.75% versus June’s 3.75–4.0%, reflecting the Fed’s heightened concern over the labor market. Looking at the rate path, the FOMC is almost split on whether they think 2 more cuts or 1 more cut is appropriate, as the SEP shows 2 more cuts by a narrow 10-9 margin.

During the press conference, Powell described the cut as a “risk management” cut, suggesting that he thinks the economy is still in decent shape but labor market risks are clear. Powell offered no clear forward guidance, instead emphasizing a meeting-by-meeting approach as macro uncertainty stays elevated. Markets continue to expect two additional cuts by year-end.

Sources:

https://www.census.gov/retail/sales.html

https://www.federalreserve.gov/monetarypolicy/files/fomcprojtabl20250917.pdf

https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html