Market Update

After concerns around AI investments and elevated valuations for the “Magnificent 7” caused markets to pullback early in the week, U.S. markets reversed on Friday posting strong gains for the day as Fed Chair Powell’s Jackson Hole speech fueled expectations for a rate cut in September. Investors took Powell’s speech at Jackson Hole as more dovish than expected, with Powell noting that risks may have shifted to prioritizing labor market weakness. Now, it will be up to the data to determine the pace and the depth of the cuts. Outside of Powell’s speech, focus last week was on retail earnings and the state of the consumer. Overall retail earnings showed that the consumer remains in decent shape, but consumers continue to prioritize spend on staples over discretionary goods and most of the strength is coming from off price retailers as shoppers look for deals. On the trade front, the US and EU announced a new trade agreement - with the main positive takeaways being tariffs on EU pharmaceuticals, lumber, and semiconductors will be capped at 15% and that the US is expected to reduce auto tariffs from 27.5% to 15%.

Powell’s Jackson Hole Speech

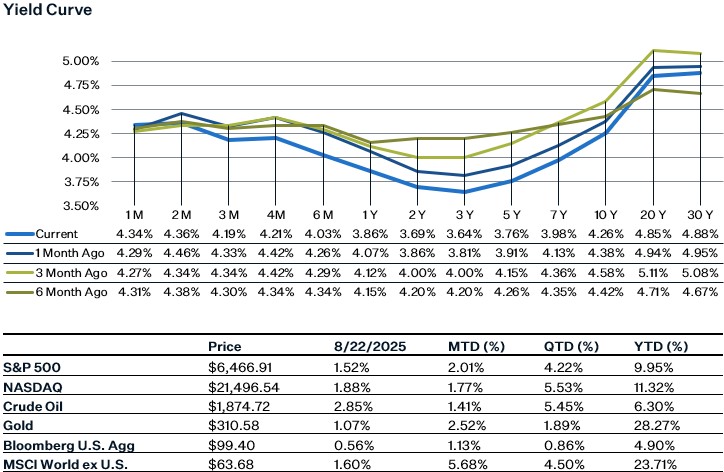

Fed Chair Powell’s remarks from Jackson Hole were welcomed by investors, as the main takeaway was that the Fed may need to adjust monetary policy to support the weakening labor market. Powell noted that “downside risks to employment are rising” and that growth has slowed significantly from 2024 largely due to a pullback in consumer spending. Additionally, Powell suggested that while tariff impacts are showing up in consumer prices, they may be short-lived and one-time price increases. Given these dovish comments, the market increased the odds of a rate cut in September to 83% as of Friday, up from 75% on Thursday.

PMIs

Flash PMIs came in strong across the board, with output, new orders, and hiring all pushing toward multi-year highs. The all-industry output index hit 55.4, matching its best level in over three years, as both manufacturing and services showed momentum and even export orders held up despite trade tensions thanks to a softer dollar. The catch is inflation: tariffs were frequently cited as a driver of rising costs, and both input and output prices moved higher, with the all-economy output price index now at its highest level in three years, well above pre-COVID. By contrast, the Philadelphia Fed survey was more downbeat, with the ISM-weighted composite slipping back into contraction at 49.7 from 54.6. Even so, it reinforced the inflation story, with prices paid and received still elevated. Interestingly, while 71% of firms expect competitors to raise prices within three months, that’s down from 86% back in May, pointing to pricing pressures that remain sticky but not accelerating further.

Sources:

https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html

https://www.federalreserve.gov/newsevents/speech/powell20250822a.htm

https://markets.jpmorgan.com/jpmm/research.article_page?action=open&doc=GPS-5065006-0

https://markets.jpmorgan.com/jpmm/research.article_page?action=open&doc=GPS-5064480-0