Market Update

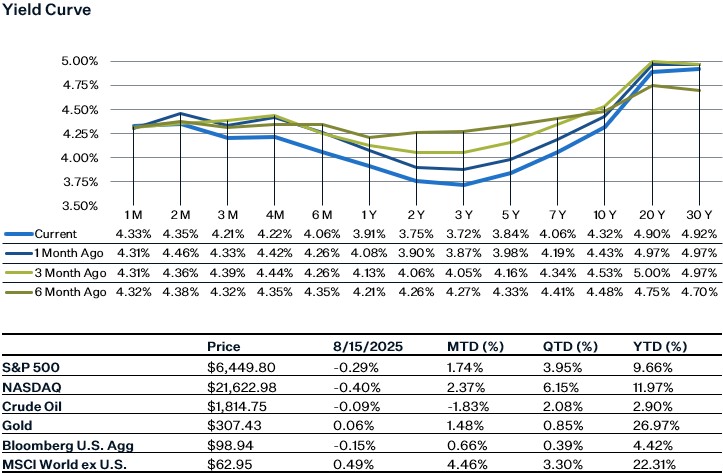

U.S. markets ended the week up again last week, as the latest inflation report didn’t change investors’ expectations that the Federal Reserve will cut rates in September. The inflation picture is a little murky with the headline CPI coming in line but Core CPI and PPI coming in above expectations. The increase in the July PPI was largely driven by services prices. Additionally, the retail sales data on Friday suggested that the consumer remains in decent shape, but the surveys suggest they don’t feel that way with rising inflation concerns lowering the University of Michigan Consumer Sentiment by 3.1 points to 58.6. It was a mostly quiet week on trade news, as President Trump extended the US-China tariff truce for another 90 days. President Trump did suggest that semiconductor tariffs could be coming soon, however specifics have yet to be announced. This week, attention turns to the Jackson Hole symposium, where Fed Chair Powell will likely strike a cautious tone. Markets are pricing in a 25bp rate cut in September, largely due to a softening labor market, though inflation remains above the Fed’s 2% target, complicating the path forward for policy easing.

CPI Inflation July

CPI numbers for July were mixed but mostly in line with expectations. Headline CPI rose 0.2% month-over-month (MoM) or 2.7% YoY, unchanged from June. Core CPI came in at 0.3% MoM and 3.1% YoY, slightly above forecasts and higher than June’s 2.9% YoY pace. The uptick in core was driven mainly by volatile categories such as airfares and used car prices, while goods inflation was cooler than feared, suggesting that companies are possibly absorbing some cost pressures in margins. While tariff-impacted goods saw some volatility in July, most goods categories have posted gains over the past three months, though the increases have been softer than feared. On the other hand, core services ex-shelter or “supercore” inflation rose 0.5%, the largest increase since January. Despite sticky inflation and a hotter core print, markets for now are expecting a September rate cut as the Federal Reserve will likely shift their focus to labor market softness.

Sources:

https://markets.jpmorgan.com/jpmm/research.article_page?action=open&doc=GPS-5058613-0

https://www.bls.gov/news.release/pdf/cpi.pdf

https://www.census.gov/retail/sales.html

https://www.sca.isr.umich.edu/