Market Update

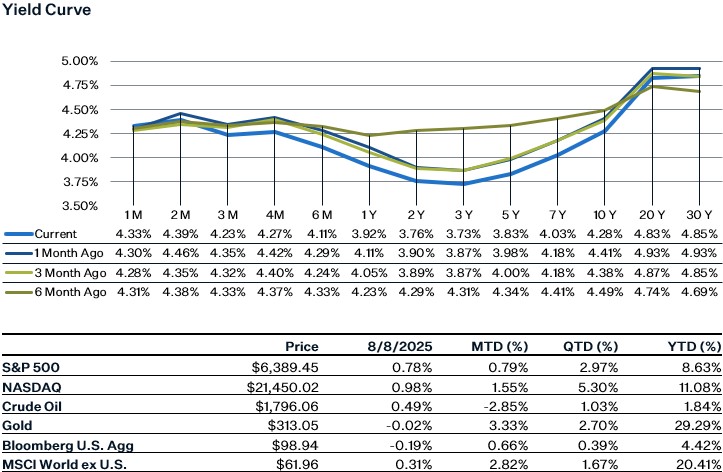

Last week was a quiet week in terms of economic data, with the market seemingly focusing its attention on earnings and tariff news. The S&P 500 bounced back following the previous week’s much weaker than expected jobs report, as better than expected earnings helped ease investors’ tension. We also got some dovish comments from the Fed, which have kept rate cut probabilities for September anchored around 90%. Despite better-than-expected earnings, macro uncertainty remains elevated given negative effect on hiring and growth, the policy shift in trade, spending, and immigration. Inflation has remained controlled but tomorrow we get a fresh CPI print for July and a chance to see if the high cost of tariffs are being passed onto the consumers.

Q2 Earnings Update

With almost all of S&P 500 companies having reported Q2 earnings (90% reported), corporate earnings showed strength yet again despite economic uncertainty. 81% of S&P 500 companies that have reported beat on earnings, above the 5-year average of 78%. The year-over-year earnings growth rate is estimated to be 11.8%, much higher than the quarter-end estimate of 4.9%. Technology, Financials, and Communication Services are reporting the highest overall earnings growth this quarter, while Energy and Materials are reporting negative growth. Profit margins remain surprisingly resilient, with the net profit margin estimated to be 12.8%, above Q1’s margin of 12.7%. One note of caution is that most of the tariffs weren’t in effect during Q2, so any meaningful margin deterioration likely wouldn’t show up yet. In terms of Q3 guidance, 38 companies have issued negative guidance so far while 40 have issued positive guidance.

Besides the overall numbers, there are two interesting takeaways from this earnings season. For one, companies that have disappointed are being punished significantly more than the prior 12 months. The number of stocks that have fallen 10% or more on the day of their earnings disappointment so far this quarter is 38. This is much higher than the average from Q1 2024 to Q1 2025, which is roughly 20 stocks. Almost in contrast to this, companies appear optimistic as the number of companies that have used the word “recession” in their earnings calls this quarter is 16, much lower than the 5-year average of 74 and 10-year average of 61. Overall it appears that AI and tariff mitigation have been the bright spots in earnings, but macro uncertainty remains elevated.

July Services Activity

Services activity data for July gave us a mixed picture on the economy, as the ISM survey showed notable weakness while the PMI survey continues to show strength. Looking at the ISM data, the ISM Services Index fell to 50.1, which is still in growth territory albeit barely. Employment declined for the second straight month, and input prices increased to the highest level since October 2022.

On the other hand, the PMI survey showed that the services business activity index rose to 55.7 in July, which is about the average level of growth that we saw in the second half of last year. New orders improved as well last month. In both surveys, tariffs were widely cited as a concern, with companies mentioning that they were passing on some of the tariff costs to customers.

Sources:

https://www.morningstar.com/economy/july-cpi-report-forecasts-show-continued-tariff-driven-inflation

https://markets.jpmorgan.com/jpmm/research.article_page?action=open&doc=GPS-5049685-0