Market Update

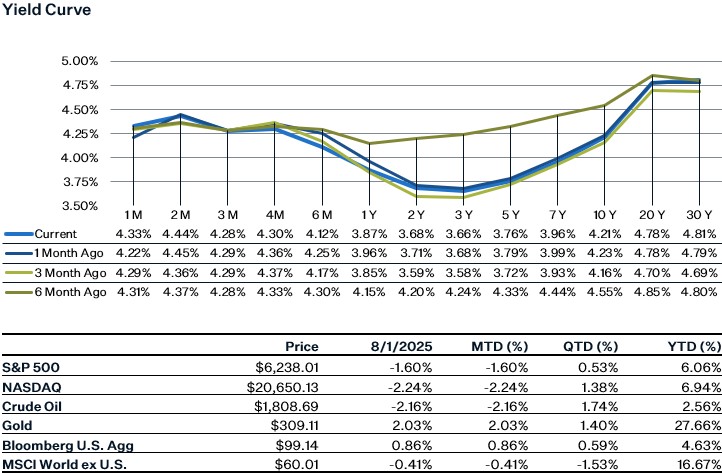

A heavy week of economic and policy developments ended with the S&P 500 ending the week down 2.36%, as the data increasingly pointed to a slowing U.S. economy. The most notable disappointment came from Friday’s jobs report, which not only showed modest hiring but also included a sharp downward revision of 258,000 jobs over the prior two months. This dragged the three-month average payroll gain to just 35K, its weakest pace since the recovery began. In response, investors shifted into Treasuries, sending the 2-year yield down to 3.68%, the 10-year yield to 4.23% and pushing the odds of a Fed rate cut in September to 88%. Last week we also saw Core PCE holding steady, rising 0.3% for the month or 2.8% year-over-year. While consumer spending also rose 0.3%, flat real disposable income hinted that households may be hitting a spending ceiling. At the same time, early signs of tariff-related inflation are beginning to show up in goods categories like appliances, furniture, and computers. On the growth front, GDP rebounded in Q2 to 3% after a -0.5% decline in Q1. However, both quarters were distorted by swings in trade data due to front-loading behavior. Smoothing these effects and looking at the average, the underlying annualized growth rate is closer to 1.25%. More importantly, final sales, an indicator of domestic demand, rose just 1.1%, down from 1.5% in the previous quarter. With a backdrop of a slowing economy, as seen in the job numbers and below potential GDP growth rate, a rate cut is looking more likely as the Fed is likely to shift their focus to the labor market despite the tariff induced inflation.

July FOMC Meeting

As expected, the Federal Reserve kept rates unchanged on Wednesday at 4.25 – 4.5%. Of interest was the fact that two voting members dissented today’s decision, both of whom were appointed by President Trump. The last time two Federal Reserve Board of Governors dissented was over 30 years ago in 1993. During the press conference, Chair Powell noted that the labor market remains stable but downside risks remain. In terms of inflation, he pointed out that headline and core PCE inflation are little changed since the beginning of the year, but that the drivers of inflation have changed have shifted. Goods prices have been driving inflation lately due to tariffs, while services inflation has been falling. The market initially lowered their expectations for a rate cut in September after the press conference, only to completely reverse course on Friday and price in a cut in September and at least one more before the end of the year.

July Jobs Report

The July jobs headline number came in weaker than expected, with employment rising 73k for the month, below consensus expectations of 110k. Additionally, employment in May and June was revised down by a massive 258k, the biggest two-month downward revision since April 2020. With the revisions, employment for May increased only 19k and employment for June was a measly 14k. The downward revisions were in both the government sector and the private sector.

Looking at the details for July, government jobs fell by 10k and goods producing employment fell by 13k. So the only increase in employment came from services industries, and yet again most of the job gains came from healthcare and social assistance (+73k) which is a more defensive service industry given that demand is relatively inelastic for these types of services. Besides that, the only industries that experienced any notable increase were retail trade (+16k) and financial activities (+15k). Factory jobs declined by 11k last month and are down by 33k since the beginning of the year. The payrolls diffusion index increased in July to 51.2 but its three-month average remains below 50, well below its pre-covid average of 56.5 in Q4 2019.

The unemployment rate ticked up to 4.2%, due to a decline in employment and a decline in the labor force. Interestingly, the increase in the number of unemployed came all from new entrants to the labor force, with new entrant unemployment increasing by 275k which is the largest monthly increase there has ever been since data began for this figure back in 1967. This could suggest that AI is starting to have a notable effect on entry-level employment, but it’s too early to make that conclusion. Average hourly earnings increased 0.33% month over month in July, in line with expectations. The weaker report for July along with the prior months downward revisions significantly increases the odds of a rate cut in September, as growth concerns are likely top of mind for the Federal Reserve now.

Personal Consumption Expenditure (PCE) Index

In June 2025, inflation picked up again, with both the headline and core PCE indexes rising 0.3% for the month. Core PCE, which the Fed watches most closely, is now running at 2.8% year-over-year, its highest level this year. Even with prices rising, consumer spending barely moved, increasing just 0.1% after adjusting for inflation, while real disposable income was flat. The main driver behind the uptick in inflation was goods prices, which now reflect the impact of recent tariffs. Items like appliances, computers, and furniture saw notable price jumps as companies began passing those higher costs on to consumers. On the flip side, service categories like airfares and hotels declined, helping to partially offset the rise in goods.

Sources:

https://www.bls.gov/news.release/pdf/empsit.pdf

https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html

https://markets.jpmorgan.com/jpmm/research.article_page?action=open&doc=GPS-5047072-0