Market Update

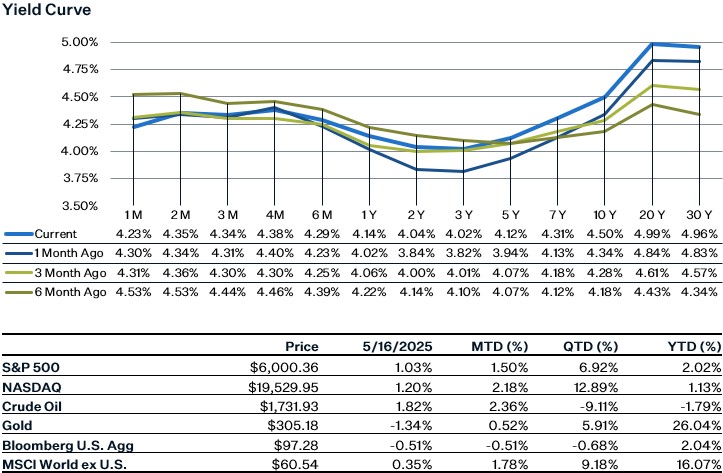

U.S. markets experienced strong returns last week, mostly supported by the potential positive news regarding the trade deal with China and a healthy BLS jobs report. The positive jobs report on Friday caused the 10-year treasury yield to bounce back to 4.5% as investors likely raised their growth forecasts. However, there was some softness underneath the surface with some sizable downward revisions reflecting a cautious hiring environment. In terms of other news, the ISM Services Index fell into contractionary territory and new orders fell to the lowest level since December 2022. Prices paid for services firms also rose to the highest since November 2022. The market seemed to brush off this downbeat hard data and focus more on the hard data that showed resilience in the labor market. This week all eyes will be on the inflation report that comes out on Wednesday. We’ll likely see some more tariff pass-through for the month of May but it’s still too early to see the full impact given the tariff pauses that are in place right now.

May Jobs Report

Nonfarm payrolls increased by 139k, above consensus estimates of 125k. Job growth for April and March was revised down however, which brings the three-month average to 135k, a still healthy number. Looking at the industry details though shows some signs of weakness, as the increase in employment was narrowly based. Health care and social assistance accounted for 78k of the jobs created last month, with the rest coming mainly from leisure and hospitality (48k). Together these two industries made up 90% of the increase in payrolls for May. The healthcare industry alone has been responsible for around half of the private jobs created every month so far this year. Federal government jobs declined 22k in May, which is not surprising given the downsizing efforts from the federal government. State and local government jobs, on the other hand, increased by 21k. The payrolls diffusion index is a measure that shows jobs gains and losses across industries, and whether more industries are adding or losing jobs. The index declined to 50 in May, which means that there was an equal balance between industries with increasing and decreasing employment.

The unemployment rate remained at 4.2%, as expected. Average hourly earnings increased by 0.42% month-over-month, above expectations and bringing the year-over-year rate to 3.9%. The labor force participation rate declined to 62.4% from 62.6%. We’re starting to see a slight impact of the effects of tariffs on the jobs market. Employment in the industries that are most likely to be negatively impacted by tariffs show a 3-month average decline of 1k. Industries that will most likely be positively impacted have seen a gain of 1k. The May jobs report is likely good enough for the Federal Reserve officials to sit on the sidelines for a while and remain on hold as they monitor the impact of tariffs on inflation. The market is still pricing the next rate cut to be in September.

PMI & ISM

May service sector surveys sent mixed signals, the S&P Global PMI rose to 53.7 (from 50.8 in April), indicating modest expansion, while the ISM services index dipped to 49.9, signaling slight contraction and marking its lowest level in nearly a year. Together, they point to subdued economic growth and rising inflation pressures, amid ongoing trade policy uncertainty. The PMI showed improvement in new business and exports, though the export index remains near cycle lows. In contrast, ISM saw sharp declines in both business activity and new orders. Encouragingly, employment indices improved in both surveys, suggesting labor resilience. Price pressures surged across the board, with tariff-related disruptions cited particularly in construction supply chains.

Sources:

https://www.bls.gov/news.release/pdf/empsit.pdf

https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html

https://markets.jpmorgan.com/jpmm/research.article_page?action=open&doc=GPS-5003217-0

https://markets.jpmorgan.com/jpmm/research.article_page?action=open&doc=GPS-5001268-0