Market Update

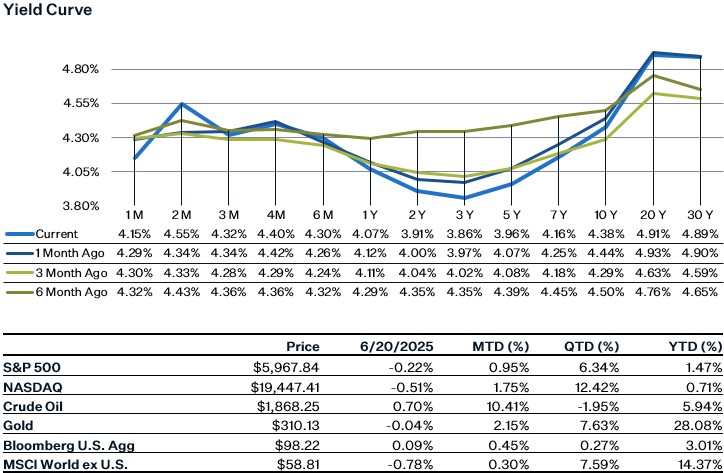

U.S. markets ended the week marginally down, with the S&P posting a slight decline of 0.15% for the week. It seems that investors are apprehensive about making any big trading decisions amidst the uncertainty in the Middle East - we had the U.S. attack on Iran’s nuclear facilities over the weekend which has increased tensions. Investors will likely be waiting on the sidelines until more details unfold. Main worry right now is a potential oil supply shock – however things are constantly evolving with several possible paths forward. Besides that, on Wednesday we had the FOMC meeting where the Fed kept rates on hold as expected. Of note was the change they made in their rate cut forecasts for 2026, with the Fed now expecting only one rate cut next year instead of two. The Federal Reserve will likely remain in wait-and-see mode until more cracks in the economy appear, and the effects of tariffs on inflation are better understood. While a spike in oil prices would certainly cloud the waters, a near term shock may not necessarily mean cuts this year given their willingness to look through one-time changes, and recent statement from Gov. Waller suggesting a proactive reaction function to labor market weakness. This week we’ll get an update on the state of the housing market as we have existing home sales on Monday, new home sales on Wednesday, and pending home sales on Thursday.

June FOMC Meeting

On Wednesday, the Fed left policy rates unchanged at 4.25 – 4.5%, as expected. More importantly, the dot plot for this year remained unchanged, with the Fed still expecting 2 rate cuts this year. However, seven officials now anticipate no cuts in 2025, up from four in March, portraying a greater divide among policymakers on the likely direction of rates this year. For next year, the median Fed Funds rate projection was increased from 3.4% to 3.6%, implying only one cut for 2026.

Looking at the other SEP figures, they lowered their real GDP forecast for this year from 1.7% to 1.4%. They increased their year-end unemployment rate slightly to 4.5% from 4.4%. Most likely taking into account tariff impacts, they increased their PCE inflation forecasts for this year, increasing headline PCE to 3% from 2.7% and increasing core PCE to 3.1% from 2.8%. During the press conference, Powell noted that the reason for staying on hold was mostly due to the expected tariff policies and their inflationary impact. He noted that it takes time to see tariff effects and that they “expect to see more of them over the coming months.” On a positive note, he pointed out that uncertainty around the economic outlook is still elevated but has diminished since April. The Fed continues to cite labor market stability as a key reason to stay patient on rate adjustments. The market is still expecting the next rate cut to be in September, followed by another cut in December.

Retail Sales

Headline retail sales were down 0.9% month-over-month for May, below expectations. Most of the drop was due to a fall in auto sales. Core retail sales (ex-autos, gasoline, building materials) on the other hand rose 0.4%, better than expected. Core retail sales for April were also revised upwards of 0.2%. Looking at the details of the report, there was weakness in electronics and appliance stores (-0.6%) and department stores (-0.4%) and strength in misc store retailers (+2.9%) and sporting goods stores (+1.3%).

Sources:

https://www.census.gov/retail/sales.html

https://www.federalreserve.gov/monetarypolicy/files/fomcprojtabl20250618.pdf

https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html