We continue to focus on the challenges of growing into current valuations in the face of rising inflation Inflation and the impact of rising interest rates are a current focus; however, the situation in Ukraine and the pressure on commodities prices are additional risks.

Inflation and Other Things That Go Bump In The Night: Summary

- While Inflation is very real and price levels may never return to pre-COVID levels, it is worth monitoring how much expectation is already built into the market: with the fed funds future pricing in at least five hikes by year end and markets assuming the beginning of the end of quantitative easing will begin next month. It is also worth noting that at least some of these inflationary factors may start to ease before the Fed is even halfway through the hiking cycle.

- While the markets are focused on dumping overvalued assets as growth remains strong but the assumed discount rate for future cashflows is rising as liquidity is expected to fall, we see segments of the growth universe becoming more attractive: Value can indeed get too expensive, but the valuation bloodletting is taking out some strong growth opportunities as well.

- The segment of inflation that may linger the longest will be in commodities where supply constraints cannot meet demand: A combination of labor challenges at the point of extraction and logistical challenges along the supply chain are creating a perfect storm for commodity prices to remain elevated for some time, possibly threatening growth.

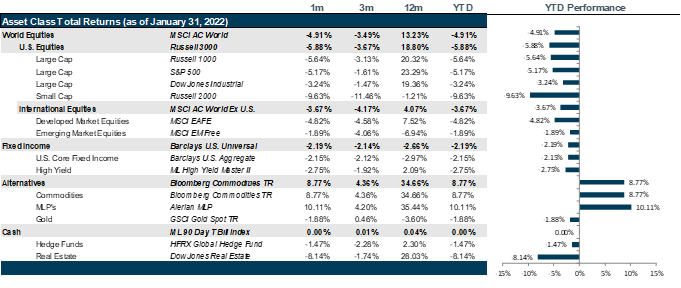

Market Review: Ugly Start to the Year

Federal Reserve policy changes and a possible Russian invasion of Ukraine rattled markets in January.

Minutes from the Federal Reserve’s policy meeting in December revealed a change in tone by committee members who have turned their attention towards tacking rising inflation. Federal Reserve Chairman, Jerome Powell, also said that the asset purchases are also likely to halt in March when the Fed is also expected to issue its first rate hike since the onslaught of the pandemic. The Consumer Price Index (CPI), a measure of inflation, has risen by 7% over the past year, driving speculation among economic forecasters to call for as many as seven rate hikes this year, although Fed Funds Futures are pricing in five. This led to a major selloff in equities especially among the high growth-oriented sectors, whose future valuation is intrinsically and inversely linked to interest rate changes. At their lowest, the S&P 500 and the Invesco QQQ lost around 10% and 15% respectively, with some recovery observed during the dying days of January as investors started refocusing on the next earnings season after Alphabet posted stellar results. Overall, value investing has continued to outperform the rest of the markets over the past two months.

U.S. monetary policy jitters affected European and Japanese markets as well, with the STOXX Europe 600 and Nikkei 225 falling by around 2.5% and 6% respectively. Euro-zone inflation has continued to skyrocket largely due to spiraling energy costs which can be expected to surge higher in the event of a potential invasion of Ukraine by Russia which will lead to major disruption in shipment of Russian natural gas to Europe. Japan is attracting a lot of investor interest as its manufacturing PMI revealed the strongest growth in factory activity since 2014 with an acceleration in domestic demand and export order growth. Japanese business confidence has also continued to increase which combined with the minimal impact from a potential Russian invasion on Ukraine has made it an ideal diversification target for international investors.

Emerging markets have been lagging over the past year due to rising commodity prices, slow vaccination rate and China’s regulatory crackdown on various sectors including technology. The relatively low valuation levels created some insulation against the market turmoil with the MSCI Emerging Market Equity Index losing just 1.9% over the past month. While China’s manufacturing profits continue to be squeezed by burgeoning commodity prices, the central bank has embarked on a quantitative easing cycle, reducing its one-year loan prime rate by 10 bps and five-year loan prime rate by 5 bps, with the aim of propping up the downtrodden housing market which has continued to slide since the advent of the Evergrande debt crisis saga.

The yield curve has risen considerably over the past month with the short end rising much faster than the long end. The Federal Reserve expects to wind down its monthly bond purchase vehicle by mid-March and rate hikes as early as March-end are currently being priced into the market. Inflation has continued to run hot and while economists are predicting anywhere between three to seven rate hikes this year, another major factor roiling markets is the pace at which the Fed is expected to wind down its balance sheet. At the last policy meeting, participants exhibited a preference for a faster runoff than last time this was discussed in 2017-2018, with some also favoring the reduction process to begin as soon as March end. Both factors are expected to send yields soaring, while its uncertain as to the degree to which inflation can be contained, leading to a surge in demand for inflation-protected securities and other floating-rate fixed income products such as leveraged loans.

Gold prices peaked in January at nearly $1,850 as an uncertain policy outlook as well as a possible Russian invasion of Ukraine led to selloff in risky assets and a move towards safe-haven assets, though within the commodities space, gold was a laggard relative to energy agriculture and industrial metals. On the energy front, lithium carbonate prices surged by another 36% in January as battery manufacturers rushed to secure long term contracts amidst soaring demand for electric vehicles, mineral scarcity, and environmental concerns regarding mining. WTI Crude Oil futures have jumped by 14% up to $88/ barrel, nearing its 2014 levels as the OPEC+ managed to raise production by only 210,000 additional barrels per day, 190,000 short of the targeted increase of 400,000 additional barrels, reflecting labor shortages and other supply side constraints. Prices of natural gas and coal jumped by 43.72% and 39.68% respectively as the northern hemisphere continues to experience cold anomalies while NATO’s stance against Russia’s possible invasion of Ukraine has put the Eurozone at odds with their major gas supplier. European countries are starting to fire back up their nuclear and coal plants to control electricity prices and prevent the unlikely scenario wherein industries would have to be shut down and electricity would have to rationed in a bid to keep people warm amid the frigid winter cold. In the crypto universe, bitcoin fell by around 17% over the past month, exhibiting sharp correlation with the rest of the growth-oriented markets as investors exited risky asset classes before the quantitative tightening cycles begins.

Going Forward: Inflation and Other Things That Go Bump In The Night

While inflation is a focus, the real fear of the markets is that the cost of capital is potentially about to begin to rise, letting the air out of the balloon that has been risk assets for the past two decades since 9/11 and the beginning of the great deluge of liquidity. For the past two decades, a combination of globalization, technological innovation and automation have conspired to drive down the costs of both goods (think commodities) and services (think wages) simultaneously, ushering in the greatest corporate margins in history. Combined with the cheapest cost of capital and greatest non-wartime fiscal stimulus in history, as a result of 9/11, the Great Financial Crisis and the pandemic, the rise in the valuations of everything from corporate equity to corporate debt to structures, on top of corporate debt fed a wealth boom. However, the pandemic also forced global economic activity to take a pause, now dubbed “The Great Reflection” which was followed by a collective shared unconsciousness, leading workers to question their value in the markets relative to the risks, leading to the “Great Resignation” and the “Great Retirement.” Wages are now rising in real terms for the first time since the peak of wage growth in 1973. The fragilities of last mile logistics also proved faulty, causing companies to consider near shoring or onshoring what used to be offshore activities like manufacturing or services support. These events have fundamentally shifted the narrative from deflation to inflation and to the fear that the Fed is about to set the U.S. on a course to wring liquidity out of the markets.

Inflation vs. the Fed’s Response

Inflation has hit 7% year-over-year for the consumer price index, a measure of the rise in prices of a set basket of goods and services in the United States. We have not seen inflation this high since the late 1970’s when then Fed Chair Paul Volcker wrestled inflation to the ground from a peak of 14% down to 3% in the early 1980’s. However, the soonest the market anticipates the Federal Reserve to begin to react is the March 16th Federal Open Market Committee (FOMC) Meeting. Consider that the market for Treasury Protected Inflation Securities (TIPS) are already reflecting a flattening of future inflation expectations and inflation surprises (measured by how high the actual inflation result is relative to the consensus forecasted expectation) have been falling since the beginning of the year. We read into this that inflation expectations are now well beyond what real inflation can be produced by wage growth, commodities price growth and supply chain challenges. The wage growth occurring as a result of right-sizing people’s pay and/or accommodating workplace flexibility are unlikely to last longer than 2022. By the end of the year, we will see this as a small contributor to inflation. Moreover, companies are working around the supply chain issues and the outlook there is improving. The one segment that may linger could be commodity prices. However, by the fall of this year, we wonder how much appetite the Fed will have to continue to tighten if inflationary pressures starts to let up. The Fed could get cold feet by the fall if inflation eases.

Buying Value or Selling Growth

The latest surge in value performance has not resulted from the market buying value. It also dumped the entire fixed income market, perhaps even more overvalued than parts of the equity market with the normally tepid asset class turning in the worst monthly performance since the Volcker era and that is saying something. Perhaps the cheapest segments of the economy, the beleaguered commodities markets and the oversold emerging markets equity segment experienced their day in the sun in absolute terms for commodities and in relative terms for emerging market equities. However, growth around the globe is still expected to remain above long-term trend growth targets and corporate earnings are expected to remain high as workers get back to work, the economies continue to re-open and demand continues to grow. While the re-rating of the discount rate for future cash flows may continue through the summer, we believe that there is potential for the markets to overshoot and quality will be more important than valuation alone. In addition, if growth is strong enough, the terminal rate could remain unchanged, and stocks should be fine despite the rate hikes. However, if not the higher discount rate will be more impactful.

The Short Term vs. the Long Term

By definition we always invest in the short-term and we never arrive at the long term, so why do we bother with the differentiation? Because short term sensitivities do not always result in the accumulation of wealth overtime and a focus on long term potential may ignore short term risks. We are currently operating in a market that reeks of short-term risks to long term outlooks. For example, while we may not believe that the Fed will achieve five rate hikes, we must remain vigilant to how sensitive our portfolio is to interest risk. Bonds, real estate and growth investing, for example, all create short term risk in the portfolio. Some protection to this interest rate risk may come in the form of exposure to financials which should participate as economic activity rises and interest rates rise. By the same token, while we may not believe that inflation will linger for more than 24 months, we must remain vigilant against inflation risks that hurts bonds, but should benefit commodities, energy stocks and real estate. Ultimately, quality is what matters in the long-run, and we believe that will be the big winner over time. But maintaining an awareness of the short-term risk sensitivities may be the way to survive the continued market turmoil.

Net View

We remain overweight to “Growth at a Reasonable Price” investments. We also remain underweight in Emerging Markets but relative to the U.S., and overweight Latin America within Emerging Markets and take Europe back to neutral until events in Ukraine are resolved within international equities.