Over the past few weeks, we have experienced extremely volatile trading. This increased volatility has largely stemmed from the current macro-economic environment. Specifically, investors have dealt with an inflationary environment, the likes of which we have not seen since the 1980s, alongside an expected monetary tightening cycle that has triggered a broad market sell off. However, over the past few trading days the market has shifted its attention to the situation in Ukraine. We evaluated a few of the larger geopolitical crises in recent history in an attempt to develop expectations and potential action items for our clients. As our research shows, the impact of geopolitical events has historically been short-lived and recoveries have been swift.

Russia and the Global Economy

The current crisis in Ukraine started in April of 2021, and for the better part of 2021 was almost entirely ignored by the markets. Numerically speaking, the impact that both the Russian and Ukrainian markets have on the global stock market is fairly small. In fact, the weight of the Russian market on the MSCI All Country World Index is just below 0.4%. For perspective, the United States is just under 60% of the same index. This however is not to say that Russia does not have a significant impact on the global economy. Despite its small impact on the global stock market, Russia is in fact the 11th largest economy on Earth; it is a major exporter of fossil fuels, including crude and refined petroleum, as well as gas and coal. Russia is also the largest single exporter of wheat and has a significant market share in gold, platinum, palladium, and aluminum production, which are crucial inputs for the global economy. This conflict does in fact have the potential to greatly disrupt the already hobbling global supply chain.

What does history tell us about geopolitical events?

Geopolitical events similar to those we are currently witnessing in Ukraine have historically had a fairly muted and short-term impact on the US Stock market. This is particularly true when evaluating global conflicts over the past 30+ years.

The Gulf War 1991

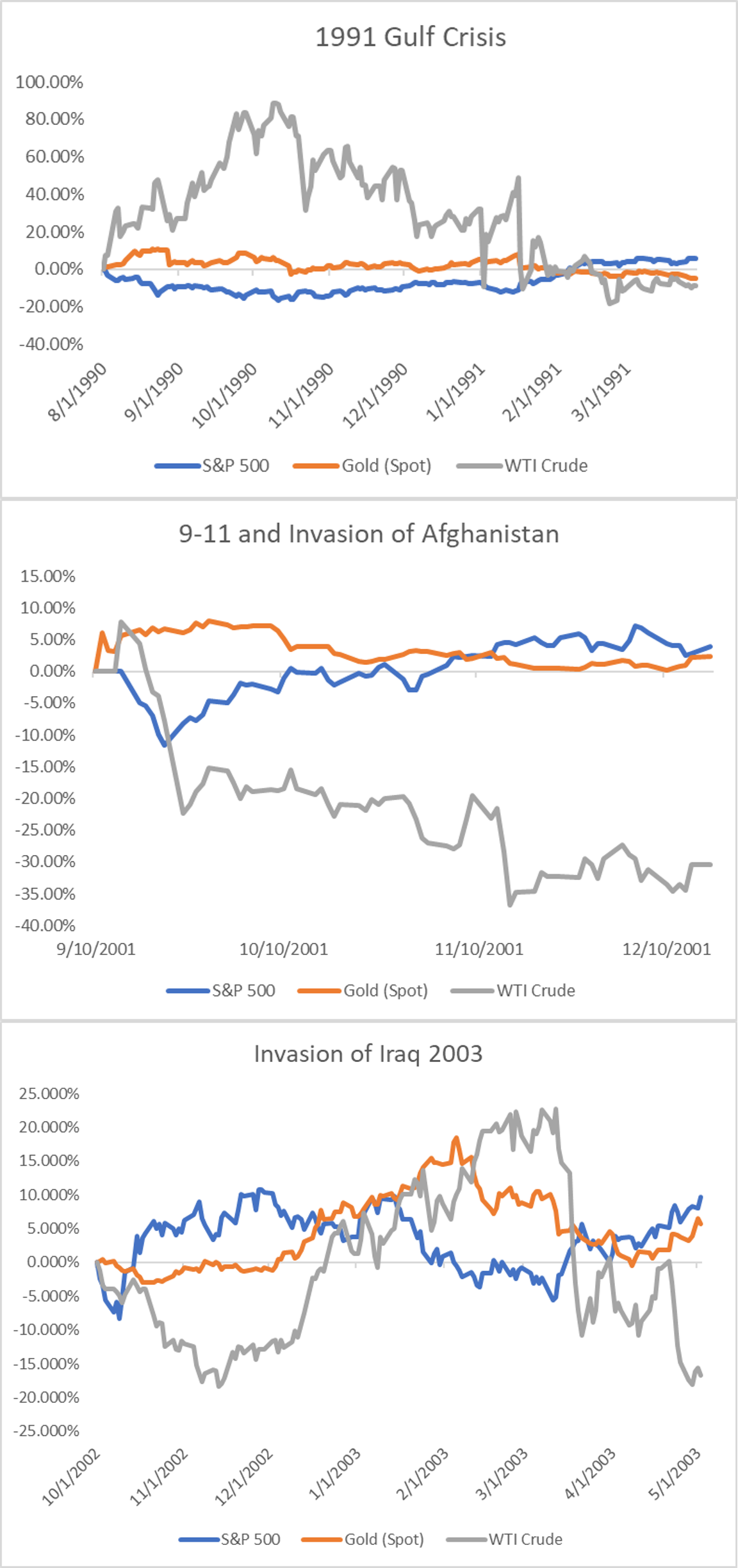

The Persian Gulf crisis of the early 1990s began with an Iraqi invasion and subsequent annexation of Kuwait on August 2, 1990. By January 17, 1991, Coalition Forces had started their operations. These operations lasted through early March of 1991. By the end of the war, Kuwait had been entirely liberated. At its lowest point between the invasion of Kuwait and its liberation, the stock market had shed -16.9% (between August 2, 1990, and October 11, 1990), and by February 6, 1991 (118 days) the market had fully recovered; by the time troops began leaving the region, the market was up. The real story during the conflict was without question oil. During the period in question oil saw major swings in price. At its highest point during the crisis, the US West Texas Intermediate Crude (“WTI”) increased by almost 89% (between August 2, 1990 and October 10, 1990), but as the war began to wind down, the price of oil gave back all of its gains and was even down -18.5% for the period of time between August 2 1990 and February 22 1991. By the time the conflict was over, oil had actually declined by -8.9%.

September 11th and Invasion of Afghanistan

The next geopolitical crisis we evaluated was 9/11 and the subsequent invasion of Afghanistan. To be clear, this period includes only the initial invasion and not the entire 20-year war in Afghanistan, which spanned multiple economic cycles. The period in question begins on September 11, 2001, and ends on December 17, 2001 with the fall of the Taliban and the establishment of the Afghan interim government. Here too we saw significant initial declines in the stock market immediately after the events of 9/11. In fact, the market reached its low point on September 21, 2001, just five trading days after the market reopened on September 17, 2001. The US invaded Afghanistan in retaliation to the 9/11 attacks on October 7, 2001. By this time the stock market had recouped most of its losses and was only down -1.9% since the September 11th attack. When the Taliban was removed from power in December 2001 the market had turned positive. Despite the swift recovery from the crisis, the S&P 500 continued to decline for the next 11 months as the dot com bubble continued to deflate. The events of 9/11 also had a drastic impact on the price of oil. The initial shock of the attack resulted in a -22.4% decline in oil prices. Unlike the stock market, oil continued to slide throughout the crisis. At its low point, WTI (Spot) was trading 36% lower than it was the eve of 9/11. By the end of the conflict in December WTI was STILL down 30%.

Iraq 2003

The final geopolitical event we evaluated is the 2003 invasion of Iraq. We mark the beginning of the crisis as October 2, 2002. On this date the US Congress passed the Iraq Resolution, which authorized the president to use “any means necessary” against Iraq. The invasion portion of the war ended on May 1, 2003. The bear market that resulted in the dot com collapse had finally reached an end on October 9, 2002. Between October 9 and November 27 the market gained +20.8% (49 days). As the date of the invasion drew nearer the stock market began to move down, eventually shedding -14.7% from its peak on November 2, 2003 to trough on March 11, 2003 (just 8 trading days before the invasion began). By the end of the invasion the market had all but recovered entirely. Oil once again moved very aggressively to the downside initially, but as the preparations for the invasion continued the price of oil recovered, only to decline over 30% peak to trough by the end of the period.

Key Takeaways

The impact of geopolitical events on the US equity market has historically not been too bad. This is not to say that these events have not been painful. But as the data above shows, these events all resulted in declines in a range of -11% to -17%. In fact, had there not been a geopolitical event at the time of these stock market declines, each would have been considered a healthy, garden-variety correction (more than -10% but less than -20%).

The impact of geopolitical events on the US equity market has historically been short lived. In each of the cases we evaluated, the stock market recovered from declines potentially associated with a geopolitical event within a few short months. This was true even during a broader bear market (September 11th and Afghanistan).

The equity markets appear to have an easier time looking past geopolitical events in comparison to oil. Much like the current crisis, two of the three events we evaluated involved a significant oil producing country. Further, in each of the events analyzed, oil experienced drastic swings and increased volatility. This is true even in the case of Afghanistan, which oddly enough has no oil and is not even in the Middle East. As such, one can only speculate as to the reason oil dropped so significantly. We believe that the oil market likely foresaw a wider conflict, which would include a significant oil producer.

Money doesn’t appear to go to gold during a geopolitical crisis. Gold has a reputation of being a safe haven asset. It is a well-known constant in the proverbial bear market playbook along with utilities, US treasuries, and cash. But in two of the three events we looked at, gold didn’t really move much.

So, what do we do?

Focus on what will matter after this is done. During times like this it is easy to lose site of the fact that there are other things going on. In this instance, we are dealing with high inflation, a monetary tightening cycle, the tail end of a global pandemic (hopefully), and mid-term elections. Now, while the world is focused on Ukraine, is without question the time to ensure that portfolios are positioned properly for these issues.

When in doubt – hedge. Lido does a lot with options. During times of heightened uncertainty, hedging can be expensive. That being said, a trade is always available. Even for clients who currently utilize our options program continuously, there are periods of time that may justify increased protection for some. Speak to your advisor to find out if options strategies might make sense for you.

Be ready – market dislocations are coming! Market opportunities are NEVER pretty. In fact, they are usually very intimidating and require a leap of faith of sorts. Ironically, taking that leap of faith simply means that you accept the idea that what happens after EVERY correction/bear market -- namely, investment opportunities – will happen this time as well. Sooner or later, these opportunities will present themselves and we will look to take advantage.

Conclusion

Geopolitical events feel huge! Between the constant “BREAKING NEWS” flashes, and the massive swings in the futures and equity markets, they feel very scary. This, we believe, is often a result of sensationalism and heightened media coverage. We believe that our clients are well positioned to deal with the impacts of this conflict. As this crisis plays out, the market will likely begin to look past it and resume trading off the other issues we discussed above. But, we would be remiss if we didn’t acknowledge the fact that geopolitical events can snowball and lead the world to very bad places. The fact that western powers seem content to handle this via sanctions (for now) reduces the probability of such a wider “global” conflict, but it is a genuine reason for some caution, nonetheless. What we propose to help deal with these potential outcomes is simple: focus on the economics, hedge, and be ready to take advantage of market dislocations.