Inflation, Commodities prices, and the Fed have ushered in a bear market repricing across assets.

Bear Necessities: Summary

- Markets have quickly repriced: While valuations across debt and equity have quickly returned to 10-year averages, we still see more room to run before we find a bottom.

- Quality matters: So far, volatility has favored quality and we suspect that will continue as the pandemic recovery has and should continue to slow.

- Inflation and higher rates are problematic when driven by inflation rather than underlying growth: the longer the commodities cycle, the worse the impact to fundamentals.

Market Review: Uncertainty Takes Hold

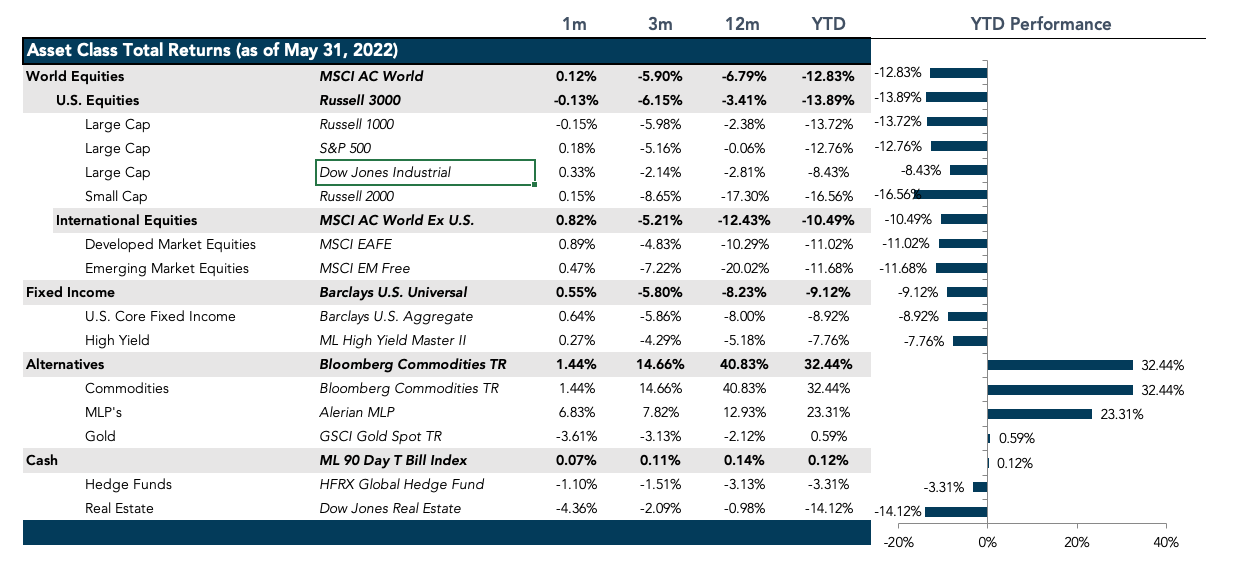

Uncertain macroeconomic conditions impacted markets in May.

The S&P 500 has returned -12.76% year-to-date to the end of May and -20.79% as of June 13, 2022. The Federal Reserve increased the federal funds rate by 50 bps at their May policy meeting and provided guidance of future rate hikes in the same target range, though the most recent inflation reading has prompted the Fed Funds Futures markets to price in a 75 bps rate at the June FOMC Meeting with expectations of finishing the year at 3.5% at the front end of the curve. Though inflation looked to be decelerating in May, the impacts of the ongoing war in Ukraine and continuing lockdowns in China. Furthermore, companies are starting to become fiscally conservative in the current macroeconomic environment, implementing cutbacks, hiring freezes and earnings estimates revisions. Snap Inc. CEO, Evan Spiegel, in an internal memo to employees, forecasted the company missing its own estimates for revenue and earnings growth due to the significant cutbacks in the digital ad-spending space; highlighting a major risk that also affects other technology companies who are heavily dependent on revenue from digital advertisements. Energy has continued to remain the top performing sector, benefitting from skyrocketing fuel prices.

European equities moved largely in line with U.S. equities in May, supported by softening U.S. economic data. Rising food and energy costs exacerbated by the war in Ukraine have continued to aggravate inflation in the eurozone which reached 7.4% in April and further rose to 8.1% in May, with potential for further spikes as the European Union passed a sanctions package banning oil imports from Russia. Japanese equities were standout performers among developed markets as the Bank of Japan continues to support an easy monetary policy.

Emerging markets performed better than their counterparts in May as China started to lift their Covid related lockdown measures, providing a boost to countries that heavily rely on exporting to China raw materials, agriculture products, machinery, and high-tech products amongst others. That said, they almost immediately began walking back the loosening measures almost as soon as they started, though prices have not reflected the about face. The Latin America region continues to benefit from surging commodity prices with demand expected to rise further as China’s Purchasing Manager’s Index recovered better than expected in May post the lockdown driven slump in April. In addition, since many emerging market central banks embarked on a monetary tightening policy well before the U.S. Federal Reserve, they are well positioned to absorb shocks arising from divergence in monetary policy, however the conflict in Ukraine and worsening climatic conditions is expected in the medium-term to boost markets that are net-exporters while pressurizing those that are net-importers.

The Federal Reserve held its policy meeting in the first week of May, and yields rose in response as a 50-bps rate hike was announced with ten-year rates rising as high as 3.12%. There remain concerns regarding the Federal Reserve’s ability to control inflation without inducing a recession, however, despite softening economic data the two-year and ten-year rates rose in a parallel shift remaining essentially flat. The Federal Reserve is still expected to remain aggressive in the short-term resulting in front loading and the yield curve flattening further.

In commodities, Newcastle coal futures remained above the $400-per-tonne mark supported by increasing demand for power generation as economic activity nears pre-pandemic levels. Gasoline futures soared beyond the $4-per-gallon mark while WTI crude oil futures have consolidated above the $110-per-barrell mark as the European Union passes a sanctions package aimed at banning oil imports from Russia in a phased manner. Among industrial metals, copper futures rose to as high as $4.5-per-pound in May as China started to ease lockdown measures and factory activity recovered from the slump in April with manufacturers in Shanghai expected to resume operations in June.

Going Forward: Bear Necessities

Inflation remains front and center, particularly with the most recent print of data which underscored the pressures emanating from conflict related commodities price pressures combined with the overhang resulting from COVID related supply chain issues. What we know is that much of the pressures in effect should be temporary, but the concern now is that may linger on. The conflict in the Ukraine does not look any closer to resolution which will continue to pressure energy and agriculture prices, creating significant pressure on demand even before tightening monetary and fiscal policy. Which brings us to the Fed. The Fed’s actions are without a doubt late, but more troubling, are not likely to be effective against commodities-oriented inflation. However, the potential for continued Fed action to tip the economy into a recession remains a key concern among investors. The bear market that we find ourselves in as the summer gets going is also a stark reminder of the significant impact that short term rates have on valuation. The flight to quality and value that has been underway for the better part of a year has hit an inflection point with the most overvalued segments of the market bleeding out. To survive these markets, we must focus on a few key factors.

Valuation

In equity markets, this metric is most easily measured by the difference between growth and value indices, where the S&P 500 Growth Index is down 26.08% while the S&P 500 Value Index is down only 8.13%. We expect this preference to remain as the markets remain volatile and the sentiment remains bearish. Valuations for equities have falling below long-term averages; though we expect a further round of EPS revisions to show current levels as still slightly overvalued. Debt markets, on the other hand, are showing a strong preference for yield now that spreads have widened furiously for higher yielding instruments. High Yield debt has widened by 1500 bps for the year, losing 10.5% on a total return basis. However, the asset class now offers 8.4% yields for the risk of default concentrated mainly in the lowest quality issuers. That said, there is still further to fall to reach longer term average spread levels. With the most punished asset classes having given back much of the last decade of excess returns, it would be quite tempting to use the opportunity to scoop up “cheap” assets; however, quality will matter in the rebound.

Quality

Volatility has so far favored quality assets and we expect that it will continue to do so as the pandemic re-opening continues to sweep around the world in the wake of higher inflation and lower liquidity. Balance sheets will matter as the cost of capital rises and cost to refinance climbs. Though with higher rates, debt issuance will likely fall, somewhat counteracting soaring yields as investors will still demand fixed income instruments for investment. Moreover, the demand for high quality balance sheets will add extra disparities between high quality and low-quality issues. Equities will also be subject to the same quality concerns with balance sheets, profitability, liquidity, and stability of margins as key factors for separating the wheat from the chaff.

Long Memory

Perhaps the greatest tool investors need today is a long memory – much longer than most younger investors have. Understanding how markets act and react when interest rates rise, when liquidity dries up, when inflation crops up and when war impacts commodity pricing requires memories that go back to the 1908’s and 1990’s. Though one thing we know for certain, things will not work out the way they did last time. However, it is important to note, for example, that high inflation is not all bad when accompanied by high wage growth. Interest rate rises are not necessarily disastrous for equities when the result in response to strong wage growth and economic growth. However, inflation not accompanied by wage growth or commodities driven inflation plus interest rate hikes are generally the worst combination of all. While the Great Resignation may not last, it has produced enough wage inflation to partially countermand energy/food price inflation. However, it is not occurring at the same pace as overall inflation and is unlikely to keep pace if commodities inflation continues to remain elevated. For that reason, we tread with caution.

Net View

We remain overweight to Growth at a Reasonable Price investments and add Value investments into the mix. With Emerging Markets starting to re-open and largely ahead of the curve on tightening monetary policy, we now change our view on EM to neutral.