Going Forward: Brought To You By The Letter L

• Most economists are calling for a mild recession: however, few are calling for much of a recovery after the recession is over which could trace out the dreaded L shaped recovery.

• The Federal Reserve is now expected to execute two more 25 basis point hikes in February and May with a meaningful chance of a pivot before May if the economy dips into recession: however, similar to the expectations for a recovery, the Fed Funds is not predicting much of a loosening cycle into the recession which means that higher rates are here to stay.

• Downside risk abounds around the globe: a global recession amidst a global rate reset could spark further geopolitical tensions and this bears watching.

As the worst year in the market since 2008 came to a close, investors were left to lick their wounds and reflect. Many seasoned investors knew the day would come when rates would be forced to normalize, but no one wanted to admit how unsustainable valuations had become. Even the long-term comparisons were corrupted by two decades of easy money. However, many investors chose the safer, higher quality path, giving up upside for the dependable and while it took a very long time, the day has come to reap the rewards of discipline. So, where do we go from here?

A Year in Review: The Great Revaluation

Things were very different a year ago. January 4, 2022, marks the peak for equity markets as inflation continued to linger because of COVID disruption and tight commodities supplies and expectations of Fed hikes and the end of quantitative easing heralded the end of a liquidity era. Then, Russia invaded Ukraine and added fuel to the simmering inflation fire by threatening the already taxed energy supply with further shortages. Inflation that should have been peaking and falling shot up, forcing the Fed into a corner and markets re-priced quickly, pricing in multiple Fed hikes with no signs of an easing cycle. Equity markets quickly began to price in significantly lower multiples as interest rates began to quickly rise. At the same time, bond markets which had benefitted from nearly 20 years of very accommodative monetary policy, fell off a cliff with massive losses hitting bond markets at the same time.

While commodity prices continued to exhibit extreme volatility, the general direction for energy and metals markets was up until they finally peaked at the beginning of June as demand began to soften post-pandemic reopening. By summer, the effects of the reopening quickly faded as household savings left over from pandemic stimulus began to dwindle and household credit levels began to rise to pre-pandemic levels. Concerns of recession faced off against some of the strongest wage growth in decades, though in real terms (after taking inflation into account) it was still lackluster. That said, the labor markets continued through the summer to exhibit strength with unemployment remaining low until a modest tick up in August that was quickly reversed by year end. So, the Fed continued to hike rates at the fastest pace in recent history to tamp down inflation.

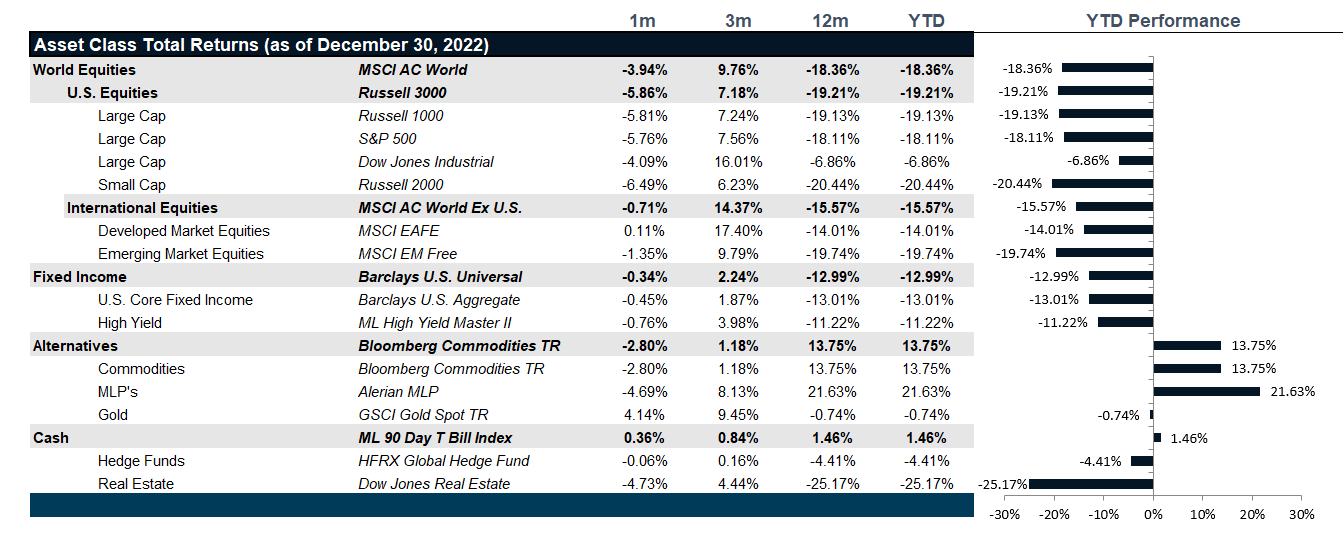

By the end of September, the U.S. equity markets took a 24.6% loss versus a 26.8% loss from international equities and a 26.9% loss from emerging markets equities. Even more surprising were the double-digit losses recorded across fixed income where core U.S. fixed income lost 14.61% and high yield debt lost 14.74%. Despite these broad losses, U.S. corporate earnings continue to come in. With large swaths of the older work segment of the workforce having retired during COVID, the younger segment of the workforce was still finding plenty of job opportunities quickly and using those opportunities to grab significant increases in pay. Optimism once again drove markets into a small end of year rally as inflation began to peak, energy prices and oil prices dropped, and the Fed began to talk about slowing the pace of hikes.

Yet, as the year came to an end, U.S. equities still remained down just over 19% while international equities recovered to a 14% loss. Emerging markets took losses in line with equities at nearly 20%. U.S. core fixed Income booked a record 13% loss while high-yield lost just over 11%. Only commodities managed a positive gain for the year with a nearly 26% gain after a decade of losses. Hedge funds fared well on a relative basis, only losing 4.4% and the interest rate sensitive real estate sector was hit over 25% on the whole. Within each of these broad losses, however, there was significant dispersion in returns with high quality, cash flowing securities significantly outperforming lower quality, loss making securities and entities. But, unless you had significant commodity exposure or cash in 2022, this was likely a tough year.

Figure 1: Market Performance as of December 30, 2022

The L Shaped Recovery is a Thing

The L shaped recovery is simply another way of saying that there will likely not be much of a recovery after the latest reset across prices, rates, wages, employment participation and other key trends. And, while this seems sudden, we would argue that in the long run, this is the best way to experience such resets. Losses are swift, but yields are higher going forward. Hits to multiples are quickly replaced with a plethora of attractive opportunities for those with the ability to discern quality from spin. To reference a famous Warren Buffet quote, we now know who is swimming naked because the tide went out rather quickly. But, does this mean that a tidal wave is about to hit?

The Case for a Mild Recession

Arguably, there is a strong case that this reset may be mild starting with the stark change in the demographics of the working population. The large swatch of retirements among older workers was met with younger workers returning to the workforce. While the Fed has done it’s best to put the screws to the economy, the shortage of workers brought on by the Great Retirement has meant that jobs have been relatively easy to find so far. That may not be the case going forward as layoffs are starting to bite. That said, labor shortages may offset some of those and looking at the average weeks that it takes unemployed people to find full time work, workers are finding jobs in just over 19 weeks, down from a peak of 31 during the pandemic, below the average peak of 21 weeks experienced during the 1982-83, 1993-95 and 2001-05 recessions and well below the peak of 43.5 during the Great Recession. While much of consumption experienced so far has been at the expense of household savings and household credit balances, savings is now rising and credit is consistent with pre-pandemic highs, though much more expensive to service today. If the Fed slows to just two more hikes or pivots and ends their campaign in February, we could see some time for the economy to adjust to the new reality of higher rates and more rational investing.

The Case for the Downside

The case for the downside is a global case. As China reopens, we must acknowledge that the strict COVID policies have left the populace in a state of unrest. Meanwhile, Russia has backed itself into a corner and there is nothing so dangerous as a cornered wild animal. The damage that could be wrought could be significant. In developed economies, Japan will be hurt by the strengthening yen. The offset is that Europe and the UK have largely taken their lumps in the market and the coming recession is largely priced in. However, disruptions in the Chinese reopening or from Russia represent an unpriced risk.

Net View

We continue to play defense with U.S. equities favoring quality and value. Yields still favor high-grade credit and broad high-grade debt generally. And, finally, we expect volatility to continue in commodities as prices reflect the recession and loss of demand.