After a strong 2023, we consider the road ahead in 2024.

Year Ahead – The Road to Nowhere: Summary

- The economic outlook for 2024 is flat: U.S. GDP growth is forecasted at 1.2%, the Eurozone at 0.6% and Japan at 0.9%.

- Equity markets may not go down, nor are they likely to go up: 2023 reinflated segments of the market before the interest rate re-set of 2022 was complete which leaves the markets not cheap but not expensive and not likely to do much in a lack-luster year of growth.

- Bond markets are pricing in a flat year as well: Fed funds futures puts the short end of the yield curve roughly at the same yield as 30-year Treasury Bonds, which allows for no expectation of either growth or inflation in 2024.

Market Review: The Comeback

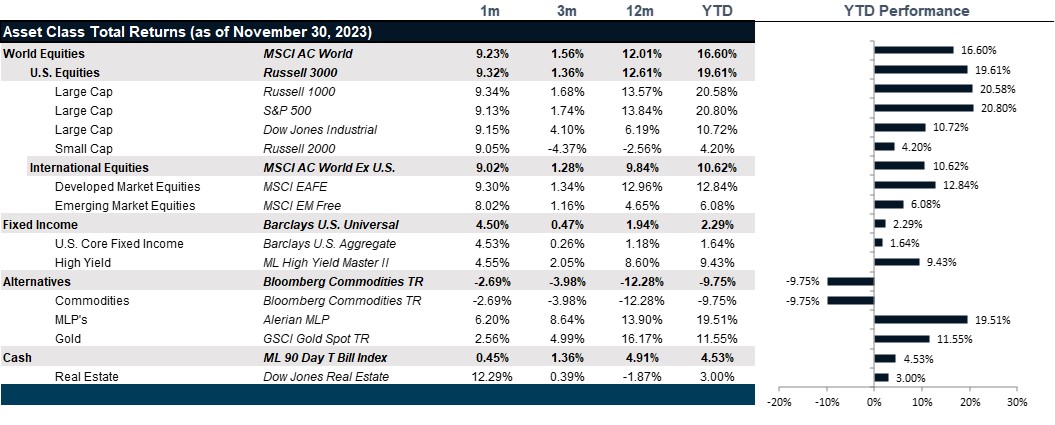

November witnessed a strong comeback in U.S. equities as market dynamics driving the previous three-month losing streak reversed course and spurred one of the strongest monthly rallies in stocks and bonds in recent history. Softer-than-expected inflation readings, declining Treasury yields, and a cooling labor market were the main forces behind this rally, increasing speculation that the Federal Reserve’s rate-hike cycle has peaked. Moreover, the House approved a stopgap bill before the November 17 deadline to avoid a government shutdown and the Q3 earnings season saw its conclusion with results showing that U.S. companies remain in a strong position. All this added to improved sentiment and the three major indices in the U.S. ended up posting big gains, with the S&P 500 returning +9.13%, the Nasdaq 100 +10.82% and the Dow Jones Industrial Average +9.15%. All sectors finished the month in the green except for energy stocks that took a hit from the significant drop in oil prices seen in November. Equity leadership came mainly on the back of rate-sensitive areas, information technology and real estate.

European stocks ended November sharply higher as cooling inflation spurred rate cut bets in the Eurozone. The Euro STOXX 600 returned 9.83% in dollar terms over the month, with the weakening of the dollar compounding gains abroad. Despite European Central Bank policymakers reiterating their hawkish view that the fight against inflation is not over, recent data has boosted bets that the ECB could start cutting interest rates in the first half of 2024. According to flash figures, annual inflation in the Eurozone moderated to 2.4% in November from 2.9% in October, well below expectations. Japan’s Nikkei 225 hit 33-year highs in November and finished the month with a return of 10.93%. A dovish Bank of Japan and strong third-quarter earnings from companies who reaped the benefits of a weak yen were the key points of support for Japanese stocks this month.

Positive sentiment spilled over to other emerging markets, especially as the MSCI EM Latin America Index posted its best month since 2020 with a return of 14.07%. Weakness in the dollar on bets of U.S. rates peaking and hopes of a soft-landing drove investor interest in the region. The standout was Argentina, with the S&P Merval up 36.32% in dollar terms on optimism following presidential-elect Javier Mile’s win. India’s Nifty 50 followed suit with a return of 5.52% on hopes of lower U.S. policy rates. The rally was also partly attributed to the market discounting the recent win in state elections by India’s ruling BJP party. Stocks in China emerged as an outlier amid November’s global rally, with the MSCI China Index returning +2.53% and the benchmark CSI 300 Index +0.37%. The decline in the dollar helped alleviate the pain, but concerns about its economic recovery persisted despite recent attempts by the government to stimulate growth.

Those investors engaging in the longer-duration trade finally reaped positive returns after the iShares 20-Plus-Year Treasury Bond ETF staged a notable recovery with a 9.92% return. This comes on the heels of the significant drop in U.S. Treasury yields seen in November. The 10-year yield declined to 4.37% in November from 4.88% in October and the 30-year yield to 4.54% from 5.03%. The decline in yields also happened at the lower end of the curve, as the yield in the 2-year Treasury Bill dropped to 4.73% from 5.07%. November also saw corporate bonds rallying with the iShares iBoxx $ Investment Grade Corporate Bond ETF and the iShares iBoxx $ High Yield Corporate Bond ETF returning 7.57% and 4.88%, respectively. The outperformance of investment-grade over its high-yield counterpart probably came on the back of its higher interest rate duration. Meanwhile, investors poured record amounts into speculative-grade bond ETFs amid increased optimism for a soft landing, despite the possibility of defaults rising next year because of elevated borrowing costs and slowed growth.

Despite pledges from main players Saudi Arabia and Russia to implement supply cuts until the end of the year, spot WTI oil dropped 6.24% in November on concerns of weakening demand, and as crude output in the U.S. held at record highs. Its London counterpart, the Brent benchmark, declined 8.94%. After logging stellar gains in October on the back of the Israel-Hamas war, gold started this month with a high degree of profit taking, especially as concerns over the Middle Eastern conflict waned. Spot gold prices then marked a strong recovery amid increased bets for a definite Fed pause and finished the month at +2.65%. High interest rates bode poorly for gold as they increase the opportunity cost of holding the yellow metal. Spot copper prices also posted a positive return of 4.46%, clocking strong gains especially in the second half of November amid expectations of tighter supplies. The decline in the dollar was also supportive of the gains in these commodities, with the U.S. Dollar Index recording its weakest monthly performance in a year on the back of growing Fed pause bets. Natural gas prices fell 17.66% on expectations of lower demand, mild weather, and high storage levels in Europe.

Going Forward: Year Ahead – The Road to Nowhere

2023 has been extraordinary if you invested in a narrow list of equities, but less so if you invested anywhere else in the markets. If you zoom out to pre-COVID, we have essentially witnessed three distinct equity markets. First, the COVID shut down in March of 2020 which caused a violent but swift downturn that set the market up for the COVID reopening which lasted through to the end of 2021, at which point, the supply chain stress, labor market shortage, and conflict related commodities pressure drove inflation up and the Fed to end an era of low interest rates that had persisted since the Great Financial Crisis of 2008. The normalization of interest rates set us up for a terrible 2022, where quality mattered and high-multiple stocks were re-priced for higher interest rates. Over the same period, wage growth finally surpassed multi-decade inflationary highs and set up the markets for a Goldilocks outlook, where consumption would mitigate the pain of a higher cost of capital and the markets returned to a growth mindset, locking past any slowdown and discounting the chances of recession, leading to the miraculous returns experienced this past year. So, what comes next?

Bond Market Wisdom

The most painful place to invest since COVID has undoubtedly been the bond markets, where a fierce normalization of short-term interest rates has quickly impacted bond pricing. That said, the swiftness of the normalization has created enticing yields, offsetting the need for investors to take excess risk to ensure investment returns. That said, the yield curve continues to remain inverted, an unsustainable situation where you earn more to invest in the short term than you earn by investing in longer duration bonds. If you buy 1-month government paper, you earn 5.4%. If you invest in a 30-year Treasury Bond, you earn 4.2%. Looking at the Fed Funds Futures implied rates, we can see that the expectation for the Fed Funds rate 12 months from now is roughly 4.1%, effectively the same as the 30-year Treasury Bond Yield. That suggests to us that the bond markets are not expecting much growth or inflation over the next year. Moreover, investors are at least guaranteed slightly more than 4% yield on very low-risk investments, which begs the question, why take excessive risk elsewhere?

Yield Competition

Equity dividend yields in the context of a 4% Treasury rate do not look enticing, currently priced at 1.5% for much less certain outcomes. Though the economic outlook for 2024 remains a question ranging from a recession to a mild slowdown, the earnings recession now looks to be behind us as we enter a period of easy comparable earnings data and a chance for companies to post positive top-line and bottom-line growth. In that context, one could argue that outlook for equity may be ok. However, there continues to be a risk that consumption is still slowing, with retail sales underwhelming this holiday spending season and credit card balances back up to pre-COVID highs, and at much higher interest rates. In that world, earnings could still be a struggle, even with easy comparable data. And the lure of equities in a low to no growth environment competing against fixed income returns that start at 4% may prove a real challenge.

The Rest of the World

In a low or no growth world, the outlook for commodities remains a challenge. The weakness of the dollar as the Fed slowed and the rest of the world’s central banks caught up with tightening looks to be played out. With that, the Latin America trade that benefitted from commodities price growth is largely played out. Global central banks are now coming to their own pause points which will likely see the dollar move sideways and modestly up as the U.S. growth outlook, meager as it is, is still expected to be better than Europe or Japan. So, the Japan trade is now largely played out. Perhaps the only bright spot in the investing landscape could be China, whose very belated reopening could drive price appreciation in a market of otherwise flat returns.

Net View

We continue to see opportunity for downside protection of equity portfolios. Within the U.S. equities, large-cap stocks continue to look more attractive in a slowdown. Within international equities, we are now looking at Emerging Markets for opportunities in 2024.