Fed Chair Jerome Powell's Jackson Hole speech has the markets braced for a recession and the world's central banks in a race to hike rates to fight inflation.

What's the Fed Got to Do With It?: Summary

- Fed Chair Jerome Powell has suggested that while continued rate hikes will be painful, the price of inaction in the form of entrenched inflation will be even more painful: Markets have been quick to price 4% Fed Funds Futures and a peak as far into the future at mid-year 2023.

- There is still downside to equity markets, commodities and real estate with limited upside should the Fed abandon their hawkishness: however, there are segments of the market that are cheap and worth considering.

- One thing we don’t see coming back is Fed Balance Sheet expansion: we don’t see a bright future for the most speculative segments of the market.

You can read the full Market Update below.

Market Review: Not Negative Enough

Markets in August were impacted by positive quarterly, macroeconomic reports and a sustained hawkish outlook by the Federal Reserve at the annual Jackson Hole Economic Symposium.

U.S. equity began the month with a solid rally as job growth surged, adding more than double the expected jobs in the non-farm payrolls report for July. Further supporting the rally, the White House signed significant bills signaling big infrastructure spending in the coming years with the tax, climate and health-care bill followed in quick succession by the Chips Bill, unleashing funding for U.S. production of semiconductor research and development. Further adding to the positive sentiment, earnings seasons continued to show companies faring well despite supply chain inflation and wage inflation. At the mid-month point, U.S. equities had hit 4.23% in returns for the first half of the month. The four-week rally that started in mid-July began to fade as the Fed’s continued hawkish tone was met with a lack of confidence and perception that inflation had become entrenched and out of the Fed’s control. In addition, the second consecutive report of GDP contraction -0.2%, though the National Bureau of Economic Research has yet to confirm an official declaration of a recession. Towards the end of the month, the markets slumped further as the Jackson Hole Economic Symposium opened with Powell’s particularly hawkish tone. Valuations and performances across capital markets, specifically technology and growth sectors have suffered both tumbling -6.12% and -5.34% for the month of August respectively, after confirmation of the strict stance on inflation.

European equities fell 4.98% as economic outlooks from inflation, rising interest rates and anticipation of an energy crisis weigh on short and mid-term expectations. In the eurozone, the dollar maintained its strength, its highest relative strength in twenty years across European economies. European nations are showcasing similar tightening policy stances as global central banks as they increased borrowing rates, with August reporting 9.1% inflation. The Eurozone GDP increased by 0.7% in Q2, but this news landed flatly as economists and analysts weigh the reality of recent European energy and oil import limitations from Russia due to the ongoing conflict in Ukraine. Prices of natural gas have continued to soar to near-record highs as energy demand reached peak levels over the hot summer months that have brought heatwaves. Energy prices have soared and the stage is set for an anticipated winter energy shortage and subsequent economic fallout.

Emerging Markets had a mini rally mid-month in sympathy to positive Q2 macroeconomic data that regained earlier losses. Latin America markets ended up 2.82% after a solid return in July despite central bank hikes in Chile, Argentina and Brazil. Emerging Markets as a whole increased only 45 bps. Chinese rebounded from a miserable July, but only managed a 21 bps gain amid an unexpected Chinese rate cut in response to alarming macro data of a slowing economy, such as depressed consumer activity from supply issues, COVID restrictions and a national mortgage crisis.

Economic data showed early signs of cooling, with the Consumer Price Index falling to 8.5% in July, marking the first monthly decline since 2021. However, this decrease is mainly due to lowered energy costs. Labor market data has also been strong reporting a low unemployment rate of 3.5%. Federal Reserve Chair Jerome Powell has maintained that one positive month of data is not enough to ease off and they are open to strong hikes in September and December or until the Fed has broken the back of inflation. August was another rough month in the bond markets losing 2.83% for the Barclays U.S. Aggregate Bond Index. Mortgages took a beating as rising interest rates hit the segment hard. The treasury curve continues to signal recession with the spread between the two-year and ten-year treasury remaining negative, though the signal continued to trend higher in August, suggesting a potential waning of concern.

The commodity markets sustained volatility during August along with the rest of the markets. The West Texas Intermediate crude oil price fell from $98 per barrel to $86 per barrel over the course of the month. Gold dropped to just above $1,700. Precious metals have been declining as the market seeks higher yielding assets. Meanwhile, as the Fed shrinks its balance sheet, choking off money supply growth and yields rise, Crypto continues it precipitous fall, losing close to 13% in August for year-to-date loss of nearly 60%.

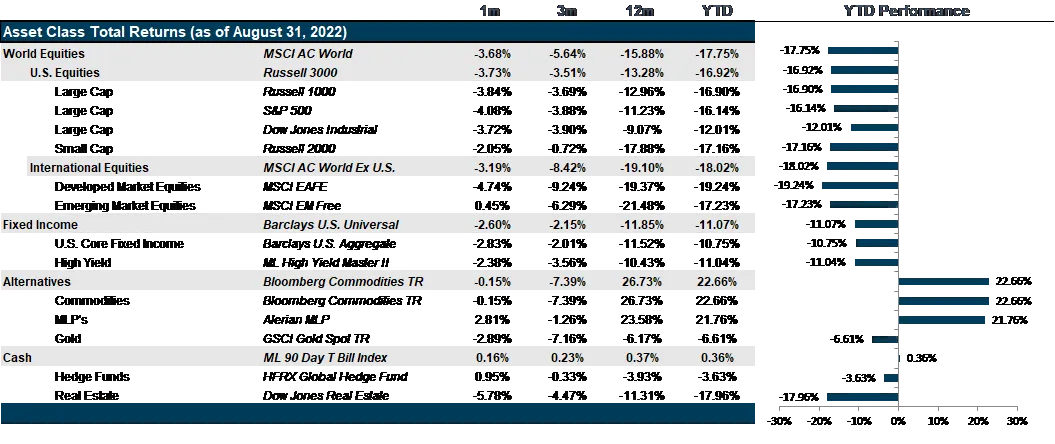

Figure 1: Market Performance as of August 31, 2022

Going Forward: What's the Fed Got to Do With It?

Fed Chair Jerome Powell’s speech in Jackson Hole drew a line in the sand. He expressed his willingness to do what it takes to break the back of inflation, leaving the markets to wonder if that means taking the economy down with it. However, inflation is already dropping, with energy prices dropping faster than food prices are rising in the face of labor shortages and supply shortages from Ukraine and Russia. Core inflation has so far remained steady through July and markets eagerly await the August print along with the wage inflation print, which will tell us much more about where we are. What we do know about the labor markets is that despite adding 315,000 in the nonfarm payrolls report, more than expected for August, unemployment has risen to 3.7% and average hourly wages gained only a tepid 0.3% last month. From our vantage point, oil and commodity prices have more than achieved a slowdown without the Fed’s help, yet markets have quickly revised their expectations for the Fed Funds rate to peak at nearly 4% and rate hikes to continue through March of 2023. If the Fed continues on its path to protect against intrenched inflation, we must consider how much continued excess valuation remains baked into markets, how much pain we can expect to endure and at what point do assets become cheap? On the flip side, if the economy shows enough evidence to convince the Fed to stop the beatings, how will markets react? And, what has changed no matter what the Fed does?

How Far Down

Though this is not our central scenario, it is worth exploring how markets could fair against an overly hawkish Fed policy mandate. Let’s start with equities, where a little over a quarter of the constituents are technology companies that have been brutally beaten since the start of the Fed hikes. One could argue that technology companies are only modestly overpriced, both relative to pre-easy money valuations as well as considering the long-term secular growth themes that center around the growth of cloud computing and the digital economy. However, the equity markets as a whole can still fall 10-15% before hitting official “cheap” status based on current P/E levels vs pre-QE fair value of 16x P/E. On the flip side, International and Emerging Markets equities look very cheap, though the strong dollar remains a significant hurdle. Now for some good news. Investment Grade Corporate Bonds, an asset class that has lost almost as much as large cap equities this year, coming in at a 15.5% loss for the year, already looks cheap. In fact, the asset class could rally another 5-8% and still look cheap, even in the face of continued rising rates. High Yield is not quite as attractive, though very close to fair value at this point. This makes the asset class more vulnerable to hikes in underlying treasuries or a rise in corporate defaults, which is certainly a possibility at the lowest credit quality but does not look imminent based on a healthy level of corporate credit upgrades relative to downgrades. Perhaps the greatest losers if the Fed drives economic activity to a halt with higher rates will be oil and real estate, both very vulnerable to demand and financing costs, respectively. Though, it should also be noted that both have underlying supporting factors. Winter demand will support oil pricing while a lack of housing supply will support residential real estate.

To Rally or Not to Rally

Assuming that the damage wrought by the continued conflict in the Ukraine through elevated oil and food prices brings the economy to enough of a slowdown to talk the Fed off the ledge, could we envision a rally in equities? To some degree, it largely depends on whether the Fed maintains rates where they are or feels compelled to enter an aggressive cutting cycle. Given the hawkish stance we have seen, we could see a prolonged pause into 2023 before considering rate cuts. In fact, if the slow-down is gentle enough, the Fed could go into a prolonged “wait and see” mode, which would leave the markets potentially moving sideways for some time. While not a terrible scenario, we could see bond markets and credit markets recoup some of the painful losses from the year through falling spreads over Treasuries, reflecting a smaller risk premia to hold various forms of credit. In order to see a strong rally, we would need to see aggressive cutting by the Fed and we just can’t envision that much an about face so soon. It could well into 2023 before we could see valuations perk back up.

What Is Unlikely to Change

What is unlikely to change is the Fed stance on quantitative tightening. We can’t see the Fed balance sheet expanding any time soon short of World War or some other extreme scenario. Though those extreme scenarios are more likely than we used to think, the reality is that if they did occur, significant asset price and economic damage would likely be sustained before we could benefit from the change in stance. So, if the Fed balance sheet continues to tighten and money supply shrinks, we could continue to see a sustained drop in asset classes that are largely driven by excess growth in the money supply. These include collectibles, highly risky ventures, crypto currencies and non-fungible tokens (NFT’s) to name a few vulnerable asset classes. No matter what the Fed does, it is unlikely to suddenly start expanding their balance sheet anytime soon. So, valuations will likely remain subdued across equities from public to private and fungibility and stability will likely dominate until the money supply expands again.

Net View

Though we are not overly optimistic about the potential for a rally, we are also not nearly as pessimistic regarding the Fed’s willingness to destroy the economy. We lean into the parts of the portfolio where the risks are largely priced in, U.S. Growth and U.S. Investment Credit. We see continued downside to energy commodities and real estate through the hiking cycle. And, until the Fed stops hiking, we prefer U.S. equities relative to international and emerging markets equities, despite the cheap valuations abroad.