With all eyes on the Fed and the fading likelihood of a June cut, markets could remain volatile.

The Waiting Game: Summary

-

Continued data evidence of an economy in recovery puts the June rate cut at risk: the likelihood for three cuts this year falls with every strong datapoint.

-

High oil prices are a double-edged sword: the challenge to the Fed in a world of elevated oil prices is that inflation will be stoked while the economy will weaken, creating a Fed policy conundrum where the economy may become collateral damage to the Fed’s bid for inflation credibility.

-

The case for volatility continues to remain strong: even measures of volatility itself have become volatile, though look to be trending up.

Market Review: Defensively Positive

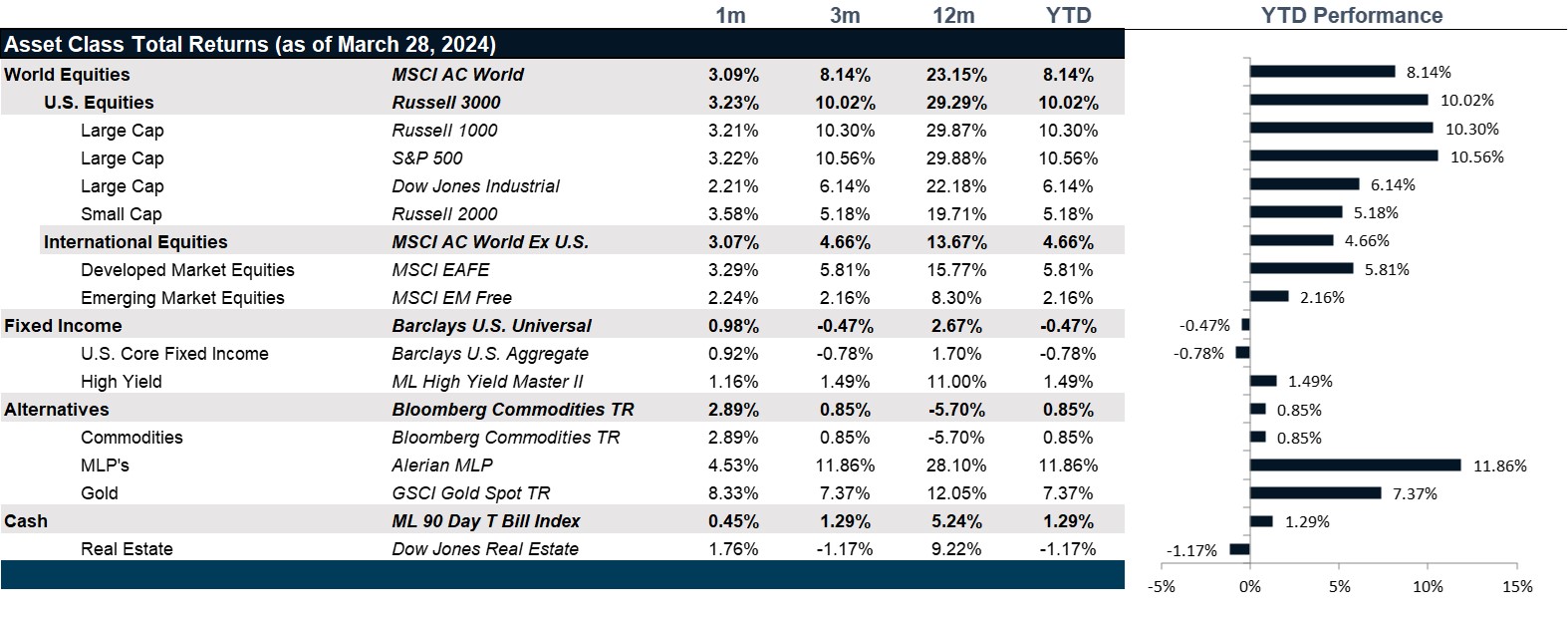

And just like that, the exuberance faded. Equity markets still continued to rally; however, the nature of the rally turned decidedly defensive with value turning in a strong performance for the month at 4.55% against 2.13% for growth stocks as measured by the S&P Large Cap Value and Growth Indices, respectively. There was little differentiation between small and large cap stocks, returning 3.24% and 2.33%, respectively. However, sector performance was the biggest telltale sign of the defensive market with energy, communications, materials and utilities topping the performance tables. That said, the price-to-earnings ratio for the S&P 500 continued to tick up steadily through the rally to a one year high, peaking out at just above 25x for the index, significantly beyond arguable fair value.

Meanwhile, international developed equities performed only modestly ahead of U.S. equities at 3.4% in U.S. dollar terms. After a long rally, Japanese equities lagged as Japan executed their first rate hike in 17 years and exited negative interest rate territory. Yet, despite this historic move, Japanese rates remain far below global rates and the Yen has continued to sink to its lowest level in 34 years. That weakness has hurt U.S. dollar based investors, with Japanese equities turning in a 2.77% total return in U.S. dollar terms versus 3.73% in Japanese yen terms. Europe, however, performed well in both dollar and euro terms as investors snapped up more attractive valuations, driving them just above fair value, but not by much at a price-to-earnings ratio of just shy of 15x. Finally, emerging markets were held back by Chinese equities as the sector has traded below its fair value all year. As the markets start to turn their backs on growthy tech names, China is suffering the most, though Korea still managed a strong month. Emerging markets equities turned in 2.22%, as measured by the MSCI Emerging Markets Equity Index while China turned in just 0.84% for the month.

The yield curve remained stubbornly inverted for another month with the long end falling ever so slightly over the course of March. The Barclays U.S. Aggregate Bond Index turned in mildly negative performance losing 27 bps, with the worst performance continued by the mortgage index, losing 46 bps for the month and the best coming from investment grade corporates, losing only 17 bps. As the overall expectations for recession continue to fade, corporate spreads continue to grind lower, supported by a surge of upgrades in bond credit ratings. High-yield credit performed worse by comparison, losing 28 bps as high-yield bonds suffered an onslaught of downgrades for the month, suggesting that all may not be rosy in corporate America. Meanwhile, as the concern that the Fed may delay cutting rates, the mortgage index suffered as the Bankrate 30-year fixed mortgage trended back up to just above 7.2% over the course of the month.

In real assets, a tale of two commodities presided over the month. Tension in the Middle East has driven up oil prices, driving up oil futures prices and contributing strong performance versus everything else as industrial metals flagged on the back of slowing economic activity and agriculture flagged. Even precious metals turned in -1.29% total return for the month compared to the screaming 2.79% experienced by the energy index and 0.4% return of the overall commodities index. Though office and retail remain real estate pariahs, returning 60 bps and losing 79 bps respectively, hotels and industrials turned in strong performance in the REITs at 5.8% and 3.59%, respectively. The total REIT index clocked in at 1.9%, though many remain concerned about the outlook for office space if the Fed does delay rate cuts.

Going Forward: The Waiting Game

Asset markets, regardless of asset class, have largely been reduced to a one factor trade: The Fed. As the investing world waits with baited breath on the Fed’s first rate cut, the need for such a cut remains elusive. If anything, the shock of the hiking campaign seems to have been absorbed into spending patterns and demand has shifted down modestly. However, it has not shut down in a way that signals any impending recession, and the markets are largely pricing in a soft landing, which truly makes the case for a rate cut just that much harder. Why should the Fed cut rates if monetary policy is not by many measures restrictive? The Fed must feel confident that they have put the inflation genie back in the bottle. Middle East tensions are now starting to manifest higher oil prices, which have the potential to produce the worst and most unproductive form of inflation. Oil price inflation acts as a tax on consumption without any resulting wage-driven wealth effects or corporate margin expansion. This could herald the slowdown no one is expecting, while forcing the Fed back into a corner to keep rates steady or even possibly hike.

Fading Hope of a June Cut

The dot plot still shows an expectation of three rate cuts. The Fed Funds futures curve is still pricing in three rate cuts. The opening market volatility kicked off by a miss in Tesla EV sales supports the notion that perhaps there is indeed enough market weakness to support a June rate cut. That said, Powell continues to argue that the Fed is still in wait and see mode, and such a stance is not exactly a roadmap to a June cut. If anything, the PMI data is marking the first manufacturing expansion in 16 months, which suggests that the manufacturing complex is on the mend. With earnings coming up out of a trough, it is very hard to justify the need for a cut if the economy is healing on its own.

The Specter of Higher Oil

If anything, cooling inflation was the biggest reason to believe that the Fed might feel comfortable cutting. The Core Personal Consumption Expenditure (PCE) Index, the Fed’s favored inflation measure, continues to fall, but the Consumer Price Index has stalled, and the Producer Price Index came in hot. It is not that surprising given that materials prices are up enough to make the sector a top performer behind energy. And, on that note, oil prices are slowly creeping back up. Admittedly, prices are nowhere near the highs experienced when Russia invaded Ukraine, but the trend is troubling at a time when the Fed’s commitment to rate cuts remains lackluster at best. A spike in oil prices could herald a rate hike, an outcome that is not priced into markets.

The Case for Volatility

We continue to see change as the only constant in markets. The VIX (the CBOE Volatility Index) has itself been rather volatile over the past year with a trend of steadily higher peaks. Though hardly in danger territory, the potential contributors to volatility remain: the potential for the Fed to continue to wait, the potential for a spike in oils prices, and the potential for a worse slowdown than is priced in. The good news is that volatility remains in a range that allows for attractive hedging, however, we see this as an opportunity to limit portfolio losses through options.

Net View

We remain neutral in our portfolio view, while our expectation for continued volatility supports hedging equity risk assets.