New sanctions against Russia have stoked commodity prices and raised the specter of stagflation and recession.

Ups & Downs Summary

• The VIX appears to be climbing out of its trough as equity volatility remains alive and well: Equities are being whipsawed by the commodity price shocks reverberating through the markets resulting from the most recent sanctions against Russia.

• Commodity prices continue to stoke inflation fears: The big question will be whether inflation momentum takes root in the economy, and so far, the Fed does not seem convinced.

• Talk of recession in the face of stagflation is the worst-case worry: We are not convinced that the Fed will act as aggressively, despite being behind the curve on the recovery.

Market Review: Continued Turmoil

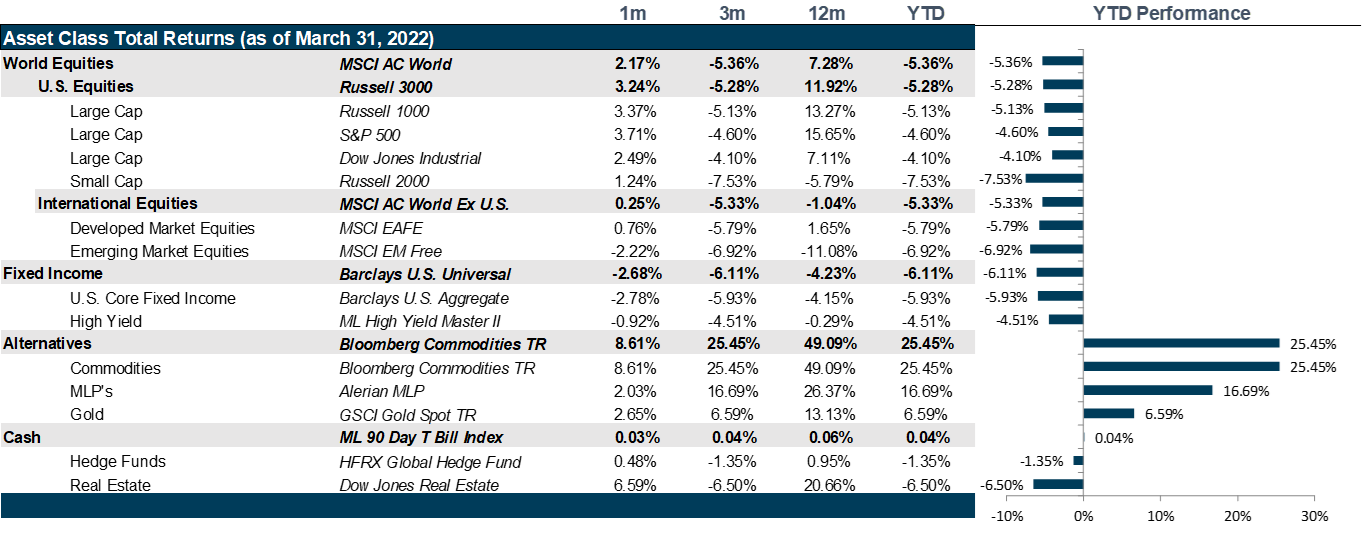

Quantitative tightening by the Federal Reserve and the ongoing war between Russia and Ukraine affected markets in March.

At the March policy meeting, the Federal Open Market Committee increased the target range for the federal funds rate to 25-50 bps, taking a conservative approach in light of the uncertainty caused by the Russia-Ukraine war. Later, at the Annual Economic Policy Conference of the National Association for Business Economics, Federal Reserve Chairman Jerome Powell expressed an urgency to normalize monetary policy, driving up short-term yields and flattening the yield curve. Fear that the Federal Reserve is behind the eight ball in controlling inflation persists in the market as inflation rose by another 0.8% in February. In addition, concerns that the economy may go through a recession and/or periods of sustained stagflation before the Federal Reserve manages to normalize monetary policy are growing. Growth stocks have been hit hard since the start of the year as rising rates resulted in larger discounts to future earnings, while inflation was expected to affect current earnings. That said, companies on average posted robust results for the fourth quarter, resulting in a strong resurgence of large-cap growth stocks in March, driven by demand for companies with high free cash flow generation and strong balance sheets that have proven to withstand through periods of sustained turmoil.

The European Central Bank announced a surprise acceleration to their tapering program in the middle of March. Eurozone inflation jumped to a high of 7.5% in March as the Russia-Ukraine war resulted in rising food and energy costs with crude oil prices briefly touching $130 per barrel. Crude oil prices in March resembled a ‘M’ shape, with equity markets in Europe and Japan moving inversely; the STOXX Europe 600 and Japan’s Nikkei 225 gained 2.69% and 4.82% respectively.

The Federal Reserve embarking on a quantitative tightening policy had a greater impact on emerging market economies than the war between Russia and Ukraine. Latin America and Middle East markets were boosted by soaring commodity prices while countries in the Asia Pacific region started recovering towards the middle of the month as China’s Vice premier Liu He, in a speech to the State Council’s Financial Stability and Development Committee, emphasized the need to actively introduce market-friendly policies and tread carefully when introducing policies that might have a contractionary effect, sending a conciliatory message to domestic and foreign investors that have been exiting the market since the onset of regulatory crackdown on large tech companies. Towards the end of the month, there also emerged reports of ongoing discussions among Chinese authorities to give U.S. regulators complete access to the audit reports of most of the companies listed on the New York Stock Exchange and Nasdaq.

The yield curve has flattened over the past month, ending the month with 2-year treasury rates at 2.44%, 6 bps higher than the 10-year rates. While the Federal Reserve was conservative in hiking the federal funds rate by just 25 bps, comments by the Chairman post the policy meeting along with the steady recovery in the job market to nearly pre-pandemic levels have led to markets anticipating six more rate hikes this year to 2.5%, expecting the Federal Reserve to move aggressively to control inflation. Markets have been concerned that an aggressive policy tightening might tip the economy into recession, leading to a major exodus from high yield credit as investors expect a greater risk premium considering the higher yield now paid by shorter duration treasuries.

In commodities, natural gas and uranium surged by 20.2% and 14.92% respectively over the past month. Europe has been attempting to replace its energy supplies from Russia by importing more natural gas from the U.S. leading to prices surging as high as $6.2 per million British thermal units. Uranium on the other hand rose to a high of $59.30/lb. as U.S. lawmakers introduced a bill to the Senate to ban U.S. imports of the metal from Russia, which as of 2020 stands at 16% of total U.S. purchases of uranium. Another metal affected by the Russia-Ukraine war has been nickel which witnessed its price surge to around $100,000-per-ton in a single day, leading to a major short-squeeze and an unprecedented disruption to trading as the London Metal Exchange (LME), in a bid to protect the short-sellers and their bankers, cancelled trades for the day on March 8th and introduced price limits when the markets reopened a week later. Tsingshan Holding Group, the worlds’ largest stainless-steel producer suffered a paper loss of nearly $3 billion, unable to honor its margin calls till a week later when it finally secured a line of credit.

Going Forward: Ups and Downs

If March returns reflected a certain optimism regarding peace talks in the Ukraine, April has begun with a collective shock over the atrocities coming to light, the expulsion of Russia from the United Nations Human Rights Council and the resulting sanctions from all corners of the world. Prices spiked yet again on the news for many key commodities from industrial metals to agriculture. That said, oil prices have trailed below $100 per barrel for the West Texas Intermediate (WTI) Crude spot price, which is a welcomed relief, but still remains high enough to warrant fears of continued inflation. And, on that note, inflation in the U.S. continues to trend upward, hitting 7.9% early in April. This continues to stoke fear across markets that the Fed Funds Rate could hit 2.5% by the end of the year, possibly ushering in an inverted yield curve and the recession fears that usually stokes. For a brief shining moment in March, growth equity looked to be making a come-back only to get hit hard as April began. Price matters when you discount at higher interest rates. And, of course, the bond market continues to be dead money. Commodities remain the best trade in town, but by virtue of ushering in such high prices, seemingly doom the rest of the market to volatility. The assumptions that seem to be priced into the market are persistent inflation, rising interest rates, and a possible recession. We evaluate each of these in turn to consider what scenarios we might be facing.

Inflation

What started as temporary pandemic-related supply chain disruption and commodity shortages, coupled with one-time wage increases has evolved into something much more persistent. Though we will never know who was right in the transitory vs. non-transitory inflation argument, there is no question that by sanctioning Russian exports, we face a very real and lingering form of inflation bred at the raw goods price level. This kind of inflation tends to be highly destructive for aggregate demand except for the most inelastic demand goods. It neither generates greater demand as rises in wages tend to, nor is it easy to pass through to consumers unless pricing power is high. At the moment, with CPI running at 7.9% and PPI running at 13.8%, it would seem that companies have lost their ability to pass prices through. This hurts corporate margins and it hurts demand. That said, inflation surprises have been falling since mid-2020 with expectations much higher than the actual data delivers. If Inflation is truly priced into the markets and not quite as high as expected, one could argue that this risk is unlikely to create further market volatility. Moreover, if inflation finally begins to ease with the U.S. release from the Strategic Oil Reserve and OPEC stepping up to replace Russian commodities, then we could see a fall in commodity prices and the rebound in equities by year end. The likelihood of that occurring is not unreasonable for commodities like coal, iron and steel. However, nickel, platinum, palladium and neon, where Russia is the number one or two producer in the world, it will be more challenging. So, we see inflation remaining a problem, though perhaps not as much of a problem as the market is pricing in.

Interest Rates

Here, we are witnessing a game of catch-up where Fed Chairman Jerome Powell admits that the Fed is behind the curve. That said, the Fed is only communicating three rate hikes in 2022 and has sped up the drawdown of its asset purchase program versus the Fed Funds Futures market which is pricing in rate cuts at every meeting for six rates hikes this year up to 2.5%. Those are very different messages. If the Fed is to be believed, then we could see a rally in bonds, real estate and growth stocks as they are laboring under the assumption that the Fed will be aggressive and indiscriminate bout raising rates. Moreover, we believe the Fed understands the difference between inflation caused by supply shortages and the inflation caused by run-away demand in an overheating economy. For our part, we are strongly in the less aggressive Fed camp and we do not believe that this inflation has the kind of self-replicating momentum that wage induced inflation has and it will therefore not be an issue in 2023 left to be solved. Of course, if we are wrong, then we could see a rush to cash to reduce interest rate sensitivity.

Recession

Since the Russian invasion of the Ukraine, the rosy re-opening rebound view gave way to a grim view of stagflation-led recession. If inflation remains persistent and the Fed aggressively tightens monetary policy, this is a reasonable assumption. However, despite the inflation and interest rate outlook, the labor market remains strong and growth shows no signs of imminent weakness. And, though the latest sub-variant of COVID is making its rounds, because the U.S. is better armed with a broadly vaccinated population, testing and treatments, it is not causing the self-lock down that might have otherwise dented the reopening. Admittedly, though expectations for growth have been revised down, they are still above trend growth at 3.5% for this year, which is pretty far away from the belief that we are heading into a recession. This is perhaps the segment of the story that remains most unlikely, though parts of the market continue to price in some likelihood of recession. We could see the market come back to life if inflation wanes and the Fed misses even just one meeting opportunity to raise rates. So, on the whole, we remain cautiously optimistic.

Net View

We remain overweight to Growth at a Reasonable Price investments. We also remain underweight in Emerging Markets and take our Latin America overweight to neutral after significant performance.