We see multiple unpriced risks in a highly correlated market.

Unpriced Risks: Summary

- Both debt and equity markets are behaving as if the worst is now over: we see identifiable unpriced risks to current market pricing across the spectrum.

- Risky assets are vulnerable: growth is assumed to be improving, yields are assumed to be stable and global risk is assumed to be contained and we see the potential for any or all of these assumptions to be revised before year end.

- We anticipate that stock-bond correlation will continue to be high: this suggests that diversification will be less helpful than normal and place greater emphasis on structuring risk through options as a tool for protection.

Market Review: Correlated Risks

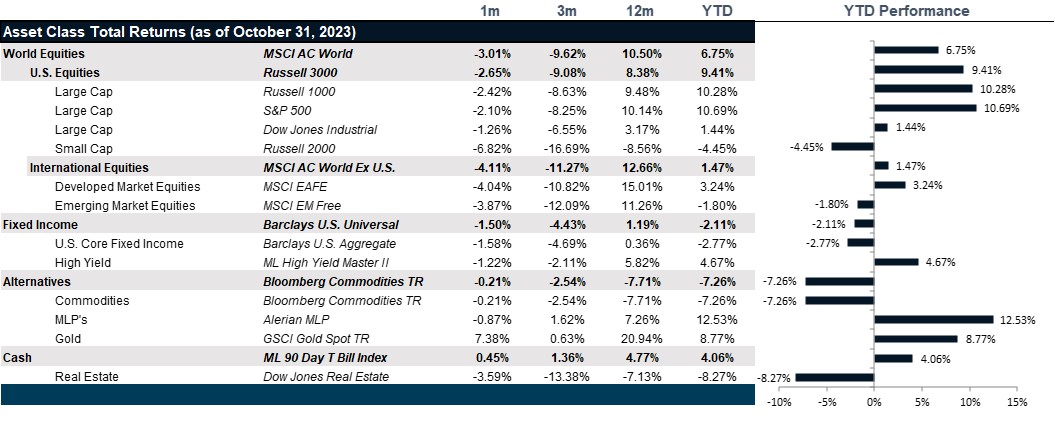

Stocks and bonds in the U.S. continued to fall simultaneously in October on the back of a sharp climb in bond yields, rising geopolitical concerns over the Israel-Hamas war and growing worries about higher for longer interest rates. All three major indexes – the S&P 500, the Nasdaq 100, and the Dow Jones Industrial Average – recorded negative returns. The S&P 500 was down 2.10% for the month, putting the index below the critical support of its 200-day moving average. October saw a stream of economic data pointing to the resilience in the U.S. economy, including strong jobs numbers, hotter-than-expected retail sales and a 4.9% annual increase in GDP over the third quarter which was more than double the level seen in the previous quarter. CPI Inflation in September came in at 3.7% year-over-year, slightly higher than the expected 3.6%, but core inflation, which strips out energy and food, dropped as expected to 4.1% from 4.3% in August. Despite strong economic data and the risk that a potential spillover of the Israel-Hamas conflict could disrupt oil supply and put pressure on inflation, the Fed left rates unchanged at their November 1st meeting. October also saw the kickoff of the third quarter’s earnings season with investors paying close attention to results from Microsoft, Google’s parent Alphabet, Facebook’s owner Meta, and Amazon. Although all these four companies reported above-consensus earnings, market sentiment took a downturn as investors were probably looking for flawless reports given high interest rates and geopolitical uncertainty.

European stocks logged their worst monthly performance since September 2022 as the Euro STOXX 600 returned -3.62% on concerns about economic growth and interest rates staying higher for longer. Inflation across the Euro Zone fell more than expected to 2.9% year-over-year in October, according to flash figures, down from 4.3% in September. The same agency that reports these statistics also revealed that the economy contracted by 0.1% in the third quarter. The readings came after the European Central Bank decided to hold rates steady after 10 consecutive hikes. The Nikkei 225 declined 4.48% on the back of rising global yields, concerns about China’s hit property sector and growing fears over an escalation in the Israel-Hamas war.

Emerging markets continued the trend from the two previous months with the MSCI Emerging Market Index returning -3.88% in October. Sentiment remained weak in China as the MSCI China Index posted a negative return of 4.28%. While some above-consensus results showed that parts of the economy in China are stabilizing, concerns about its troubled property sector prevailed. China’s GDP for Q3 came in above expectations at 4.9% year-over-year, although it was lower than the 6.3% increase recorded in the previous quarter. This upbeat was not enough to offset the bad news coming out of property developer, Country Garden. The country’s biggest private property developer failed to pay for the first time $15.4 million interest on its offshore bonds, therefore constituting an event of default. The MSCI Latin America Index had a return of -4.75% as high U.S. borrowing costs dented the appeal of riskier Emerging Markets assets.

All year long, investors have been piling into the iShares 20 Plus Year Treasury Bond ETF. The duration of longer bonds means a slight decrease in yields can deliver bumper returns, while an equivalent rise in yields would not harm returns too much. But just like all year long, investors kept getting battered this month as the long end of the curve climbed to highs not seen since before the Great Financial Crisis. The 10- and 30-year yields settled at 4.88% and 5.03%, despite having risen to 5.00% and 5.14% respectively. Therefore, U.S. debt markets have started to show early signs of weakening. Risk premiums for investment-grade corporate bonds reached their highest levels since June, and in the high-yield space, some companies have been having problems selling debt. The flight to quality in response to the conflict in the Middle East probably prevented yields from rising further from the 5.00% psychological resistance. On the other hand, the 2-year yield remained more stable at 5.07% as shorter-dated bonds follow more closely the Fed’s interest rate decision.

The oil market pulled back early in the month on worries that persistently high interest rates will slow global growth and dent demand. Oil prices then recovered some of the lost ground as a potential spillover from the Israel-Hamas war added concerns to an already constrained supply by Saudi Arabia and Russia. The WTI and Brent benchmarks settled at $81.02 and $87.41 per barrel and remained mixed amid the opposing forces of a weak demand outlook and the evolution of the war. Concerns over a broader escalation in the Middle Eastern conflict also sent investors into conventional safe havens, with SPDR Gold Shares ETF rising 7.37%. Copper posted a negative return with spot prices declining 2.23% as investors dumped the red metal on growing concerns about China’s property sector. Bitcoin rose 27.99% after the news that the SEC would not appeal a court decision on Grayscale Bitcoin ETF, making the approval of a Bitcoin spot ETF more likely.

Going Forward: Unpriced Risks

Looking across the markets today, the market bounce that took hold at beginning of November has a few key characteristics. First, it is growth oriented. The markets seem to be shrugging off concerns about recession and assuming a resumption of growth, looking past a modest slowdown that keeps getting upgraded. Second, it is internationally focused. It seems to assume that the dollar weakness that has taken hold will continue. Embedded in that assumption is the underlying assumption that rates hikes are at their end and while significant rate cut are not currently forecasted, the projected pause in rate hikes and modest cuts are enough to support valuations at current levels. Finally, the current Israel-Palestine conflict is assumed to be local not global in nature, leading to an underperformance in VIX, Gold, Oil, and other similar risk-based assets. Also, underlying that assumption is that inflation has now turned the corner, and this is the most dangerous assumption in the lot. Primarily because the failure of this assumption can undo the rest of this bullish story.

Growth Assumption

Earnings are on a downward trajectory and margins remain under pressure despite wage pressure finally falling along with general inflationary pressure. While most economists have thrown in the towel in calling for recession, there are still lingering concerns that a slowdown is still in the cards. Let’s start with the Conference Board of Leading Indicators which has been calling for an economic contraction all year. However, the massive pent-up COVID demand seems to have blunted the immediate symptoms of a slowing economy. However, pent-up COVID savings have largely been exhausted and the switch to credit card financed consumption is now starting to bite as higher interest rates have consumers treading water in newly acquired, expensive credit card debt. Though the fear of an immediate slowdown has been significantly revised up and the outlook for the slowdown next year has been revised up, make no mistake. A slowdown is still in the cards and with that a bout of challenging earnings that will test valuations. With interest rates normalizing higher, the ability to discount back into a high valuation is no longer the game. Real earnings and revenues will be what drives valuation.

Yield Assumption

Jerome Powell continues to assert his willingness to hike interest rates if necessary. The markets are shrugging off these threats, treating them like the Dread Pirate Roberts who will most likely kill us in the morning. Fed Funds futures continue to price in a modest likelihood of a 25 bps hike followed by three to four 25 bps cuts back down to 4.5% by January of 2025. The belated adjustment in the long end of the yield curve heralded much pain to holders of long dated Treasury Bonds, but with such a swift adjustment behind us, a new era of higher coupon rates should make up for the recent pain. That is assuming that defaults remain in check and we have the soft landing that is currently priced in. What is not priced in is a significant rise in credit risk or defaults. In addition, this also assumes that the government can agree on budget appropriations for fiscal 2024 before November 17 when the temporary continuing resolution to fund the government runs out. This perhaps presents the greatest risk to U.S. Treasury yields and credit debt, by extension.

Geopolitical Assumption

Falling ten-year Treasury yields, falling VIX, falling gold spot prices, falling oil prices and the falling dollar suggest that global risk is largely under control, despite the boiling conflict in Israel, frozen war in Ukraine and threat of further economic conflict between China and the U.S. and potential armed conflict within Asia. The risks here are decidedly downside risks but the market sentiment remains extraordinarily rosy. This presents a good environment for downside protection.

Net View

The current environment presents significant opportunities for downside protection of equity portfolios. Within the U.S. equities, large caps stocks continue to look more attractive in a slowdown. Within international equities, Japan continues to look more attractive than Europe and Emerging Markets equities are least attractive.