As we enter the new year, we focus on the challenges of growing into current valuations in the face of rising inflation and the removal of monetary stimulus.

Turning the Page: Summary

- As the economic engine of the developed world comes back to life, questions about valuation will emerge: the Fed’s plan to taper in preparation for rate hikes to fight off inflation will make high valuations a challenge for equities.

- Deglobalization will add to the pandemic challenges in Emerging Markets: the outlook for Emerging Markets goes from bad to worse, with the exception of Latin America which may benefit from near-shoring.

- The outlook for bonds hinges on the outlook for liquidity: much of the corporate and structured product landscape requires ample liquidity provided by the Fed. The Fed’s removal of liquidity as the world reopens reduces the outlook considerably.

Turning the Page: Summary

- As the economic engine of the developed world comes back to life, questions about valuation will emerge: the Fed’s plan to taper in preparation for rate hikes to fight off inflation will make high valuations a challenge for equities.

- Deglobalization will add to the pandemic challenges in Emerging Markets: the outlook for Emerging Markets goes from bad to worse, with the exception of Latin America which may benefit from near-shoring.

- The outlook for bonds hinges on the outlook for liquidity: much of the corporate and structured product landscape requires ample liquidity provided by the Fed. The Fed’s removal of liquidity as the world reopens reduces the outlook considerably.

You can read the full Market Update below.

Market Review: Caught Off Guard

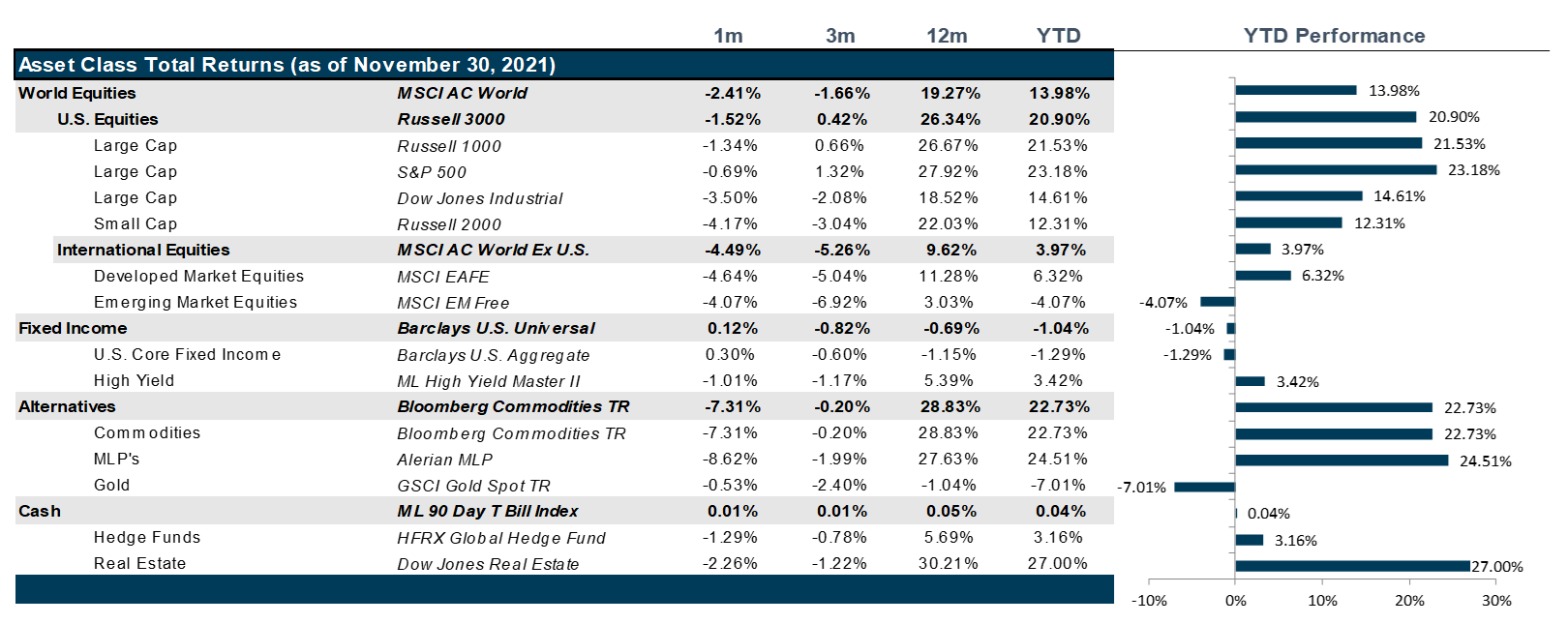

In November, markets fretted over inflation and possible change to top post of the Federal Reserve while being caught off-guard by a new and highly mutated variant of the COVID-19 virus.

In U.S. equity markets the industrial real estate sector was the top performer. The pandemic has increased e-commerce penetration and supply chain bottlenecks have pushed storage utilization to record highs according to Prologis’ Research Department. High demand has resulted in a structural shift in the sector away from the ‘just-in-time’ model, towards developing more resilience in the supply chain. This shift has significantly benefitted industrial real estate sector revenues. In the second week of the month, President Biden signed the $1 trillion infrastructure bill into law which buoyed market sentiment. In addition, encouraging nonfarm payroll numbers for October and falling unemployment claims further supported positive sentiment. Despite improvement in the job market, inflation continued to rise and hit its highest rate in three decades. However, expectations for Fed response rested not directly with inflation action, but rather with the decision of whether to reappoint current Fed Chairman Jerome Powell. As markets contemplated the potential appointment of Lael Brainard, a more dovish Federal Reserve Board member, expectations for the exit of easy monetary policy began to get pushed father into the future, according to Fed Funds Futures, only to get snapped back to reality when Chair Powell was reappointed. The discovery of the Omicron variant of COVID-19 virus by researchers in South Africa and its subsequent classification as a variant of concern by the WHO led to a selloff in the markets in the last week leading to a rotation from ‘Value’ towards ‘Growth’ stocks that largely comprises technology stocks which have proven to be more resilient the entirety of the past 2 years.

European markets remained flat for a large part of November despite a good earnings season. The sluggish market largely resulted from spiraling energy costs, record high inflation and a lack of substantial improvement in uptake of vaccinations. The discovery of the omicron variant in Europe as well as the revelation of its existence on the continent preceding its discovery in South Africa led to a selloff towards the last week of the month. Further lockdowns and restrictions stand to severely affect the travel and hospitality industry as well as others such as manufacturing which are still reeling from the sky-high energy costs. Japanese markets have also suffered for similar reasons.

Emerging markets as a whole have underperformed over the past couple of months owing to geopolitical factors and a slow vaccination rate. The risk posed by the collapse of the Evergrande group seems to have subsided, however China’s real estate sector has continued to stumble. There is a policy change underway in China with an increased focus on cybersecurity that is expected to affect all sectors. Financial regulators recently asked ride sharing company Didi to formulate a plan to delist from the U.S. markets.

Intermediate (2-10 year) rates jumped by an average of 12 bps on November 10th, in response to inflation numbers surpassing economist expectations, and again on the 22nd of November as the minutes from the Federal Reserves’ policy meeting insinuated a more hawkish posture towards tempering inflation. However, on the 26th rates took a tumble with news of the Omicron variant, falling by an average of 16.4 bps. As a whole, over the past month, the yield curve has flattened with the short end rising in response to inflation while the longer end has fallen on news of the new covid variant. Corporate bonds have been net losers over the past month due to widening spreads as investors prefer to hold treasury bonds in times of turbulence.

Energy fuel prices such as crude oil and natural gas maintained their highs for most of November as the OPEC + continues to stick to their plan of gradually increasing production which seems sensible given how news of the Omicron variant and countries mulling new lockdown measures to prevent transmission, sent energy prices into a nosedive. Demand for electric vehicles as well as renewable energy storage have boosted prices of lithium and cobalt which have gained around 4% and 17% respectively over the past month. Lumber prices soared by roughly 50% this month, reminiscent of June, boosted by strong off-season construction activity and labor shortage, and coffee prices have continued to rise by 13% over the past month due to supply chain issues and extreme weather conditions.

Going Forward: Turning the Page

October always feels scary, but statistically, the chances are not different than any other month to be the worst month of the year. And yet, here we are staring down what feels like a tsunami of risks that just hit the economic ocean shelf of recovery and has built up to monumental heights quickly. So, will this pass or will there be significant destruction as Total COVID deaths have now surpassed five million, though that is generally accepted to be an underreported number. That said, the world has produced abundant testing methods, multiple vaccinations, and now multiple effective treatment options. That said, for various reasons, these resources are neither equally shared among those who desire to partake and not fully exploited by those with access. Regardless of the reasons, the result has been a steady stop and go recovery that has yet to materialize into the grand “reopening” that we all had hoped for. In fact, many market and business observers agree that the world has changed forever as a result of the pandemic. But the markets are still waiting for Godot. Evidence can be seen in valuations which have a been most unusually patient with thAs we close out the second year of the pandemic, on the whole, the world is more optimistic than it was last year. We have more tools available to manage the continuing health crisis: vaccines, testing and treatments. Though the country and the world has yet to fully embrace, or in many cases, have access to many of these tools, the fact that they exist has unleashed an economic reopening in the U.S., parts of Europe and some parts of Asia. However, the problem with that is that that optimism was already priced into the market. The question we are now grappling with is: will that optimism be rewarded? Put another way: will assets grow into their valuations? And, here, we are left with questions. In many respects, the stubbornly high valuations that persisted through the pandemic assumed several things. First, they assumed that we would recover to pre-pandemic levels. Second, that the impact would be relatively short-lived and therefore not exact significant structural changes. Finally, that the trends going into the pandemic would be the trends coming out of the pandemic. But the impact of the pandemic seems to be longer than expected, more structural than expected and has changed how we do business, work, interact and live. The reopening of the economy has confronted everyone from households to businesses with the fragility of the supply chain, the risks to offshoring labor and manufacturing, the true costs of bringing manufacturing back to the U.S. and the challenges of finding workers in a labor economy less tethered to companies or location.

De-Globalization

Because of vaccinations, the recovery cycle is out of sync globally with China entering recovery first, followed by the U.S., then Europe, and finally Japan. However, many emerging market countries such as Vietnam or Peru are still struggling to vaccinate their populations and are stuck in lockdowns and the outlook for the recovery of EM’s is still TFor decades, through a combination of offshoring manufacturing to lower cost, countries with easier regulations and less oversight and scrutiny, U.S. and European countries were able to successfully import deflation while pouring liquidity into their own markets. In doing so, companies effectively benefitted from easy monetary policy with little to no consequence in terms of the cost of capital and gorged themselves on debt. However, with corporate and sovereign debt at historic highs, the pandemic looks to be undermining globalization. The U.S., in particular, is focusing on on-shoring to create more resilient and more reliable supply chains and where possible, this on-shoring is done in a much more automated way, which could offset its inflationary effects. Where on-shoring is still not feasible, we hear the term “near-shoring” which is effectively a move towards regional partnering. While this marks a challenge to the outlooks for emerging markets, it could mark the rise of Latin America as a potential partner of choice to the largest consumer economy in the world.

Inflation

Perhaps the greatest threat to a successful and smooth recovery remains the supply demand mismatch between the recovery in countries that primarily consume goods and those that primarily produce goods. The lack of vaccinations The impacts of shifting labor and manufacturing back to more developed countries has the potential to unleash significant inflation. This is partially explained by falling population growth in the majority of developed countries where birth rates have fallen below replacement rates, and where labor market participants are aging out of the labor force faster than new entrants are coming in. While this potential labor shortage could be overcome with continued automation, delayed retirement, recruitment of unpaid workers into the formal economy (ie stay at home parents) and immigration, each of those comes with significant policy challenges and costs. More importantly, an aging economy is generally assumed to be deflationary. So, the inflationary effects of de-globalization could be temporary and the concern about lingering inflation may well be overblown. Meanwhile, despite the rise in shipping, logistics and wage costs, the stimulative effects of fiscal stimulus have unleashed corporate pricing power not seen since 1974. With the distinct exception of the utilities sector, every sector of the economy has expanded operating margins since the rise in inflation. Moreover, in some sectors like technology, financials, communications and materials, margins have surpassed pre-pandemic levels. So, inflation is not a bad thing when it adds to wage inflation and overall aggregate demand. From this perspective, some sectors may in fact be able to grow into their multiples.

Liquidity

The push and pull of inflation on the policy outlook paints a more concerning picture for liquidity. Corporate debt is currently supported by one part fiscal and monetary stimulus and two parts hope. Moreover, treasuries and mortgage-backed securities have been significantly supported by the Fed Balance Sheet which is about to begin to shrink. Though, while many market observers are ringing the alarm bells on risk assets in the face of peak liquidity pushed by inflation and economic overheating, the reality is that until real yields start rising, this catastrophe can be held at bay. So, inflation is once again our friend. That is, if you experience it in the right way, through pricing power and rising margins. That said, we remain cautious that as we remove excess money from the system that asset markets will suffer a risk re-rating relative to the real economy. Therefore, the path out of the pandemic still looks to have potential bumps in the road.

Net View

Our outlook for growth in the face of tapering and rising rates leads us back to a neutral growth vs value stance. We also remain underweight in Emerging Markets relative to the U.S. and move to neutral between Europe and Japan. We initiate an underweight in corporate debt and high yield debt versus treasury debt.