Mixed signals suggest very different outcomes.

This Time It’s Different….Or Is It? | Summary

- The divergence between high-yield debt and U.S. equity suggests downside for equities: current equity valuations still do not reflect a recession or prolonged higher rates.

- The inverted yield curve is not consistent with the Fed Funds Futures curve which suggest a round of rate cuts in 2024: equity markets are currently pricing in a cutting cycle that the Fed may not be prepared to make.

- Economists are moving out the recession expectations: though the data suggests that the recession could be shallow, economists are projecting that it could last longer than the usual recession.

Market Review: The Worst and Best Month

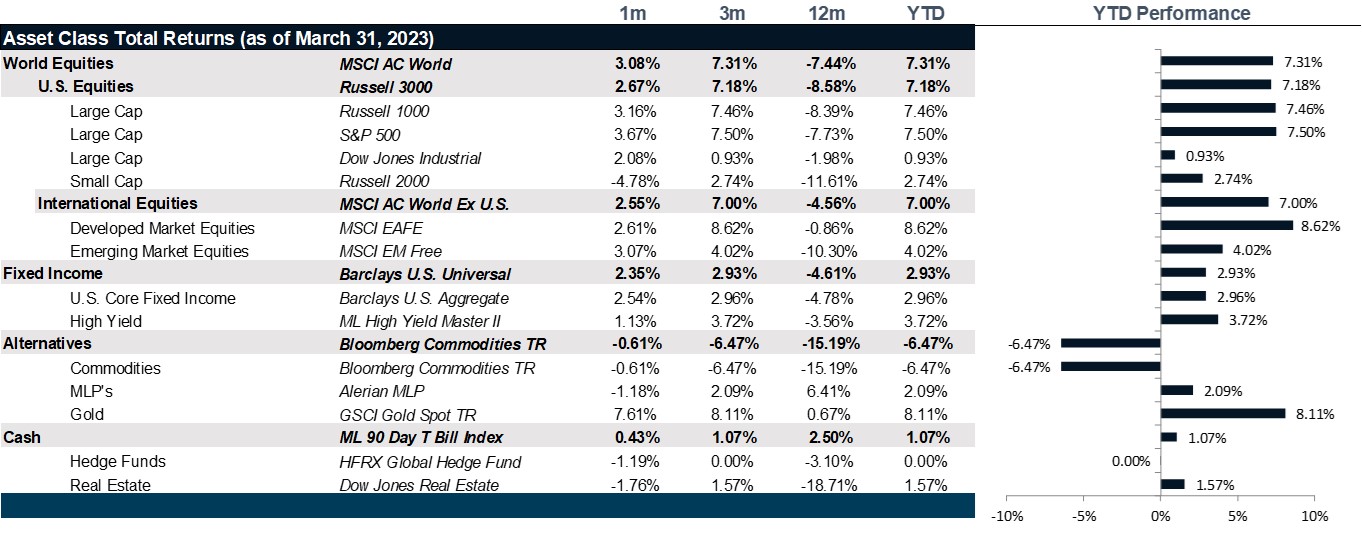

Equity markets posted a positive March to end the first quarter on a high despite concerns regarding the health of the financial sector following the collapse of Silicon Valley Bank (“SVB”). The SVB collapse led to a major sell-off in U.S. and European equities, especially in the financial sector. However, stocks recovered with the S&P 500 ending the month up 3.7%. Most of the gains came from the Technology and Communication Service sectors prevailing over the laggards in the financial sector. The gains in the Technology and Communication Service sectors drove the NASDAQ up 6.8% as well as the Nasdaq-100 into a bull market. Year-over-year inflation dropped further to 6.0%, but the Fed maintained that inflation remains too high setting the tone for at least one additional rate hike. Despite subdued inflation data and the turbulence surrounding SVB and the banking sector, the Fed flowed through with a 25 bps hike in March. Inflation remained rooted in shelter costs where rents have remained high as well as in the services sector, where wage inflation is falling slowly. The labor market came in hot as nonfarm payrolls rose by more than the expected 311,000.

European stocks ended the month flat at 0.05% as the banking crisis and the Credit Suisse fiasco caused markets to have one of the worst days in over a year. However, the STOXX 600 index gained 10.2% in the first quarter and 2.3% for the month of March despite a few highly volatile weeks. As core inflation still remains high, the European Central Bank raised rates by 50 bps and indicated more rate hikes to come but at a slower pace. The U.K. unexpectedly saw a rise in year-over-year inflation to 10.4% and the Bank of England responded by raising interest rates by 25 bps. The London Stock Exchange’s FTSE 100 was down 3% in March even as the economy fares better than expected as opposed to four months ago when the Bank of England warned that Britain was possibly facing its worst recession in a century.

Emerging markets reversed course from last month posting gains of 3.04%. China posted a stronger performance gaining 4.51%. for March. China has been witnessing a strong recovery ever since it dropped its zero covid policy while inflation still remains low. Asian markets gained 3.59% as fears of an impending banking crisis seemed to fade. Although the Latin America region posted gains of 0.91%, there are reports of a potential slowdown in its GDP growth.

The U.S. investment grade bond market posted gains. High-yield corporate bonds were another story, finishing slightly negative for the month with credit downgrades outpacing credit upgrades. The Bloomberg U.S. Aggregate Index posted a return of 2.5% for the month. U.S. Treasury yields fell with the 10-year falling to 3.48% and the 2-year falling to 4.06% as the market started to price rate cuts for later this year. Global bond markets also posted gains with the Bloomberg Barclays Aggregate Index for U.K. and Europe posting 2.2% and 2.0% respectively.

Commodities had a dismal month with energy falling -6.95%. That said, precious metals had a very strong month with gold posting a gain of over 7% and silver around 15% as the banking crisis pushed investors into safe havens. WTI crude touched a low of $68 per barrel mid-month; however, an unexpected production cut from OPEC drove a strong oil price rally at month-end. The dollar also weakened, further extending its losses. Crypto had a strong month in March with Bitcoin gaining as much as 70% this year but the question remains if they are a reliable alternative class of investment.

Going Forward: This Time It’s Different….Or Is It?

Silicon Valley Bank was a canary in the coal mine that at best revealed what we already knew – that the fast pace of interest rate normalization was creating real risk in the bank system which is a system that relies primarily on faith to overcome the natural mismatch between deposits which can be withdrawn at any time on request and assets which are of longer duration. If this is all it revealed, then we only face a liquidity crisis that can be solved with time and faith. To ensure that depositors are keeping the faith, the Federal Reserve announced the Bank Term Funding Program to help bolster depositor faith. Since the SVB collapse, U.S. commercial bank deposits, which had been falling gradually since September of 2022, began a more precipitous plunge out of the banks and into the money markets. Commercial loans, which had been elevated over the same time, quickly fell back to a more normal pace. However, the bigger concern is that lending out of the banking system will slow even more precipitously, tighten financial conditions, and plunge the economy into a deep recession. That is the better outcome. The worse outcome is that this liquidity crisis in the banking system morphs into a credit crisis on the balance sheet where banks are faced with delinquency and default rates that are currently not priced into markets.

High Yield Debt Canary In the Coal Mine

Traditionally, equity and high-yield debt are reasonably correlated, varying between .65 and .69 on a U.S. and global basis. Yet, this past month, performance in the respective markets diverged significantly with equities rallying into the announcement of the Bank Term Funding Program. However, high-yield debt posted a small loss for the month with credit downgrades outpacing credit upgrades two to one over the course of the month and through the start of the year. Divergences between these markets are rare enough for us to take note that the more conservative credit markets may be sending up smoke signals that amount to danger ahead.

The Inverted Yield Curve Reality Check

The yield curve remains deeply inverted as the Fed is expected to hike one more time before pausing in May. However, the Fed Funds Futures anticipate that the deterioration in economic activity and financial conditions could entice the Fed to begin a series of rate cuts ranging from four to six 25 bps cuts, leaving the Fed Funds Overnight Rate at 4% - 4.5% after all is said and done. Equity markets took this development as reason to be less concerned about multiples and this was another driver of the March rally. However, the likelihood of this, given the Fed’s hawkishness, is low. If the Fed leaves the short end of the yield curve above 5%, then multiples still have more to fall before the yield curve normalizes higher. When that happens, bonds will experience their own volatility.

Economic Growth Revisions

Perhaps more concerning are the revisions to U.S. growth which have seen 2023 growth upgraded to a milder recession, but 2024 got downgraded, suggesting a longer recession experience on a quarter-over-quarter basis. If this recession drags on longer than the typical recession, the notion that liquidity issues within the banking system could manifest into credit issues and possibly into a full blow credit and banking crisis is a real concern. Bank lending activity is falling, but still within normal activity for now. That could easily slip into a more restrictive territory. And, remember that the composition of the loan books at smaller and regional banks has a significant exposure office and retail real estate related, a segment of the market that is starting to experience real credit pain. Combined with the loss of deposits, this could manifest into something more pernicious than a simple liquidity problem that can be solved with time.

Net View

We continue to play defense with U.S. equities favoring quality and value. Yields still favor high-grade credit and broad high-grade debt generally.