An otherwise benign outlook faces some challenges with the debt ceiling and the banking crisis.

- An earnings recession is underway: though companies are beating and putting up ok numbers, the trajectory of earnings growth is down partially because companies posted such strong earnings into the reopening a year ago and partially because the growth slowdown is upon us.

- Yields are range-bound: while the Fed Funds futures are pricing in four rate cuts in 2024, signaling a modest relief from the tight financial conditions we have endured over the past 12 months and room for yields to fall some, the debt ceiling talks are creating upward pressure on yields as the Congress flirts with a U.S. credit downgrade.

- Most components of inflation are now falling: energy was a negative contributor in March, signaling both good and bad news for corporations where margins will expand but demand will contract.

Market Review: Fighting to Rally

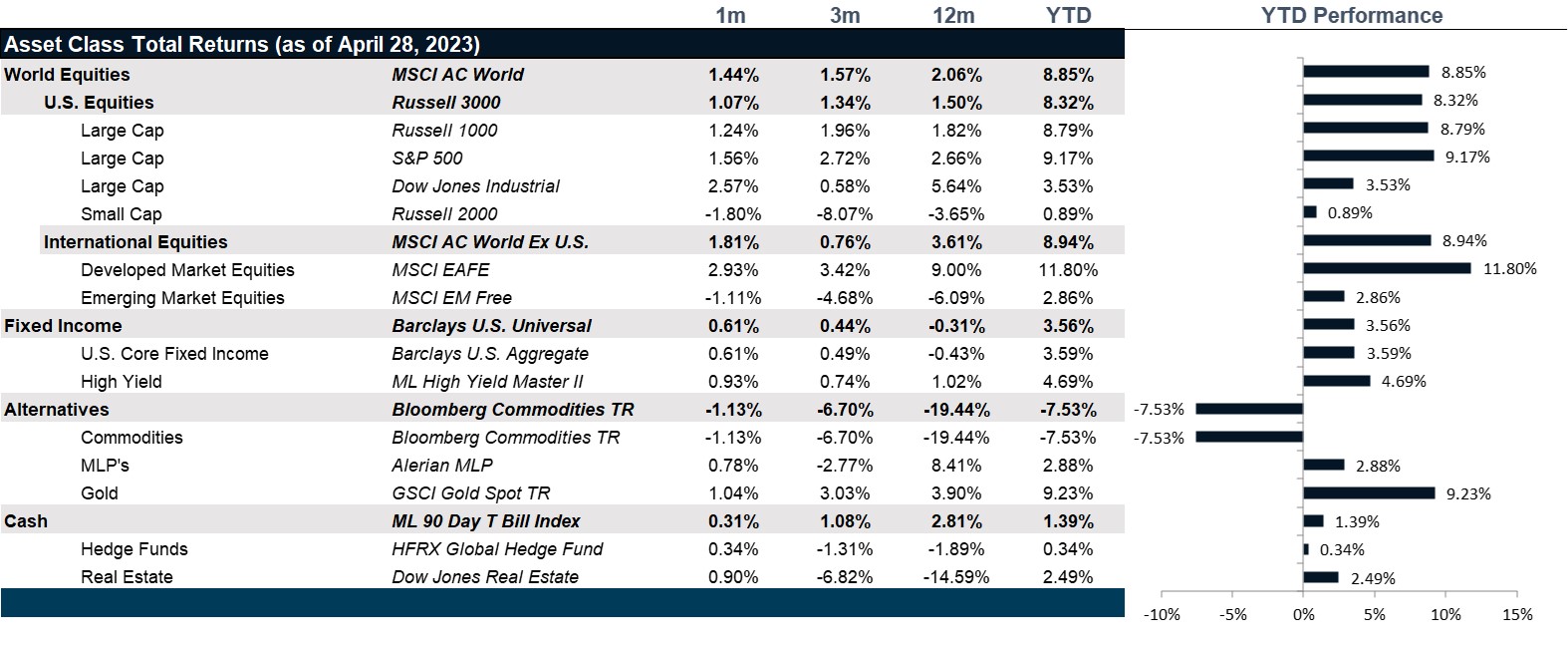

April was a predominantly positive month, with most asset classes posting modest gains even as the U.S. economy slowed to 1.1% below the expectation of 2.0% and interest rates remained elevated. Major U.S. indices apart from small company stocks posted gains with the S&P 500 ending the month up 1.56%, the Dow Jones Industrial Average 2.6% and the NASDAQ up 0.5%. Large-cap stocks outperformed small and micro-cap stocks. The market saw a rally at the start of the month, but the earnings season was mixed even though most companies beat expectations. Communication stocks made the most gains with consumer staples and energy following closely, industrials and consumer discretionary were the laggards. Markets were pricing in a 25bps rate hike in May, which came to pass as expected, before a pause. The banking crisis seems to be far from over with the First Republic sale to JP Morgan in yet another small bank failure. There was also focus on the debt ceiling as Democrats look towards a further increase in the debt limit. Inflation fell by one percent to 5%, however core inflation increased to 5.6% from 5.5%. The personal consumption expenditure index, a crucial inflation measure for the Fed rose 0.3% signaling that inflation could be slowing down. Unemployment fell to 3.5% and 236,000 jobs were added, indicating that the labor market was displaying signs of cooling.

European stocks posted gains too with the STOXX 600 gaining 4.14% in U.S. dollar terms in April, mostly driven by earnings. Inflation in the region took a nosedive with inflation falling to 6.9% from 8.5% in March, however more rate hikes are expected. Eurozone GDP grew by 0.1% in the first quarter, recovering from a contracting economy at the end of last year. UK inflation also fell to 10.1% from 10.5%. The UK’s FTSE 100 posted a gain 5.31% in U.S. dollar terms boosted by gains in the energy sector, overperforming its neighbors in Europe. Japanese stocks also posted local currency gains with the Nikkei 225 and TOPIX both gaining 2.91% and 2.7%, respectively, but were largely flat at 40 bps and 20 bps, after conversion to U.S. dollars.

Stocks in emerging markets presented a different picture with the MSCI EM index down 1.1% for the month. Chinese stocks were the biggest laggards down 5% for the month however Latin American markets helped offset some of these losses with the MSCI EM Latin America Index gaining 2.7%. Chinese stocks were largely influenced by the geopolitical tensions in the region however their economy grew by 4.5% in the first quarter largely fueled by the rebound from the post-Covid reopening.

The U.S. bond market fared well outperforming global sovereigns with Treasuries returning 54 bps for the month. The 3-month and 6-month yields further increased to 5.1% and 5.06% respectively, the 2-year landed at 4% and the 10-year at 3.42% with the 10 Year-3-month yield spread settling at the highest inversion ever in history. U.S. high yield bonds also returned 1% for the month. Most international bond markets fared poorly with the UK bond market losing 1.8% and Euro government bonds down 0.1%.

Precious metals continued their rally with gold gaining 1.1% this month over concerns about the U.S. banking turmoil. Silver and palladium also posted gains. WTI crude made gains earlier in the month after OPEC announced productions cuts but ended flat at $76.78 on the backdrop of recessionary fears, just marginally higher than the March close of $75.67. The U.S. Dollar made losses early on after reports of some countries using other currencies to trade but remained mostly stable over the month. Energy posted losses, helping bring headline inflation down in most developed markets.

Going Forward: Push and Pull

Nothing is straightforward this month. Earnings look terrible when compared to the bumper numbers from a year ago, but they aren’t that bad either, which is consistent with a growth recession outlook. Treasury yields should finally start to fall with a potential for a pause in the hiking cycle and some relief from inflation, yet Congress is flirting with a U.S. default. The turmoil that could be unleashed will certainly send yields up in the short term, creating further pain to already struggling small and regional banks that hold Treasuries as collateral against their recently unstable depositor base. And, finally, the labor market is starting to crack, which is the most concerning signal of all as this could portent a deeper recession than is already baked in. But, the result could equally be positive for stocks if margins recover just in time for a series of rate cuts to put some support under multiples. On the whole, not a terrible outlook but not a good one either.

U.S. Earnings

The picture coming out of U.S. earnings is one of a slowing consumer, consistent with economic forecasts of 1% growth for 2024, which is traditionally referred to as a growth recession. That said, the earnings data varies widely from sector to sector with the hardest hit sectors last year showing a rebound. Consumer discretionary earnings contracted by over 10% in Q2 of 2022 and are now rebounding to extraordinary growth levels which are expected to remain strong through 2024. Large capitalization financials were beaten down in 2022 and are now recovering as assets flow from small banks to large banks. The most defensive sectors, however, are facing very tough comparables with consumer staples, healthcare and utilities all in solid earnings recessions. This sets up a push and pull with more cyclical sectors posting better earnings growth and priced more cheaply and more defensive sectors facing tough comparables and priced more expensively.

U.S. Bonds

By all accounts, bonds should be in for a bit of relief. If the Fed does pause and begins a cutting cycle, we could finally see the yield curve begin to normalize. That said, the short end of the curve is not expected to come down by more than 1% over the course of the next twelve months which would just leave the yield curve flat as a pancake. Worse still, the drama over the debt ceiling is the stuff that drives the cost of borrowing up and could send yields very high and then into a growth crash as the fiscal reality of much higher interest expenses meet the required belt-tightening and layoffs that would go with a failure to increase the statutory debt limit. What is currently envisioned as a modest, if not longer than normal, growth recession or technical recession could turn out worse than expected with further impacts to the already stressed banking system.

Inflation

Everything about inflation suggests that much of the inflationary pressures are going away. That said, the long term will likely see modestly higher inflation than we have gotten used to over the past two decades. However, on the whole and given our indebtedness, that is probably a good thing. In the meantime, most raw goods prices are falling in response to a real fall in demand, which is not a good sign for the health of the economy. Though the labor market is in severe shortage, even it is starting to show signs of weakness, which can’t be a good sign for the recession outlook.

Net View

If up is down and down is up in this current state of valuation and risk, we are focused striking a balance between protecting downside and keeping access to market beta.