Market Update

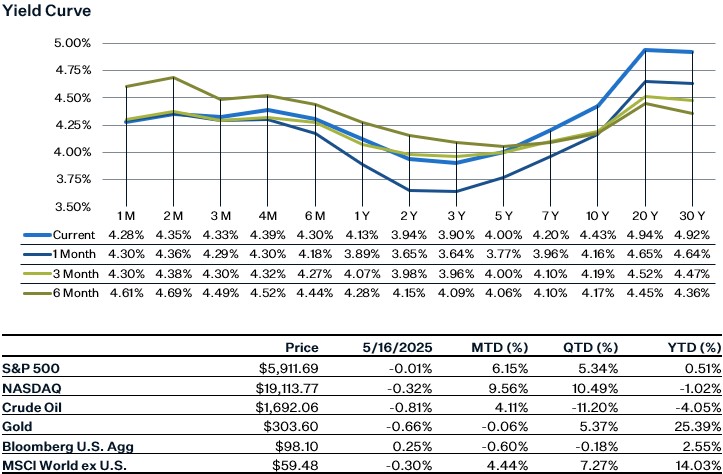

Looking back in May, the S&P 500 recorded its biggest monthly gain of approximately 6.15% since November 2023, putting the S&P 500 slightly positive for the year. Despite the uncertainty around all of the tariffs, investors seem to think that major deals will still be made. Trump’s friendlier tone on certain tariffs, along with healthy Q1 earnings and tame inflation data helped the S&P 500 recover from its April lows. Over the month, treasury yields rose across the curve, most likely due to a combination of higher inflation and reduced recession odds. The market is now pricing in just 50bp of future rate cuts this year, the lowest since February. On the economic front, consumer sentiment has begun to rebound following the temporary pause on China tariffs a few weeks ago, and inflation expectations have moderated. This week, additional insight into tariff impacts will come from Monday’s ISM Manufacturing Survey and Wednesday’s S&P Global PMI numbers. We will also get insight into the labor market with the jobs report on Friday.

Jobless Claims

Initial jobless claims for the week ending May 24 rose to 240k, above expectations of 226k. It is possible that seasonality is partly to blame, as claims in late May in 2023 and 2024 did show an upward trend, but it’s too early to tell. However, the more concerning part of the report was the notable jump in continuing claims. Continuing claims increased to 1919k from the previous week’s 1893k, and they are now at their highest level since November 21. This also brings the 4-week average up to 1890k, a cycle high. One week doesn’t equal a trend though, so we’ll need to wait and see how the data comes in for the next few weeks. Nevertheless, this jump in continuing claims does introduce the possibility of the unemployment rate increasing in the May BLS report which comes out on Friday.

Consumer Confidence and Sentiment

Consumer confidence and sentiment showed signs of recovery in May, boosted by a temporary pause in U.S.-China tariffs and easing inflation fears. The Conference Board’s Confidence Index jumped to 98, its strongest monthly gain in four years, driven by improved expectations for the economy, jobs, and income across a wide range of demographics. Similarly, the University of Michigan’s sentiment index rose to 52.2 in late May from an earlier 50.8 reading, helped by a pullback in long-term inflation expectations to 4.2%, the first decline this year. Despite these gains, overall levels remain historically low, and concerns about job security and personal finances persist. Consumers are cautiously optimistic, with some willingness to spend on big-ticket items, but still wary about the economic outlook amid ongoing trade policy uncertainty and early signs of labor market softening.

Sources:

https://www.dol.gov/ui/data.pdf

https://fred.stlouisfed.org/series/CCSA

https://markets.jpmorgan.com/jpmm/research.article_page?action=open&doc=GPS-4997727-0