Market Update

U.S. equities had a strong week last week, with the S&P 500 and Nasdaq 100 each gaining over 1% on Friday, marking a second straight week of gains, while gold declined for the second consecutive week. The move reflects a continued reduction in growth-related risks, supported by easing U.S.-China tariff tensions and improving investor sentiment. Part of the rally last week was also due to relatively good earnings and a better-than-expected jobs report, which helped ease growth concerns by showing continued strength in the labor market despite elevated policy and economic uncertainty. As we’ve highlighted before, there’s a growing disconnect between weak soft data—such as consumer sentiment falling to pandemic-era levels—and resilient hard data like employment.

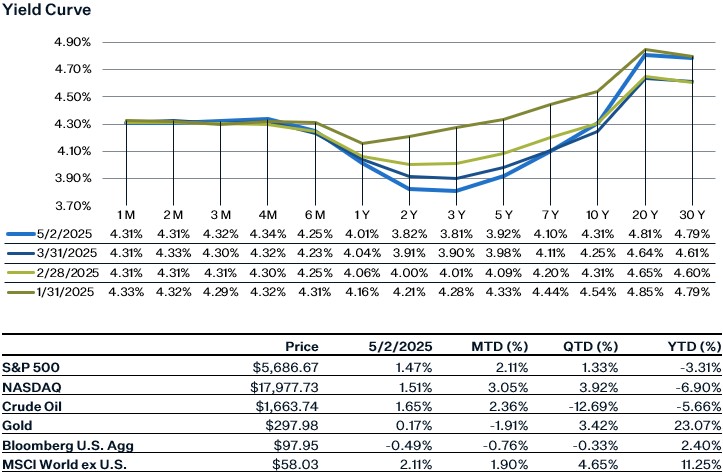

However, there are some important nuances. Part of the recent strength in activity appears to be driven by firms front-loading imports ahead of potential tariffs. This may delay the economic impact of higher costs and weaker demand, potentially concentrating the drag into the second half of the year. With the labor market holding firm and core PCE inflation still elevated, the Fed is likely to maintain its hawkish tone. This view was reflected in a 12-basis point rise in the 2-year Treasury yield, as markets pushed out expectations for near-term rate cuts. That said, if the labor market begins to weaken, the Fed could quickly shift its focus back to supporting growth. Looking ahead, this week’s calendar is light on data. Key releases will include PMI and ISM Services reports, which should offer timely insights into current business activity and forward-looking sentiment.

April Jobs Report

The details in jobs report for April were a surprise in that they showed a labor market that is overall resilient in the midst of high business and economic uncertainty. Nonfarm payroll employment increased by 177k, above expectations of a 138k increase. April’s headline employment is above the 12-month average of 152k. The unemployment rate remained at 4.2%, and hasn’t moved much in the past 12 months as the rate has been rangebound between 4-4.2% since May of last year. Average hourly earnings increased 0.2% for the month, the softest increase in over a year and bringing the year-over-year number slightly lower to 3.77%.

Employment in healthcare increased by 51k, about the same as the average monthly gain of 52,000 over the past 12 months. Gains in transportation and warehousing employment surged to 29k, perhaps from tariff front-loading. The number of people working part time for economic reasons fell for the second consecutive month, another positive. On the other hand, median unemployment duration rose to 10.4 months, slightly below last November’s cycle high. Additionally, the share of people unemployed for more than six months rose to its highest since September. Overall though, the jobs report likely showed the Federal Reserve that the labor market remains healthy and they can continue to wait until there is weakness to resume cutting rates, with the market expecting their next rate cut to be in July. It’s important to note that although the labor market is resilient, conditions can change quickly. If layoffs start to creep up and the unemployment rate starts resuming its trend upwards, the Fed may feel the need to act sooner rather than later.

US GDP

The U.S. economy contracted by 0.3% in Q1, marking its first decline in three years. The pullback was primarily driven by a record surge in imports ahead of Trump’s tariffs, which created a historic 4.8 percentage point drag from net exports. A sharp drop in federal spending, particularly in defense, added to the weakness. Despite the headline contraction, underlying fundamentals remained solid. Final sales rose 2.3%, outpacing expectations, and business investment in equipment surged 22.5%, the strongest pace since 2020. Inventories contributed 2.25 percentage points to growth and are likely to support Q2 as imported goods continue moving through the supply chain. Looking ahead, GDP is expected to rebound in Q2 as front-loaded trade activity normalizes. However, downside risks remain. Tariffs have pushed the U.S. trade tax to its highest level in over a century, increasing uncertainty around retaliation, supply chains, and inflation, just as consumer confidence weakens, debt levels rise, and major retailers report softening discretionary demand.

Sources:

https://markets.jpmorgan.com/jpmm/research.article_page?action=open&doc=GPS-4971432-0

https://markets.jpmorgan.com/jpmm/research.article_page?action=open&doc=GPS-4967084-0

https://www.bloomberg.com/news/articles/2025-05-01/stock-market-today-dow-s-p-live-updates

https://markets.jpmorgan.com/jpmm/research.article_page?action=open&doc=GPS-4971993-0

https://www.bls.gov/news.release/pdf/empsit.pdf

https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html