Earnings are outperforming lowered guidance, but the weakness could just open the door for the Fed to cut.

Mixed Signals: Summary

- The consumption may not be as strong as assumed: Chinese consumption is overhyped with little evidence to support the assumption while U.S. consumption is a credit card debt induced fantasy and neither is a good sign for equity market valuations.

- Inflation has taken a bite out of margins: U.S. margins have stabilized lower while outsourcing is falling and taking out key sources of income across emerging markets, which also underscore equity market fragility.

- The Fed may have some room to cut: meanwhile, interest rates may not remain as high as the Fed is suggesting if the real economy and inflation continue to weaken which could help ease the pain of yield curve normalization.

Market Review: Outperforming Lowered Guidance

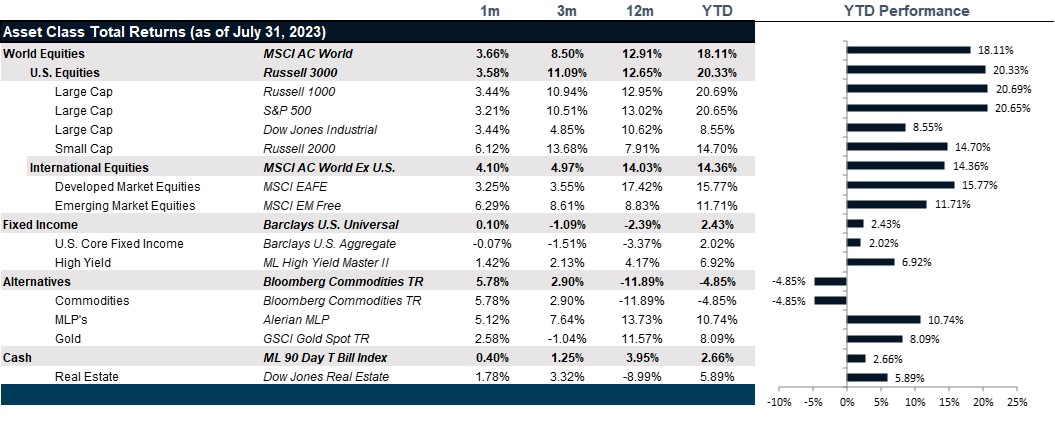

As Q2 earnings kicked off, U.S. companies managed to just beat lowered expectations, continuing a streak of positive returns, up 3.2% for July. Energy was the top performing sector with the rally in energy commodities taking center stage and overcoming challenging earnings. Healthcare, in contrast, was the main laggard as investors continued to dump defensive stocks, positioning for a soft landing. The Dow Jones followed suit, posting a 3.4% return for the month and the tech-heavy Nasdaq returned 3.8%. June’s CPI print came out below expectations at 3.0% year-over-year, the lowest reading in more than two years, while core CPI advanced 4.8% year-over-year, also below expectations but still well-above the Federal Reserve’s 2%-target. The precipitous decline in inflation combined with the stronger-than expected GDP print supports the notion of a soft landing. The FOMC raised the Federal Funds Rate twenty-five basis points, a move almost fully priced in by the market. Moreover, U.S. equity investors continue to behave as if the Fed is done with its hiking cycle largely ignoring hawkish statements from the Fed that we could see one more hike before the end of the year.

European stocks started the month with the Euro STOXX 600 Index recording its worst weekly performance since mid-March on the back of hawkish messages from central banks, weak economic readings from the Euro Zone and new data confirming China’s slow recovery. Later in the month cooling inflation in the U.S. lifted broad global investor sentiment, pulling European shares up 2.9% despite the Federal Reserve and European Central Bank’s interest rate increases. The ECB raised interest rates by 25 bps to 3.75%, the highest since October 2000, and hinted at a potential pause in rate hikes in September. Nikkei 225 index finished the month flat as weaker-than-expected economic data from Japan triggered another round of profit taking. The Bank of Japan left interest rates unchanged amid risks of above-average inflation but made its yield curve control policy more flexible in what some analysts consider the start of a slow shift away from decades of loose monetary policy.

Emerging markets extended the gains from June with the MSCI EM Index returning 6.3% in July. China posted a return of 10.9% despite new economic data signaling that the country’s economic rebound after COVID has so far fallen short of expectations. Investors are hoping for increased demand from China as they expect additional stimulus measures through the second half of 2023 in an effort from the government to shore up the faltering recovery.

Strong ADP jobs data sparked a jump in U.S. Treasury yields with the 2-year and 10-year yields rising to 4.99% and 4.05% respectively. However, Treasury yields dropped after the inflation report for June showed an easing in prices with the 2-year and 10-year yields falling by 16 and 13 basis points, respectively. Since then, and with the hike in July almost fully priced in, U.S. bonds have remained mixed amid falling inflation and resilient economic growth. The 2-year and 10-year yields ended the month at 4.87% and 3.96% respectively, and U.S. Treasuries posted a return of -0.47%.

Commodities had a strong month with the Bloomberg Commodity Index posting a 6.3% return. WTI and Brent oil prices rose from $70.64 to $81.80 and $74.9 to $85.09, respectively. This rally has been fueled by Saudi Arabia’s extension to their previously announced June cuts through at least August with Russia following suit. On the demand side, prospects of higher demand from China because of new stimulus measures and a further decline in the U.S. dollar lifted the price of oil. Investors betting that the Federal Reserve may be nearing the end of its rate hikes caused the dollar’s collapse in the first half of July and pushed gold prices higher. Gold futures posted a return of 2.6% and Precious Metals returned 4.0%. Copper continued to rally, despite concerns that higher interest rates would slow global industrial activity. Prospects for new stimulus measures from China, coupled with continued dollar weakness, drove the red metal futures to post a return of 6.7%. Wheat, corn, and soybean prices all rose on the unfortunate news that Russia would suspend the Black Sea Grain Initiative on July 17, a deal allowing Ukraine to export grain via the Black Sea.

Going Forward: Mixed Signals

U.S. equity markets are suffering an earnings recession but are priced for a recovery. Developed international markets are just experiencing the beginnings of an earnings retrenchment and are priced stagnation. Emerging markets equities are in an earnings recession that has lasted longer than expected but are priced for a massive recovery that just doesn’t seem to come. Meanwhile, the government bond yield curves are priced for a global recession. The challenge is not just that that each market is seemingly telling a different story of what could happen. It is also that the stories are all extremely different from each other. What makes the challenge even greater is that the macro data is telling equally confusing stories that rest on some very specific assumptions that we must evaluate in order to form a view.

The Strong Consumer

There are several pieces of macro data that support the notion that the consumer is strong, which is a key notion underpinning the bullish equity view. First, median wage growth, 5.6% as of the end of June, is now growing faster (or falling slower) than Consumer Price inflation (CPI) at 2.97%. Real wage growth is contributing to rising money velocity, which is a measure of how quickly money circulates in the economy from bank balances to purchases in the economy. Unemployment has remained stubbornly low and the duration of unemployment, measured in the average number of weeks between jobs, is also stubbornly low at only 20 weeks between jobs, on average. So, based on these data, one could very quickly assume that earnings should continue to improve as the consumer earns more and is willing to spend it. However, there is also the notion that we are in a labor shortage based on labor participation data and that older works who have largely exited the labor markets are now living off on their savings, which are a huge part of what has supported valuations over the past five decades. As we go from a retirement nest egg that has been in accumulation mode to one that is in distribution mode, we could be looking at less general support for equities going forward. More importantly, the same consumers that appear strong are also driving up credit card balances to maintain spending post COVID stimulus. So, the consumer may not be as strong as the data suggests and older consumers may be spending less and less over time and selling equities to do it.

The Trouble with Margins

One of the great challenges to earnings outlooks is that they tend to assume some mean reversion. However, much of what contributed to robust earnings over the past two decades comes from a two-decades long trend of outsourcing of labor and manufacturing that lead to unsustainable low inflation and unsustainable high margins. Margins look to have topped out as outsourcing has finally turned the corner. Manufacturing is coming back the U.S. and outsourced jobs have peaked out and are falling. This is great news for U.S. workers and wages, but not great news for companies that have gotten used to very high margins and the resulting operating leverage. With margins falling, the outlook for earnings is a bit harder to swallow unless you also assume a massive improvement in U.S. worker productivity. And remote work does not help this outlook. So, the earnings forecasts may have to be revised down.

Higher Interest Rates

As inflation has come back to life and the Fed has continued to raise interest rates, the fear in a debt burdened landscape is that we will not be able to afford the interest expense associated with the piles of debt on the fiscal balance sheet, the corporate balance sheet and the household balance sheet. The outlook for growth MUST be lower in the long run, hence the very bearish bond outlook. Now here, the outlook may not be as dire as it appears. First, the likelihood that the Fed can keep interest rates higher for longer assumes that inflation is not tamed, and that the consumer is strong. If inflation is not as sticky as it appeared to be last year, and the quick fall off this past year would support that idea, and if we assume the consumer is not as strong as their credit card spending habits might suggest, then we could start to see enough weakness in the economy to support the Fed cutting rates more than is currently priced in. So, the outlook may be somewhere in the middle with a bout of weakness that is not as terrible as the bond market would suggest but not as rosy as the stock market might suggest. If that is the case, then both markets lose. Equities must reprice for a lower margin, lower earnings growth, and lower price to earnings multiple world. Meanwhile, the long end of the bond market will have to reprice for a slightly more buoyant outlook. Both markets could lose significantly, but not catastrophically.

Net View

We remain balanced in our view of equity risk with the U.S. equity outlook, though large caps stocks look more attractive in a growth slowdown. With in international equities, Japan continues to look more attractive than Europe and Emerging Markets equities are least attractive. Finally, within bonds, we maintain an overweight to high quality, investment grade corporate bonds and an underweight to long duration bonds.