Markets are looking past the anticipated slowdown and pricing in a recovery in 2024.

Looking Beyond the Slowdown: Summary

- Companies have fared well despite inflationary pressure: though companies have issued downward guidance and continue to do so, every sector of the S&P 500 posted positive sales growth and 8 of the 11 sectors also posted positive earnings growth despite cost pressures, suggesting healthy pricing power offsetting the prospect of waning demand.

- The U.S. Treasury yield curve is quickly recovering from its inversion: the gloomy outlook for the economy has started to abate as expectations for the Fed are less hawkish and the economy is showing some resilience.

- As oil prices fall, inflation pressures should also fall: expectations for year-end oil prices are finally being revised down to $98 per barrel, suggesting we may see a recovery in oil prices, but not a bounce back to conflict highs which is good news for inflation.

You can read the full Market Update below.

Market Review: Inflation Persists

Markets in July were impacted by higher-than-expected inflation, a second consecutive Fed rate hike, and fluctuating energy supply and demand patterns.

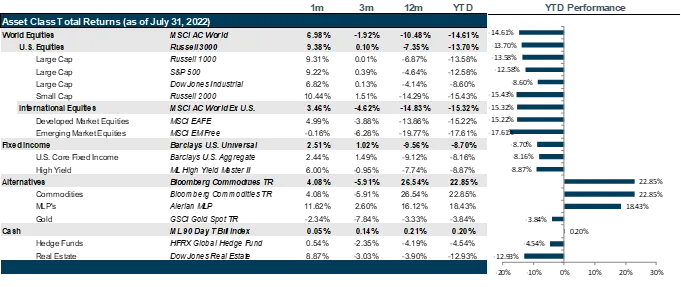

U.S. equity markets posted a strong recovery in July setting pace for the best month of the year. The S&P 500 closed the month up 9.11%, despite inflation worries and the continued hawkish Fed stance. The Consumer Price Index tracking inflation rose by 9.1% year over year, prompting another 75bps hike from the Federal Reserve. However, an upbeat earnings season across the financial and tech sectors helped buoy the first leg of the stock rally as companies showed profits in spite of the high inflation in Q2. Economic data showed a contraction in U.S. GDP for the second consecutive quarter of 0.9% which prompted an expectation that the Federal Reserve would be less aggressive in raising interest rates in the fall and winter. The worst performing sectors for the month included Health Care, Materials, and Utilities. Recessionary fears continue to linger though the National Bureau of Economics Research has not yet declared a recession. The NBER weighed the second quarter of consecutive negative GDP growth against the strength of the labor market to reach this conclusion reflecting the reality that the corporate earnings are not showing significant signs of recession , or at least not yet.

European equities rose steeply in July, gaining 5.1%, reacting to the positive earnings data from U.S. companies and European industrial production outperforming estimates, despite the challenging access to energy, the resulting soaring oil and natural gas prices and the following on economic challenges stemming from the Russo-Ukrainian conflict. In addition, the European Central Bank (ECB) hiked interest rates by 50 bps marking the first increase in over a decade, in efforts to combat inflation that measured at a staggering 8.9% and slowing growth. The euro fell to parity with the U.S. dollar before narrowly edging above towards the end of the month. Europe is anticipating a worrying winter as energy demand is expected to rise above supply which stokes fears of an unprecedented recession as indebted countries will suffer from both higher costs to borrow and potentially increasing energy cost.

Within emerging markets, Chinese markets equities posted the lowest performing month this year. China’s zero COVID policy continued to prevent restrictions from being completely lifted as cases continued to rise. In addition, a tight housing market, rising political tensions with the U.S., and global monetary policy tightening measures have eroded confidence in the near-term growth of the Chinese economy. Decreasing global demand from China has slowed production for the month as measured by the Purchasing Managers’ Index (PMI) which came in below expectations for the second month in a row. The U.S. dollar strength is up 5% compared to China’s yuan and 15% against the Japanese yen. Latin America has recovered from recent energy-related losses, with a gain of close to 4.5% for the regional MSCI Latin America Equity Index.

Economic data showed signs of cooling, with GDP output slowing, however exports for the last quarter surged. Nonfarm payrolls came in higher than expected while Consumer Price Index (CPI) tracking inflation rose by 9.1% for June which was .2% more than expected. With the cooling Industrial Production numbers, the Federal Reserve expressed a willingness to take less aggressive action going forward until 2023. The yield curve inverted this month, a classic signal for recession expectations. However, other factors like unemployment, payroll and Q2 company earnings show positive signs of an economy dealing with unprecedented inflation. As a result, high yield credit spreads compressed dramatically over the month from a high of 583 bps to a month end of 409 bps above Treasuries. In addition, the pace of downgrades fell this month, though downgrades continued to exceed upgrades, which should not be ignored.

Energy based commodities contracted in July. WTI crude oil futures traded near $95-per-barrel during the last ten days of the month and Crude oil prices in Europe have dropped 10% as European political leaders discussed a plan to impose a price cap on Russian oil to prevent future global spikes. Among metals, outflows from gold and silver pushed gold to $1760 per ounce toward the end of the month as markets re-evaluated their expectations on the Federal Reserve’s policy for the second half of the year. Within the crypto universe, Bitcoin has managed to recover 20% of its price closing out the month at around $24,000.

Going Forward: Looking Beyond the Slowdown

For investors in their golden years, the memory of stagflation bubbles to mind as the Fed lamely raises rates against commodity-induced inflation much like Don Quixote waging battle against windmills. Though the reduction of liquidity was necessary for proper risk allocation, the manner in which it is being done is triggering two forms of inflation: energy-driven inflation which it has limited impact on and interest rate inflation which it is directly driving. Interest rate inflation is driving up the cost of debt in all forms from mortgages to autos to credit cards, significantly crimping spending. The reduction of demand can have an impact on energy demand in the medium term, however, supply constraints are the key cause of it. No amount of Fed tightening can make the oil wells pump more supply into the system. That takes time and coordination. In the meantime, inflation readings continue to linger and though they should fall, they are expected to remain higher than the preferred 2% level while the economy slowly cools bringing on a milder form of stagflation.

Equity Multiples

One of the positive aspects of Fed action has been a significant compression of forward price to earnings multiples, making equities more attractive on the whole. However, overall forward P/E multiples range from as low as 6x for energy companies to as high as 28 for consumer discretionary companies with the S&P 500 sitting at 18x overall. Though economists are expecting a recession, it is likely to be mild based on the performance of corporate profitability and labor markets so far. European companies look quite a bit cheaper at 12x, but the outlook for the economy is a bit more dire given their proximity to the Russo-Ukrainian conflict and energy dependence. Between now and winter, European policy makers will have to create some economic insulation from the conflict in order to make investing in the region look attractive. Japanese equities are at nearly the same valuation but could be subject to a repricing if U.S.-Sino tensions continue to rise. Overall, despite the fears of a mild recession, investors are continuing to test the waters in growth stocks and favoring growth outlooks.

Bond Yields

Now that the bond bloodbath looks to be behind us for now and ten-year yields have settled back to the upper 2% range, currently trading at 2.8% with an upward trajectory and high yield bond yields offering reasonably attractive 7.5% yields, we anticipate some support in the bond markets as investors step back in to the markets. Credit markets have fared well as corporates benefitted from the inflationary environment. Despite a rise in the cost of capital, corporations pushed margins by raising prices and ensured reasonably healthy balance sheets at the higher end of the high yield quality spectrum. That said, the lower end of the quality curve, like unprofitable company stocks are likely still going to find it hard to attract capital until we are through the recession. Quality matters across the corporate bond spectrum.

Inflation Outlook

While the Fed is determined to control inflation, we remain convinced that energy will be more determinant for the inflation outlook than the Fed. And, though many are concerned that the Fed could induce a recession by crimping demand, so far, the data does not yet show it. We have now seen a technical recession with two subsequent quarters of negative GDP growth; however, the National Bureau of Economic Research has not yet declared a recession. The labor markets are still robust and corporate earnings have done well in the recession. Though wages also grew, they grew less than inflation, suggesting that incremental earnings are buying less. We fully expect a mild recession, but we don’t anticipate further impact to multiples unless the Fed suddenly returns to their aggressive hawkish stance. The Fed Funds futures curve is anticipating the Fed Fund rate to peak out at roughly 3.5% at the February 2023 meeting after which it will go on hold briefly and then begin cutting rates back down to 3% by year end. This could support the search for growth in anticipation of a 2023 rally.

Net View

We are going back to neutral on value vs growth as we believe that the opportunity has largely played out.