Hopes that the Fed will reduce the pace of rate hikes have created further optimism in the markets.

Hope Is Not a Strategy: Summary

- Equity and bond markets continue to hope for a Fed pivot: If they are right and the Fed cuts by only 50 basis points (bps) in December, the rally will be strong, but if they are wrong, the markets will have another leg down.

- The real economy continues to weaken: The weakness in the data is being masked by a labor shortage, but if the Fed continues to raise rates, it risks causing real damage to the economy.

- The good news is that food and energy prices finally look poised to take a pause: The only mitigating factor to the downside is the softness that is expected in commodity prices.

You can read the full Market Update below.

Market Review: Too Good to Be True?

U.S. equity posted gains in October after several weeks of decline as corporate earnings outperformed expectations and the markets began to price in a Fed pivot toward less aggressive rate hikes. The S&P 500 gained 8.1% in October, its first positive month since July and the best October since 2011. The market also factored in the potential for legislative gridlock next month after the midterm elections that will likely stall legislative action, in what has historically been a good time for markets. The Dow Jones was up 14.07% last month, its best month since 1976. The tech-heavy Nasdaq lagged behind the other indexes but was still up 3.94% last month after Snap reporting of slowing ad growth triggered a sell-off in companies earning revenue from digital advertising. High mortgage rates have also caused a slowdown in new residential construction and house sales, weighing heavily on the real estate market.

European stocks also logged gains, ending the month up 7.28%, with the energy and industrial sector leading the pack. The European Central Bank also raised interest rates by 75 bps and acknowledged an impending recession. Markets interpreted this as a sign that rate hikes could ease. Inflation hit a record high of 10.7% in October, with energy prices largely contributing to this rise. Europe also announced new plans to tackle the energy crisis by introducing legislation to cap energy prices and instituting a common purchasing plan. With current storage facilities almost full amid energy saving measures and milder weather, this brings some stability to the energy crisis in the region before winter. Germany also announced a €200 billion energy aid package to help stabilize prices in the region. Japanese markets also posted gains of 3.56%. Japan’s further easing of Covid restrictions, signaling normalization of economic activity in the region and an expected recovery in the tourism industry, introduced some renewed investor interest in the stock market.

Emerging markets lost 3.09% in October despite Latin America’s solid performance of 9.69%. The Communist Party of China confirmed President Xi Jinping’s continuing leadership, which stoked some volatility in the Chinese markets, especially among Internet companies. With no near-term end expected for China’s zero-Covid policy, this created further weakening in the market, with Chinese markets ending the month down 16.8%, and continued to create ripple effects around the globe, especially with supply chains. Markets in Brazil performed well, with inflation coming under control and markets expecting former President Luiz Inácio Lula da Silva to win the election. Markets in the Middle East, especially the oil-exporting countries, performed well, as OPEC’s production cuts helped boost oil prices.

With bond yields still hovering at multiyear highs, the U.S. bond market continued to perform poorly in comparison to other major markets. As labor-market data came in better than expected and inflation remained stubbornly high, the Fed continued its hawkish rhetoric. The U.S. 10-year yield rose from 3.83% to 4.08%, and the 2-year rose from 4.28% to 4.48%. With the yield curve still inverted, demand for short-term bonds trumps demand for long-term bonds. The UK bond market was a notable outperformer, with the selection of a new prime minister and a fiscal U-turn that restored stability to the Bank of England. Global bond markets in general had a good month.

West Texas Intermediate Crude oil ended the month at $86.5 per barrel and Brent Crude oil ended at $94 per barrel as the dollar weakened a little, boosting demand from economies holding other currencies. Energy commodities performed well in October overall as higher energy prices, especially for heating oil and gasoline, offset any fall in the price of natural gas. Among precious metals, silver and gold achieved very modest gains as the demand for non-yielding assets remains low.

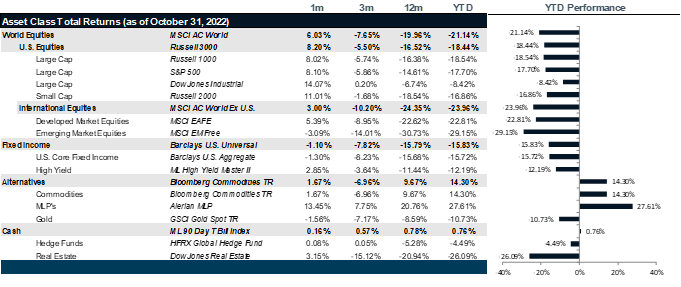

Figure 1: Market Performance as of October 31, 2022

Going Forward: Hope Is Not a Strategy

With the midterms largely behind us, the markets are refocusing on the economy, and the recent inflation print has reinvigorated hope for a Fed pivot. Almost instantly, the fed funds futures curve took down the expectations for the terminal fed funds rate from 5.25% to 4.75% and just as suddenly priced in an easing cycle starting by midyear 2023, sparking the green shoots of an equity rally. But will it continue? More interestingly, the change in sentiment for rates has had an even bigger effect on the beleaguered bond markets, whose repricing was evident within minutes of the inflation print. If indeed the worst is behind us, then this rally could be the holiday rally that investors have been hoping for all year. If not, then this holiday could easily be one to forget in the markets for both stock and bond investors. What is very clear is that the outcomes could be very good or very bad—and that points to volatility. There will be many data points that point in both directions between now and the next Fed meeting.

Labor

The most recent inflation print came in at 7.7%, below expectations. In theory, this could give the Fed some wiggle room to take a less aggressive stance at the December meeting with a 50 bps hike rather than another 75 bps hike. However, the bigger question remains: Is inflation becoming entrenched? The answer to that will be tweezed from several data points between now and then. The first place to look for entrenched inflation is wage growth. If wage growth remains strong, Fed Chair Jerome Powell may feel more obligated to keep the momentum going. It is important to understand that the dynamics of the labor markets are showing very strong data, but not because the underlying economy is actually strong. It is because a large swath of workers aged 55+ retired during and after the pandemic, leaving the labor market in shortage. The lack of workers is keeping unemployment low and wage growth high. So, the Fed could deliver a proverbial lump of coal in the market’s stocking, sending both equities and the recently recovered bond markets down further.

Food and Energy

Both food and energy prices have been a drag on consumption, with supply constraints in the energy sector and food shortages in the agriculture arena driving up prices for beef, corn, soybeans, wheat and sugar. The good news on the energy front is that rationing efforts and concerted efforts to build inventories have been met with expectations for mild winter weather. This, combined with a weakening dollar, could prove a welcome relief as the Russia-Ukraine conflict drags on. On the flip side, food prices have remained stubbornly high but expectations for crop production in 2023 are starting to look up, so we could see some relief in food pricing. However, that is likely not going to impact pricing until next year, so the lingering influence of these will be neutral and continue to be negative at worst. So, let’s call that a half a lump of coal.

Consumption

The greatest impediment to consumption at this point is the fact that households have spent down their savings and started building credit balances. Those credit balances have become ever more expensive to service. In the same vein, adjustable-rate mortgages continue to drive up housing costs, also crimping consumption. This has led landlords to adjust rents upwards, with the same crippling effect. This could be a weak holiday shopping season, and that may be the data point that the Fed uses to take a step back. But taking all the potential influences together, it is still a toss-up, which gets us back to the notion that volatility may still be on the table.

Net View

We continue to prefer U.S. equities to international and emerging markets equities. We also continue to like high-grade credit on a risk-adjusted basis.