Markets are beginning to forecast the end of rate hikes. We consider the key questions that investors must be able to answer in order to form an opinion.

Beyond Peak Rates: Summary

• Inflation is finally falling: however, few are calling for much of a recovery after the recession is over which could trace out the dreaded L shaped recovery.

• Recession is a given, though a small but growing group are calling for a soft landing: that said, markets disagree on whether the Fed will execute a meaningful easing cycle or keep rates high once rates have peaked in May.

• Yield favors the bond: with investment grade bonds offering attractive yields relative to stocks, they are hard to ignore.

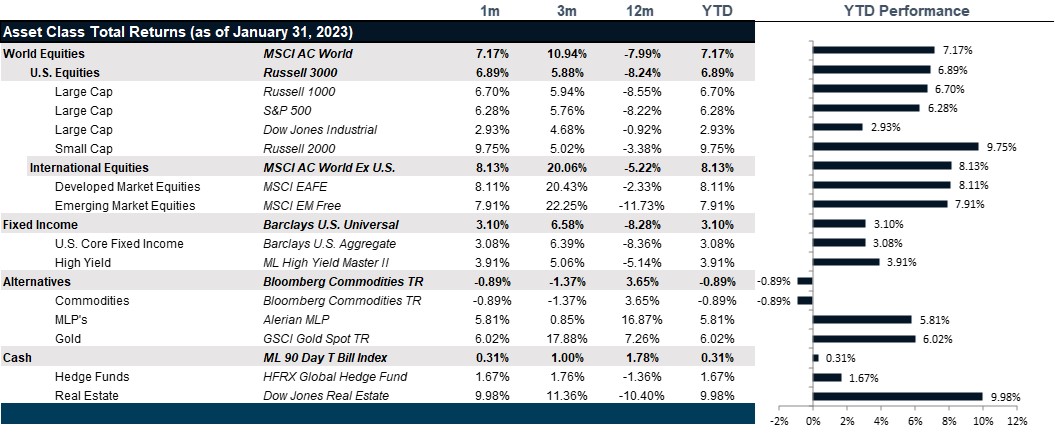

Market Review: January Was a Great Year of Returns

U.S. equities started the year strong following last year’s abysmal performance. All major indices posted gains with NASDAQ leading the pack at 10.7%, marking its best January since 2001. The S&P 500 added 6.3% and the Dow gained 2.9%. As investors hope that the economy will beat a recession this year and instead have a soft landing, stocks were mostly positive. Hopes that inflation is starting to abate has also contributed to the good run of stocks last month. Stocks that lagged in 2022 were some of the best-performing last month with communication, consumer cyclicals, real estate and technology stocks posting major gains. The economy added a record 517,000 jobs in January and the unemployment rate fell to 3.4%, the lowest since 1969. In the fourth quarter, the U.S. GDP rose 2.9% even as fear of negative growth this year persists. Year-over-year inflation fell from 7.1% in November to 6.5% in December. A fall in energy and vehicle prices and lower health insurance and airline fares contributed to falling inflation.

European markets rallied as well in January gaining 6.8% overall. Information technology and real estate posted solid gains. Europe experienced a milder winter than expected, helping to ease the worst concerns on energy prices. The Eurozone economy expanded 0.1% against the expected contraction of 0.1%. However, the biggest European economy, Germany, contracted 0.2% heralding fears that the economy is heading into a recession. Italy also posted negative growth in the fourth quarter. Inflation in the Europe region dropped further to 9.2% from 10.2%, food and alcohol were the highest contributors to inflation in the region. However, the European Central Bank President, Christine Lagarde, warned that further rate hikes would be required to bring inflation down to target levels. Stocks in the UK posted gains as well with consumer and financial sector stocks leading the pack. The Japanese markets also gained 4.4% last month, with positive results expected from corporate earnings.

News of easing covid restrictions and reopening of the economy in China created market buoyancy by boosting investor sentiment in both developed and emerging markets. Further, signs that inflation is starting to cool and interest rates have hit the ceiling is spreading optimism. Most emerging markets posted gains last month with the Czech Republic and Mexico posting the biggest gains. With the technology sector performing well, Korea and Taiwan also posted strong returns. Inflation and anti-government riots in Brazil caused Brazilian stocks to underperform. Lower energy prices across the board contributed to lower returns in the middle east area, especially in Qatar and Saudi Arabia. India posted negative returns after allegations of stock manipulation and fraud at one of India’s biggest conglomerates.

Yields on bonds fell globally along with inflation. The U.S. 10-year yields fell from 3.88% to 3.51%, with the two-year falling from 4.42% to 4.21%. However, the yield curve remains inverted. Credit markets outperformed government bonds as inflation fell and growth in some economies supported investor risk appetite. The

Commodities markets recorded negative performance, with precious and industrial metals posting strong gains. The worst performing sectors were energy and livestock with brent crude oil ending the month at $82.49 as compared to $122 last June. Gold prices soared 5.8% while silver prices fell slightly. The U.S. dollar declined further by 1.35% on expectation that central banks will curb interest rate hikes. Uncertainty in the cryptocurrency market continues over the FTX debacle and government intervention and regulation.

Going Forward: Beyond Peak Rates

As inflation has begun to fall and the Fed has finally started to take its foot off the proverbial monetary tightening gas pedal, begging the natural question: what comes next? The near term is largely expected to be a recession, though there are still some investors wearing their rose colored glasses and hoping for a soft landing. The band world, however, is still resolute with a very inverted yield curve pronouncing the recession to come. But, the length and depth of it are still in question. And, given that outlook, what happens beyond peak rates.

Inflation

Inflation is finally falling, so the end of the hiking cycle should be near. However, the fly in the Fed’s ointment continues to be the labor market. Unemployment has been very slow to respond to the relentless hikes we have experienced at the fastest pace in over 35 years. Currently sitting at 3.4% and well below the golden rule of 4% which is considered the level at which the Fed deems their tightening measures to have been impactful. And, to add insult to injury, the non-farm payrolls data, often referred to as the “jobs data” registered a strong move up with 517,000 jobs created over the month of January, signaling a seemingly healthy economy. And, though the wage growth data published by the Atlanta Federal Reserve does show that wage growth has peaked, it is still currently growing at a much higher than normal pace of 6.1% growth, year-over-year. And, if you look at the total inflation picture, the reality is that every other segment of the inflation basket is seeing deflation except services, which are largely driven by wage growth. Oil, gas, input costs and goods are all seeing price declines in response to falling demand. And, even consumer credit is registering the impact that higher interest rates are having on consumer’s willingness to add to their now very high interest rate credit balances. But, we continue to point to labor participation rates for the 55+ cohort of workers that fell dramatically during COVID and never recovered, leaving a shortage of workers in the economy. If the Fed does continue to raise rates waiting for the magical 4% unemployment level, there is a meaningful chance that the recession could be quite severe because unemployment is painting a rosier picture, largely a function of the labor shortage, not of the health of the average consumer in the economy.

Recession

The question of recession has largely been priced in with a small but growing group calling for a soft landing. That said, we see room for the Fed to overshoot in terms of their impact on consumption, there is also a reasonable chance they will stick to the plan and finish their hiking by May just a recession settles in. Equity earnings would suggest a very brief two quarter recession that could be mild based on current earnings expectations. Bond yields would suggest a deeper recession, though technical features causing an upward kink at the short end of the curve may be exaggerating that expectation. Less debated is the length of the recession with most forecasts putting the recession end point right at year end. However, the Fed Funds futures are currently not pricing in much of an easing cycle once we hit the peak despite a deeply inverted yield curve that almost requires the Fed to ease. However, if we assume no easing cycle, then we can also assume no rebound in the multiples of stocks whose multiple depended on excess liquidity to justify. Either way, quality remains the name of the game in this market to protect the worst case. But, even if our outlook is overly pessimistic, we still believe well run companies and strong balance sheets supporting bond yields are the best path to excess returns.

Yields

For the foreseeable future, we are exploring a world where short rates normalize at higher levels like 4%-4.5% at the short end. If you can clip a 4.25% coupon with almost no risk, then the temptation to take risk will have to be very impressive. This underscores our thesis that quality will be the name of the game going forward. In that world, investment grade corporate debt begins to look very attractive, benefitting from strong balance sheets, a better position in the capital stack, and being paid before everyone else except bank loans. We also anticipate that within equity, the most necessary products and the most efficiently run companies will be the victors where money is more expensive to borrow and yield is easier to earn with less risk.

Net View

We continue to play defense with U.S. equities favoring quality and value. Yields still favor high grade credit and broad high-grade debt generally.