While there is broad agreement that rates will likely fall, there is still disagreement on when, by how much and why.

Are we there yet?: Summary

- Markets broadly agree that interest rates will fall: it is a question of when and by how much.

- Markets disagree on the state of the economy: equity markets believe the soft landing; bond markets believe the stealth slowdown.

- Markets are generally not priced for higher for longer: meanwhile, most of the tail risks that we assess would result in higher inflation and likely higher interest rates as a result.

Market Review: Soft Landing

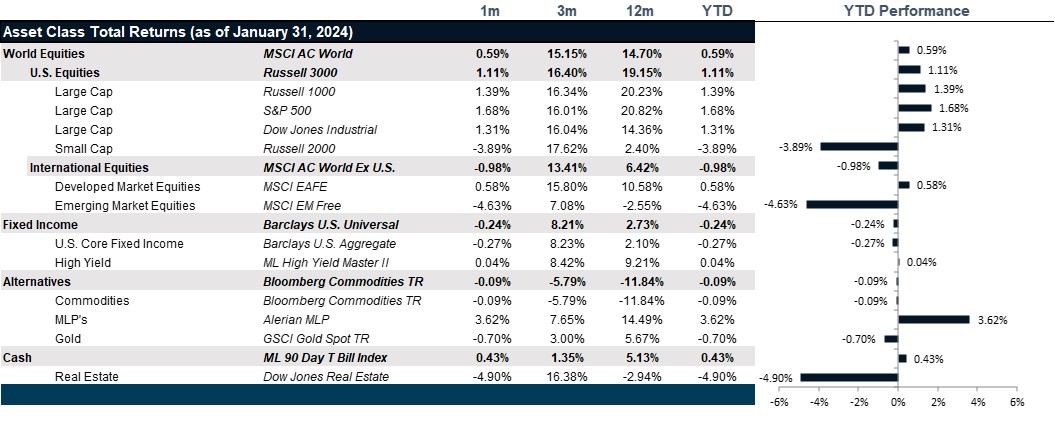

U.S. equity performed well in January, with large cap stocks significantly outperforming small and midcap stocks. Moreover, the flavor of the rally was all about growth as GDP revisions were upgraded throughout the month, GDP came in significantly above expectations. Perhaps the challenging disconnect in the equity markets in the month of January was the upward drift in price to earnings above 23x, now enough above long-term averages to suggest that equity markets are pricing in a “Goldilocks” scenario where the economy avoids a significant slowdown and the Fed cuts interest rates. Now about halfway through earnings season, earnings are faring well in most but not all sectors with energy, materials and healthcare doing the worst and communication services, consumer discretionary, utilities and technology doing the best. Admittedly, this suggests a growthy outlook and continued reduction in inflationary pressure.

International equity markets, meanwhile, are struggling far more with European companies reporting terrible sales and earnings growth as European economy continues to struggle with stagnating growth that is expected to linger for at least two more years, if economist forecasts are to be believed. Meanwhile, Japanese company earnings are faring well so far, though are expected to remain steadily positive throughout the year. Unfortunately, the stagnating European outlook is dragging down the total performance for the MSCI EAFE Index, which returned 0.59% total returns versus 4.38% total return in USD terms for the Japanese component and -0.36% for the European component. Both currencies lost against the U.S. dollar where the Fed’s delay in cutting rates continues to make the dollar more attractive against other currencies and effectively reduce investment returns in other currencies. Emerging markets equities were battered as the housing slump and economic slump in China drove double digit losses at -10.61%, a significant contributor to the -4.64% loss in emerging markets equities.

The bond markets were soft throughout the month, effectively moving sideways. With the Fed effectively on hold and the higher-for-longer narrative offering a counterpoint to the soft-landing scenario, the only place for yields to go in the short-term is up to match a higher expected short end of the yield curve. Though Fed Funds futures are pricing in closer to 5 rate cuts for this year, Jerome Powell has emphatically called for only three. That would leave the Fed Funds rate at 4.75%. Despite the need to rise, ten-year yields fell through the month from 4.05% to 3.9%, suggesting a marked disagreement between market participants and the Fed. While the Fed held rates steady in light of supportive economic data and inflationary trends that remain above target, bond markets are pricing in a slowdown that will force the Fed to cut further and sooner.

Real assets had a challenging month as well with real estate losing -5.37% in the broad REIT markets with hotels losing less than office, industrial and retail real estate. Infrastructure and natural resources also got hit, and industrial and precious metals took a hit in the futures markets while energy remained positive. The very interest rate sensitive and heavily debt burdened real estate sector remains a challenge for most investors. Energy seems to suggest continued demand while the hit in precious metals suggests a reduction to the inflation outlook. Perhaps the odd one out in this review is that industrial metals were hit so hard, suggesting some weakness in the economy worth keeping an eye out for.

Going Forward: Are we there yet?

The markets appear primarily to be in flux, waiting with bated breath over the timing of the first rate cut. Equity markets have priced in a soft landing. Bond markets continue to price in a slowdown. Real assets are registering mixed signals with oil prices broadly in decline over the past year but energy demand on the rise and energy inventories being drawn down. Meanwhile, real estate has been in decline since the Federal Reserve began raising interest rates and the outlook is largely dependent on a combination of economic activity and the cost of financing. Markets seem to have areas of agreement, disagreement, and some notable blind spots.

Where Markets Agree

While most markets want (or need) the Federal Reserve to begin cutting rates, they seem to arrive at the conclusion differently. Equity markets fully believe in the soft landing and remain optimistic on everything from demand to earnings to the Fed outlook for rate cuts because inflation is trending down. Bond markets remain glum, assuming that inflation is on its way down because demand is not as strong as macro data suggests and the Fed will have to cut rates sooner. And, yet, somehow, these two divergent views seem to result in the same outcome of the Fed cutting rates more than they are currently suggesting. Regardless of how the conclusion is reached, markets generally agree that peak interest rates are behind us and that the broad trajectory of interest rates for at least the next several years will be downward toward 2.5%, which is the Fed’s latest estimate of what long term rates should be for the Federal Reserve Overnight Rate. Even international markets seen to be hampered by the slow-moving Fed, Europe and China in particular. In this world, equities, international equities, and real estate win if “the year of the bond” fails to materialize.

Where Markets Disagree

These narratives have notable differences. First, equity markets assume strong enough demand to support robust earnings for the coming year and yet also assume that inflation is under control such that the Fed will have enough leeway to begin to cut rates. Moreover, to justify current market price to equity ratios, rates will have to be reduced more than the 75 basis points suggested by the Fed. Meanwhile, for the yield curve to normalize without any rise in the long end requires the Fed to cut a minimum of six times to get rates down to 4%. The stubbornness of the treasury yield curve seems to tell a story of a much weaker economy where consumers are not as strong as wage inflation might suggest and where a delayed impact to the economy is on its way and will be much worse than the Goldilocks scenario priced in by equities. This narrative would destroy earnings, but rescue valuations in the short run. Eventually, those valuations would have to be revised down. In this world, “the year of the bond” is less exciting than hoped for, but is far better than the outlook for equities, international equities, or real estate where the fall in demand will hurt more than the relief of cheaper money.

Blind Spots

The continuation of the wars in Ukraine and Gaza and proxy wars across the Middle East continue to feel like a potential powder keg that could ignite the markets with the potential for natural resource disruptions and general chaos. Such an interruption, even if short-term, could cause the kind of spike that feeds inflation and makes the Fed’s job much more challenging. Meanwhile, China remains a threat and is largely fueling current deglobalization policies in the U.S. and Europe. Finally, the market seems to be oblivious to the potential danger of election year policy bumbling, which is to say that if anything goes wrong, Congress is not in a good place to respond quickly or decisively. The worst outcome that could come from any or all of these tail risks is continued inflationary pressure that could make the current “higher for longer” assumptions look optimistic and could create a lost year for investing.

Net View

Equities remain less attractive in a higher yield environment, leading us to prefer both high-grade and high-yield credit to benefit from corporate strength while minimizing equity volatility. the portfolio, we expect greater volatility this year, making options potentially more expensive, but still worth considering.