Fear of recession has overtaken the fear of entrenched inflation.

Are We There Yet?: Summary

- Inflation seems to look more like a cash grab than an entrenched phenomenon: supply chain disruptions and high oil prices have given everyone an excuse to charge more, but we would argue that this is not entrenched and that as demand falls, so will the illusion of inflation.

- However, if we do experience a policy induced recession, the loss of demand will be very real: we could see a second repricing in equities before this is all over.

- Commodities prices pressure looks to be subsiding in the face of recession fears: That said, until Russia is expelled from Ukraine, volatility in the commodities markets could make the pain worse.

Market Review: Belated Hawkishness

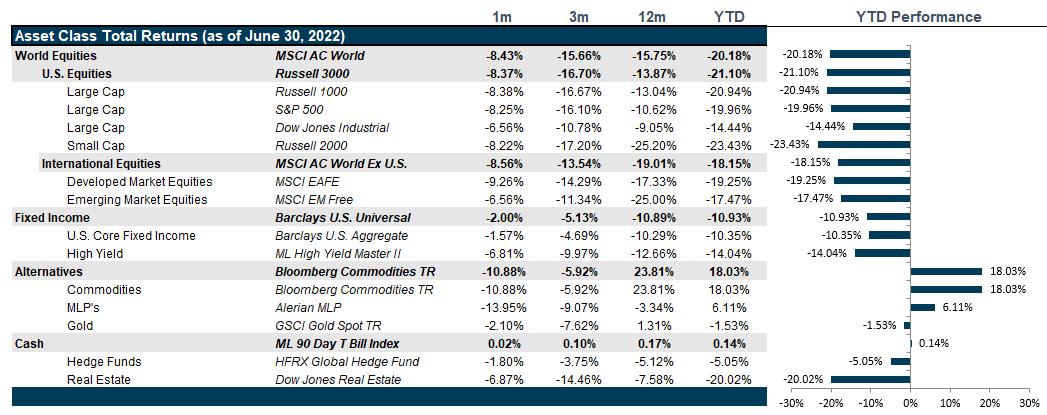

Markets in June were impacted by high inflation growth and a belatedly hawkish Federal Reserve.

US equity markets continued to trend lower in June. The S&P 500 lost nearly 8.7% to the vicissitudes of a central bank induced recession and entrenched inflation. Economic data showed no signs of softening with nonfarm payrolls as well as the Consumer Price Index (CPI) surpassing economist expectations. The CPI at 8.6% year-over-year prompted the Federal Reserve to accelerate its quantitative tightening policy by hiking the federal funds rate by 75 bps, increasing fears that the central bank is willing to risk recession and higher unemployment to alleviate inflation. The worst performing sectors for the month includes Energy, Materials, Industrials and Financials, as recession expectations sparked fears of an economic slowdown that will curtail demand as well as reduce borrowings.

European equities fell sharply in June, losing 7.7%, reacting mainly to higher-than expected U.S. inflation reading as well as the European Central Bank’s (ECB) policy decisions. The ECB raised its inflation expectations for the eurozone to 6.8% this year and also downgraded its growth forecasts, expecting high commodity prices and supply-chain bottlenecks to erode purchasing power. In addition, towards the end of the month, Gazprom reduced gas exports to Europe by 60%, citing delays in repairs on the Nord Stream 1 pipeline. This action stoked fears of energy rationing that could slow down manufacturing and other industrial activities and lead to further economic contraction. Meanwhile, Japanese equities experienced a more moderate decline as the Bank of Japan, in sharp contrast to that of its global peers, has continued to maintain an easy monetary policy.

Within emerging markets, Chinese equities were standout performers in June, gaining nearly 6.5% on the back of local governments rolling back COVID related restrictions and the central bank ramping up stimulus measures in a bid to mitigate economic pressure arising from the lockdowns. In addition, investor sentiment toward China was also buoyed on news that President Biden may consider lifting tariffs on certain goods to help stem inflation in the U.S. The Latin American region suffered from a reversal of fortunes in June, losing 16.95%. Most central banks around the world have taken an aggressive stance towards combating inflation, tipping the scales toward expectations of recession. Commodity prices have fallen dramatically in anticipation of the fall in demand that recession would herald. With the US acting more aggressively than the rest of the world central banks, the dollar has also strengthened in comparison to a wide basket of securities. The strength of the dollar effectively pushes inflation higher in countries that purchase goods from the US, causing those central banks to tighten further and hits energy importing countries even worse as oil is priced in dollars. The dynamics between policy, the dollar and inflation have worked against most emerging market countries.

Economic data showed signs of softening last month however latest readings of nonfarm payrolls surpassed expectations while the Consumer Price Index (CPI) tracking inflation rose by a staggering 8.6% year-over-year, stoking fears of entrenched inflation. The Fed Funds futures market quickly repriced expectations for future fed rate hikes, increasing the likelihood a 75-100 bps hike, pushing two-year and ten-year yields to highs of 3.45% and 3.49% respectively. Subsequently, the Federal Open Market Committee hiked the federal funds rates by 75 bps and Chairman Jerome Powell reaffirmed the central bank’s commitment towards lowering the pace of inflation to Congressional lawmakers the following week. Concerns then shifted from entrenched inflation to a Fed rate hike-induced recession. As yields fell later in the month, the spread between the two year and the ten year continue to flirt with inversion, a classic measure of recession expectations.

Most energy commodities contracted sharply in June on prospects of weaker demand stemming from recession fears; WTI crude oil futures traded below $100-per-barrel towards the end of the month. Prices of natural gas in the eurozone however have continued to rise owing to strikes organized by Norway’s gas and oil unions and supply being reduced by 60% on the Nord Stream 1 pipeline by Gazprom. Among metals, a weak demand outlook affected the prices of industrial metals while gold consolidated below the $1800-per-ounce level as investors expecting the Federal Reserve to aggressively hike rates, preferred to hold the dollar versus a non-yielding asset. Within the crypto universe, most digital tokens have suffered from massive losses and many companies within the space are filing for bankruptcy; Bitcoin briefly traded below the $20000 level towards the end of the month, erasing all of its gains since December 2020.

Going Forward: Are We There Yet?

Most investors are bracing for a recession; however, the timing is somewhat squishy. Some say we may already be in a recession; others suggest that it will not arrive until 2023, at which point it is an inevitability. No matter the outlook, most market participants agree that inflation and interest rate hikes by the Fed have contributed to a quick cooling of the recently reopened global economy. Most would agree that the conflict in Ukraine has certainly exacerbated COVID-related supply chain shortages and labor shortages. What is not clear is how pervasive these inflation pressures can really be over time. We have generally contended that by the end of 2023, most of these inflationary effects will have faded and consensus forecasts seem to agree with us. That said, inflation can remain elevated for some time and the economy either gets back to normal or transitions to whatever new reality will set up post-COVID. De-globalization or on-shoring, for example, could be highly inflationary but also strongly stimulative in terms of domestic consumption while continued automation is likely to be highly deflationary, though not very stimulative at all as it does not increase household income in aggregate. But, on balance, we expect that inflation will likely fade back to the deflationary environment we were in pre-COVID. But, in the meantime, we must survive the here and now where inflation is here and the economy is slowing.

From Here to There

Let’s start with the notion that the Russian invasion of Ukraine set the stage for higher prices generally. We would argue that much of the inflation we have seen has largely been driven corporations making up for years of weak pricing dynamics and individuals making up for decades of weak wage growth and only marginally by actual base input price pressures. If anything, the recent weakness in oil prices should provide a relief valve for consumption to pick back up. But, instead, it is being viewed as a canary in the coal mine, a harbinger of weak demand to come. We should see inflation generally start to fall, but we expect margins to continue to remain high or even continue to expand to the detriment of overall consumption. So, while prices will remain high, volumes will almost certainly suffer and a reckoning in earnings revisions is almost surely coming this earnings season through guidance if not in actual results. So, while valuations have started to look attractive, we still see another shoe to drop as earnings estimates get slashed and valuations shoot back up and cause a second repricing later this year.

Bond Bloodbath

While bond returns rival the returns experienced during the Great Financial Crisis (GFC), there is one thing that is markedly absent in today’s bond markets: a significant repricing. Bonds rebounded dramatically after the GFC in part because the Fed put a floor under the markets by pledging liquidity but primarily because many bonds were trading at the cheapest levels ever seen in history. Investment grade corporate bonds that normally pay under 100 bps over an equivalent maturity Treasury Yield soared to paying over 550 bps over an equivalent maturity Treasury Bond. The overall yield of an investment grade bond that generally has a very low likelihood of default paid nearly 8%. Meanwhile, in today’s bond market rout, prices have fallen dramatically, but because interest rates have risen dramatically, spreads have hardly risen to 157 bps over Treasuries and overall yields are coming in at 4.7% which is hardly distressed. This will hardly entice an investor to put cash to work in the bond market. If anything, with 2 Year US Treasuries paying 3%, it hardly seems worth the extra risk to hold a corporate bond that has five more years of maturity risk. So, while this year has been pretty rough for bond holders, with interest rates expected to continue to rise until the end of the year or, at the very least, remain high, it is hard to get excited a rebound in the asset class anytime soon. Though generally, the purpose of bonds is to provide stability through lower volatility, we think that until the Fed has declared victory over inflation, the volatility will continue in this normally stabile part of the market.

Commodities

And, in the most basic segment of the market, commodities, we have not seen such dramatic shifts in supply and demand in over a decade. The entire market was stuck in a bearish phenomenon driven by technological shifts that drove up productivity and drove down prices. Then, the pandemic hit and suddenly, we saw significant labor shortages and dwindling supplies eventually meet with a geopolitical event that was largely expected, but nonetheless shocking in its reverberation across markets. We went from deflation to inflation overnight with sudden flashbacks to 1980. That said, this isn’t 1980 and the likelihood of these dynamics remaining in place beyond 2024 are unlikely. The chances that they will wreak havoc between now and then are actually quite high. Though WTI crude oil prices have finally dropped below $98 should be positive, until Russia is expelled from Ukraine, these issues will continue and will be felt well beyond energy to agriculture and metals. So, while we don’t view commodities prices as a long-term concern, they certainly have the potential to remain a short-term source of volatility which will have knock on effects to margins and consumption patterns as well as monetary and fiscal policy.

Net View

We remain overweight to growth at a reasonable price (GARP) investments and Value investments believing we are still not out of the woods.