The outlook for the economy is now squarely in the hands of the Fed.

All Eyes on the Fed: Summary

- The Fed’s path for the Fed Fund Rate has enormous impacts to the markets and the real economy: the most recent Fed comments have left investors bracing for further rate hikes.

- The failure of Silicon Valley Bank is collateral damage to the reduction in liquidity: high interest rates and a reduction in cheap capital came home to roost at Silicon Valley Bank and the equity markets continue to price in lower multiples across the markets.

- The dislocation and general market fear have created opportunities: like most market turmoil, broad repricing inevitably creates opportunities, and this is not an exception.

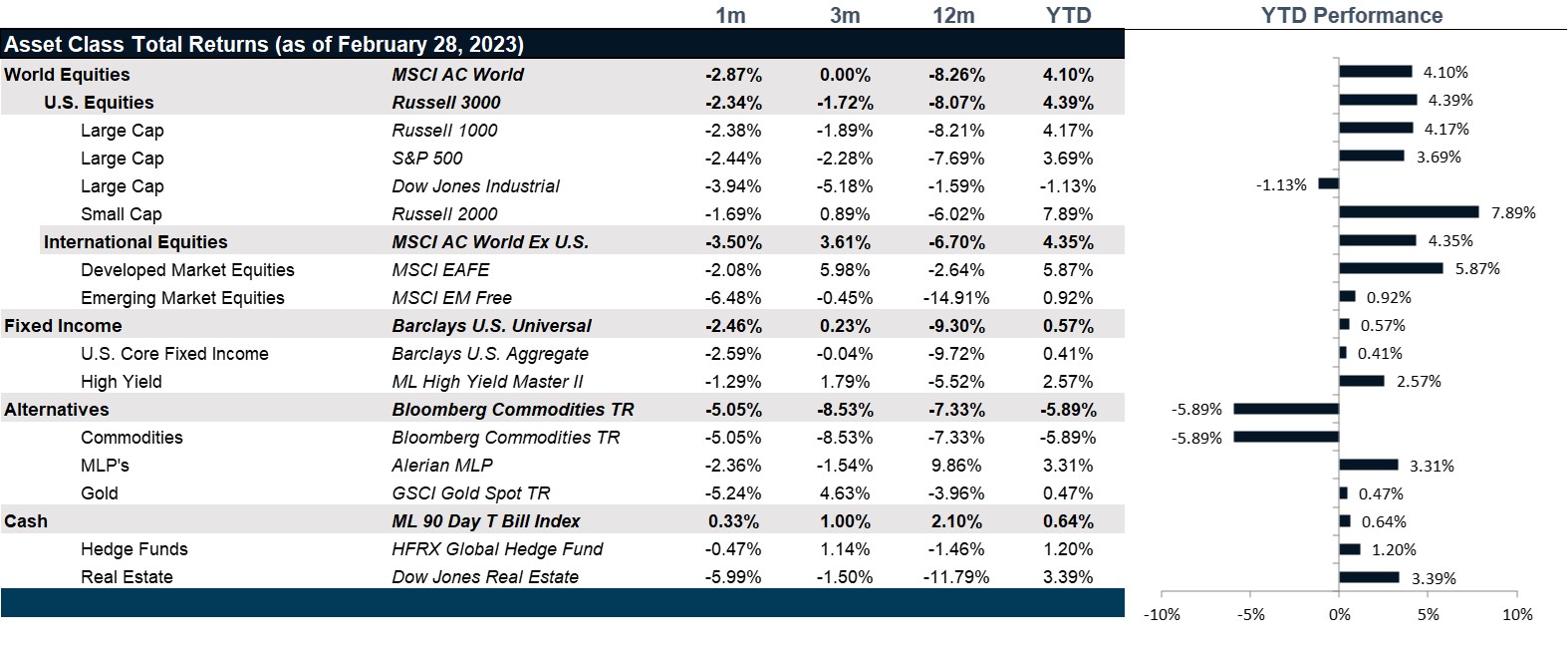

Market Review: A Long Way to Go

While markets ushered the new year with strong gains, February was not so rosy with U.S. equities finishing the month in red. Economic data from February was strong but hotter than expected inflation data continued to fuel the Federal Reserve expectations for further hikes as the Fed announced a rate hike of 25 bps. Fed Chair Jerome Powell’s statement included language suggesting that there was still a long way to go with inflation, dampening investor moods with the S&P 500 falling 2.6% and the Dow down 4.2%. The tech-heavy NASDAQ also shed 1.1% after disappointing fourth quarter earnings reports from tech giants Alphabet, Amazon and Apple with Meta being the only exception. Year-over-year inflation came in at 6.4%, higher than the expected 6.2%. With retail sales increasing in January indicating that consumer spending is not slowing down, the job report coming in hot and housing costs still hovering high, the market is not very optimistic about the path to normal inflation numbers with some investors starting to price in a 50-bps rate hike in March.

European stocks extended gains rising 2.21% in February, up almost 10% year-to-date. With inflation falling to 8.5% and the risk of a severe recession decreasing drastically, markets in Europe stayed optimistic. The energy crisis seems to have almost evaporated with energy prices falling further. Reopening of Chinese markets brought further cheer as investors expect this to support a strong recovery in the European markets. Further, upbeat corporate earnings from the fourth quarter reinforced investor confidence. However, stocks saw a dip towards the end of the month as inflation data from France and Spain seemed to indicate that inflation was lingering. The European Central Bank (“ECB”) also raised interest rates by 50 bps and comments from ECB president Christine Lagarde indicated that they would continue to do so as core inflation was still a significant concern and the EU would like to hit the target inflation rate of 2% sooner than later. The same with the Bank of England as they raised interest rates by 50 bps, however they maintained a dovish tone acknowledging that the worse with inflation may be over with stocks ending the month positive.

Emerging markets had a dismal month with the MSCI Emerging Markets index falling 6.5%, its worst February since 2001 erasing almost all the gains made in January. Rate hikes in the U.S. and geopolitical factors including heightened U.S.-China tensions contributed to decline in stocks. China was hit particularly hard with stocks falling 10.4% even as reopening of the economy post-Covid indicates China could see a rapid recovery. Other Asian markets performed poorly as well as interest rates and the strong dollar continued to put a strain on corporate borrowers.

Bond markets were battered last month after stubborn inflation data led investors to reverse course. Yields rose with the 10-year rising to 3.92% from 3.52% and the 2-year rising to 4.81% from 4.21% with the yield curve still staying inverted. Bond selloffs were observed across the board and across the curve as the higher yields translate to lower bond prices.

Commodities markets expanded loses from January into February with the S&P GSCI commodity index falling just over 5% in February. A strong dollar put pressure on commodities globally with losses seen across the board with energy, precious and industry metals hit the most. Gold and silver witnessed significant declines with gold falling 5.6% and silver 11.6%. Agriculture was the least affected but still dropped 0.5% with wheat taking the brunt of it. Livestock was the only sector which made gain as demand remains strong. The warmer than usual winter in the U.S. and Europe saw a reduction in demand for oil with WTI ending the month around $75.

Going Forward: All Eyes on the Fed

A month has passed in the first week of March with Powell’s commentary unnerving the markets followed by the sudden failure of Silicon Valley Bank (“SVB”), the largest venture lender in the country. That said, it is not the largest bank in the country and its client profile was very specific, primarily technology industries elevated cash burn levels. While there will almost certainly be spillover effects, those will likely be contained to technology ventures rather than to the banking community at large. If anything, many banks had experienced an influx of cash over the past several weeks as venture companies began to diversify their deposit bases across other banks. Over the past several years, technology ventures were bursting at the seams with cash, but the last year has been a great reckoning as sources of capital funding dried up. However, while some companies may fail and many will lose jobs, it is unlikely to cause the Fed to suddenly ease up.

The Fed Outlook

The Fed remains a driving force behind our outlook for the economy. And, we were already concerned that the Fed was walking into a policy mistake by keeping its foot on the pedal of rate hikes. With inflation falling in all categories except services, we continue to make the case that the lingering wage inflation is not the result of strong demand, but a shortage of workers. Moreover, we don’t see continue rate hikes as an effective solution to a labor supply shortage and continued interest rate hikes are only likely to create unnecessary pain and economic damage. The expectations at the beginning of the month were that the Fed would peak out at 5.5% and then normalize rates at 5.25% for the foreseeable future, essentially cutting out the prospect of any rate cuts after the cycle is done. The Fed’s commentary early in March suggested that they would not rest until inflation was beaten, which would almost certainly have sparked a significant recession. One element of the outlook that has changed since the failure of SVB is that the market is now pricing in a modest easing cycle of 50 bps back down to 4.75% by year end. All eyes will now be on the Fed and how they choose to respond to the failure of the 16th largest commercial bank. Given that its assets are not widely held by other banks and therefore not likely to cause capital pressure at other banks and nor are they large enough to cause market dislocation if they are sold, the Fed is not likely to suddenly take on a dovish tone.

The Market Outlook

The markets are a different animal. Markets are being forced to reconcile with the notion that the Fed will not come to rescue when this is all over. Multiples that were elevated by rampant cheap and available cash are unlikely to recover in an environment where investors can earn more than 4% with little to no risk. The failure of SVB only serves to underscore the re-pricing happening across the markets. That said, with the rise in overall volatility and fear, treasury yields have fallen dramatically, setting up for a solid month in the bond and credit markets. Though high yield is still struggling, diversification seems to be working for the moment in portfolios. While some of the volatility we are experiencing is coming from the fear of bank contagion and we see that as overblown, some of the volatility is also coming from fears that the recession may be deeper than had been currently priced in.

Recession Outlook

We started the month with an eye towards a short, shallow recession. However, the Fed’s fighting tone in their most recent comments gave us pause. If the Fed goes ahead with a 25 bps rate hike at the March Federal Open Markets Committee (FOMC) meeting this month, which was the consensus going into March, that outlook may still be on the table. If the Fed surprises with a 50 bps rate hike, then markets could be in for another bout of volatility and a much deeper recession could be ahead of us. While expectations for 2023 GDP growth continue to be revised up, expectations for 2024 growth continue to be revised down. Though, SVB was indeed a surprise and while it is having an impact on the pricing of banks generally, we don’t see that as significant enough to change our outlook for a recession. However, if the Fed communicates any willingness to ease even slightly by the end of 2023, we could escape a deep recession.

Net View

We continue to play defense with U.S. equities favoring quality and value. Yields still favor high grade credit and broad high-grade debt generally.