A Coin Flip: Summary

- The top-line strength of the labor market continues to give the Fed a clear path for further rate hikes. However, if you dig into the data, the labor market is in shortage, not overheating and showing signs of weakness.

- The probability of a recession is now a coin flip, with the Bloomberg U.S. Recession Probability Index now reading 50%. Equity markets are not priced for either a recession or for significantly higher interest rates across the curve.

- Fed funds futures are pricing in close to 4.75% for the fed funds rate, with rates remaining above 4.4% into 2023. This continues to put pressure on the short end of the curve while the long end is not keeping up, keeping the yield curve inverted.

You can read the full Market Update below.

Market Review: Rough Waters

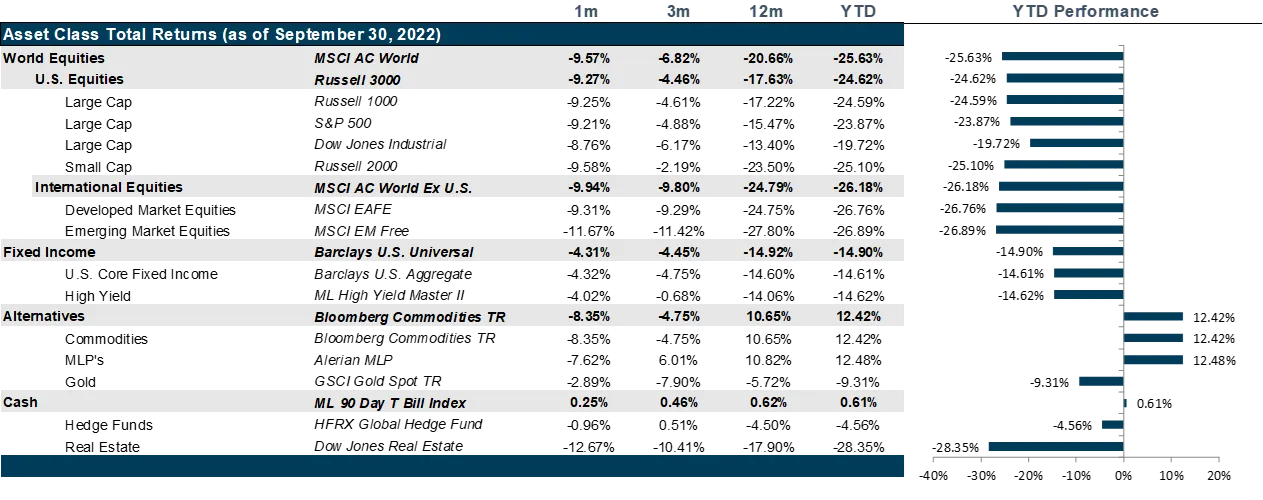

The S&P 500 was down 9.2% this September, the worst monthly decline since the pandemic started and the worst September since 2002, widening the year-to-date return from -16.15% to -23.88%. The Nasdaq also dropped 10.4%, with tech stocks taking a further hit to multiples with the latest interest rates hike hurting the six largest U.S. tech companies by more than $500 billion in a single-day sell-off in mid-September. While markets expected a rate hike in September, investors were caught off guard by the spike in the Consumer Price Index (CPI) despite falling oil prices. The fear of entrenched inflation drove a steep sell-off in stocks. With the CPI still hovering at 8.3% year over year, the Fed further increased rates by 75 basis points and pledged to keep increasing rates into 2023. The job market saw 263,000 jobs being added in September, reflecting a resilient labor market and clearing the way for further Fed rate hikes, thereby significantly increasing the chances of recession. The real estate market performed poorly, with some respite in the unlikely office real estate space as people return to the office.

European stocks ended September with sharp losses, falling 8.74% in U.S. dollar terms. This period saw an intensification in the energy crisis in Europe, with Russia shutting down Nord Stream 1 entirely, followed by pipeline damage and suspected sabotage. With this huge energy insecurity looming, Europe is rationing energy and industries are unable to function at full capacity. The U.K. is plunging into uncertainty driven by the new prime minister, Liz Truss, releasing a controversial budget and the pound crashing to a record low. The budget, which featured sweeping tax cuts, saw foreign investors fleeing from U.K. government bonds and the Bank of England stepping in to buy government bonds on a temporary basis to help restore orderly market conditions. The September announcement from the Bank of Japan that they would hold rates down caused the yen to fall to its lowest level in more than 20 years, leading the Japanese government to intervene, spending a record $20 billion in the currency markets.

Emerging markets performed poorly on the backdrop of the Fed raising rates and a strong dollar leading to fears of a global recession. Latin American markets fared better on a relative basis, ending down only 3.24% as commodities prices began to contract last month, but they still outperformed other markets. Chinese markets were down 14.5%, with economists increasingly pessimistic about China’s economic outlook for next year and expecting any rebound to be bumpy under Beijing’s COVID-zero strategy, with disruptions likely when the country fully reopens. In addition, China’s housing market continues to be in a crisis, with homebuyers refusing to make mortgage payments on unfinished buildings, which has led to home prices falling more than 20% this year.

The rise in rates has hammered bond markets across the world, with U.S. two-year and 10-year yields at 4.30% and 3.88%, respectively. The comparatively larger increase in two-year note yields relative to longer-maturity Treasury yields underscores increasing concern about how much further the Federal Reserve will hike interest rates to tame inflation. Given the low unemployment rates and the high degree of inflation, the market is now pricing in that the Federal Reserve will induce a growth recession or even a stagflationary recession that will lead to increased inversion of the yield curve and widen the corporate bond spreads as junk-rated companies struggle to service and refinance their loans.

After the largest OPEC production cut since the beginning of the pandemic, WTI crude hit $92, and Brent crude hit $97. Precious metals reversed trends, with gold and silver gaining amid increased demand in a very nervous marketplace. Industrial metals were a mixed bag, with most falling in September. However, concerns about a shortage in bauxite (iron ore), which is used in the manufacturing of aluminum, along with power outages and a government crackdown on polluting industries in China have disrupted the aluminum supply chain. In the crypto space, focus was on the Ethereum merger, as it changed the way it validated transactions on its ledger, reducing its electricity footprint from 8 GW to 85 MW.

Figure 1: Market Performance as of September 30, 2022

Going Forward: A Coin Flip

This month opened with a number of first-week news items that certainly will set the stage for what comes next. First, Australia hiked below expectations, stoking the hope in the U.S. that the Fed may take a similar view. The Fed staunched that with a vow to keep up the pressure. The market rallied on that hope, only to be met with the largest OPEC production cut since the pandemic. The rally fizzled with the certainty that inflation would remain and that the Fed could be stubborn enough to go head-to-head with OPEC. To make matters worse, the Great Resignation continues to make labor markets look healthier than they really are. Labor force participation has fallen, but primarily in the 55+ age group. This has left the labor market in shortage, driving up wages and keeping unemployment numbers down. And although the data is showing signs of weakening—such as the drop in job postings and the uptick in weekly jobless claims and the continued downward trend in the number of payrolls added to the labor market—to the non-economist, the headline numbers still look OK. But if the Fed remains on its path to raise the fed funds rate to 4.5% and keeps rates high through 2023, the economy will almost certainly take a nosedive. But more importantly, if OPEC continues to cut production amid already tight oil supplies, the effect of higher oil prices will ensure continued energy price inflation. If central banks around the world don’t follow the Fed, the dollar’s strength will kill international sales and the global economy. But if they do, then we could be plunged into a 1980s-style debt crisis. So much for a soft landing.

The Stagflation Scenario

That said, stagflation is now a possibility. If energy prices continue to act as a tax on consumption and food prices remain high while rents are increasing and credit card debt balloons with rates above 20%, then all the wage gains garnered by workers during the post-pandemic labor shortage will be more than lost to inflation. Meanwhile, demand will evaporate for all but the most necessary purchases. In this case, cash will be king, and next to cash will be anything that throws off steady and dependable streams of cash, though those will be harder and harder to find. Investments will have to remain defensive and essential, while balance sheets will have to be strong enough to weather the storm. Dollar strength will favor U.S. investments, with the more domestically oriented small and midcap markets looking more attractive by comparison. Going up the capital structure and holding high-quality debt will look even more attractive as bonds reprice and yields become very attractive relative to dividend yields. And above all, safety will matter most.

The Consumer Recession

One element of the Fed’s efforts that is indeed working is the hit on consumption since the pandemic reopening pop. Almost as soon as the Fed started increasing rates, consumption in the U.S. began to fall, showing up in the data by the June print. Though much of the current consumption continues through household credit card balances and other forms of leverage, the continued rise in interest rates will eventually crimp that. If the Fed is satisfied with a consumer-led slowdown in the economy, the outlook could be much less dire. In fact, in a scenario such as this, long-term growth investments look quite attractive. Growth at a reasonable price (GARP) is an investment style popularized in the 1990s, but its performance has occasionally outperformed when the outlook starts to lean in this direction.

The Fed Pivot

This may seem like an unlikely scenario based on Fed Chair Jerome Powell’s recent commentary, but it is not completely off the table. This would basically amount to a Fed wimp-out, which usually occurs when the Fed chair stares down into the abyss of global stagflation and realizes he doesn’t want to be *that* guy. Now, the Fed could remain resolute and bring down the global economy, but the Fed has a long track record of wimping out. In this case, OPEC goes head-to-head with the Fed by ensuring that inflation remains high, despite the Fed’s efforts, and the Fed recognizes the futility of driving the economy to the breaking point. In this case, the market will rally with a vengeance. But the next shoe to drop will be what the Fed does after the pivot. If the Fed keeps interest rates high, then the economy and the stock market may still be sluggish, but the markets will begin to achieve some semblance of stability.

Net View

We continue to prefer U.S. equities to international and emerging markets equities. We also continue to like high-grade credit on a risk-adjusted basis. However, given the uncertainty in the outlook and the risks to the downside, we must keep a balanced approach to growth and equity but keep a strong quality bias as a hedge against the downsides.