Market Update

Last week we got the big policy news investors were hoping for – a tariff deal with China that brought the general tariff rate on Chinese imports down to 30%. Although temporary and only lasting 90 days, the fact that an agreement of a significant reduction in tariffs was reached suggests that the current administration is more willing to work with other countries on bringing down tariff rates than previously thought. As expected, the market experienced a strong rally last week on the back of this good news – with the S&P 500 ending the week up over 5% and up almost 2% for the year, sitting 3% below its all-time high. On Friday we got preliminary numbers for consumer sentiment in May, which continued its downward trend – and inflation expectations increased for both Republicans and Democrats. However, given that most of the survey was conducted before the China tariff deal, it’s likely that we’ll see a bounce back in sentiment next month.

One of the big questions now regarding the market is where do we go from here? S&P 500 valuations are slightly above pre-Liberation day levels with the S&P 500 forward P/E standing at 21.3, and yet a lot of tariff uncertainty remains. It seems that the market is pricing in additional good news. If tariff deals aren’t reached with other big trading partners (Europe, Japan, and Vietnam among others) or if the deals are underwhelming, it’s likely that we’ll see another pullback in the market. No matter the outcome of future policies, we expect periods of elevated volatility to continue for the rest of 2025.

CPI – April Inflation

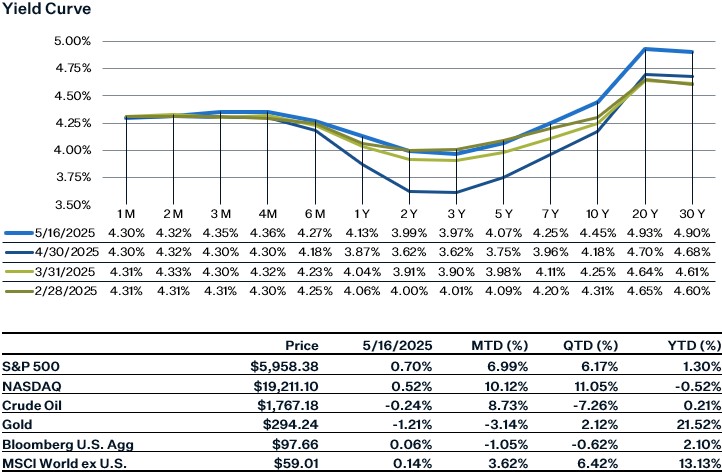

U.S. inflation came in softer than expected in April, with core CPI easing slightly to 2.78% year-over-year from 2.79% and headline CPI falling to 2.31% from 2.39%. The decline was partly driven by a 0.2% month-over-month drop in food prices, including a sharp 12.7% fall in egg prices. Energy prices rose modestly, led by natural gas, while gasoline declined 0.1%. Notably, goods categories exposed to tariffs, such as new vehicles and apparel, did not see the expected price increases, suggesting retailers may be absorbing higher costs or selling pre-tariff inventory. At the same time, discretionary services weakened, airfares dropped 2.8% and lodging dipped 0.1%, pointing to softer consumer spending and reduced international travel. Core services inflation remained sticky, rising 0.29% month-over-month, with shelter costs still elevated despite some easing. Overall, while April’s data show limited near-term pass-through of tariff-related pressures, future increases remain a risk as affected goods move through the supply chain. Given these dynamics, the Fed is expected to stay in a wait-and-see mode, with markets now pricing in a 25-basis-point rate cut in September and another by year-end.

Retail Sales and Consumer Health

Retail sales in April were slightly underwhelming, with retail sales up 0.1% month-over-month in April compared to 1.75% in March. Core retail sales (ex-autos, gas, building materials, food services) came in lower than expected, falling 0.2% for the month. Core categories that were the weakest were sporting goods stores (-2.5%), miscellaneous store retailers (-2.1%), and department stores (-1.4%). The strongest categories were furniture stores (+0.3%) and electronics and appliances stores (+0.3%), with some of that strength most likely coming from people rushing to buy ahead of tariffs. With China tariffs temporarily reduced and the labor market remaining healthy, there could be some further front-loading of spending in the next couple of months.

Despite that retail sales in April weren’t that strong, other consumer measures continue to suggest that the consumer remains in a good position. The Federal Reserve of Bank of New York released their quarterly report on Household Debt and Credit last week, and overall consumer health is unchanged from last quarter. Total consumer delinquencies by balances remain roughly the same as last quarter, and transition rates into serious delinquencies (90+ days) remained relatively unchanged for credit card and auto loans. One thing to note is the sharp rise in student loan delinquencies. The percentage of student loan balances that are 90+ day delinquent rose from 0.53% in Q4 of last year to 7.74% in Q1, as the Department of Education ended their 5-year pause of student loan payment collection.

Sources:

https://www.bls.gov/news.release/cpi.nr0.html

https://www.census.gov/retail/sales.html

https://www.newyorkfed.org/microeconomics/hhdc

https://markets.jpmorgan.com/jpmm/research.article_page?action=open&doc=GPS-4983945-0