Welcome, fall—or, in investing, welcome to the season of unpredictability. Historically, September is traditionally thought to be a down month for equity markets. October, too, has seen record drops in 1907, 1929, 1987, and 2008.

These marked the onset of the Panic of 1907, the Great Depression, Black Monday, and the Great Financial Crisis . As a result, some investors believe that September and October are the most volatile and unpredictable months in the stock market.

Fall 2022 could be no different. Markets have rebounded from midsummer lows. Nevertheless, there is plenty of economic and fiscal ambiguity today. The US Federal Reserve Bank is rapidly tightening financial conditions to calm inflationary pressures via interest rate hikes and a reduction of monetary supply. This could put downward pressure on equity valuations and potentially drive prices lower. Recently, most of the equity downturn has come from rate increases and much less from stock earnings downgrades, at least at the index level. Is your portfolio ready for that potential uncertainty? Is there an existential event that could cause a large market disruption? Who knows? What if there were a better way to manage these known and numerous unknown risks?

We believe that leveraging a custom, defined-outcome, options-overlay equity index solution could be an effective way to mitigate market risk. This would basically allow investors to keep one foot in a potentially rising market while keeping one foot out. This type of strategy helps alleviate some of the psychological effects that euphoric or pessimistic markets have on investors. This strategy attempts to preserve equity-like returns in rising markets while also trying to provide protection from losses in hostile ones. We believe this strategy makes the most sense for investors who are uncomfortable with pure equity risk or those who are uncomfortable with current market levels or uncertainty.

Controlling risk is paramount to investment management and long-term client success. We subscribe to the mantra “If you lose less money, you make more over the long term.”

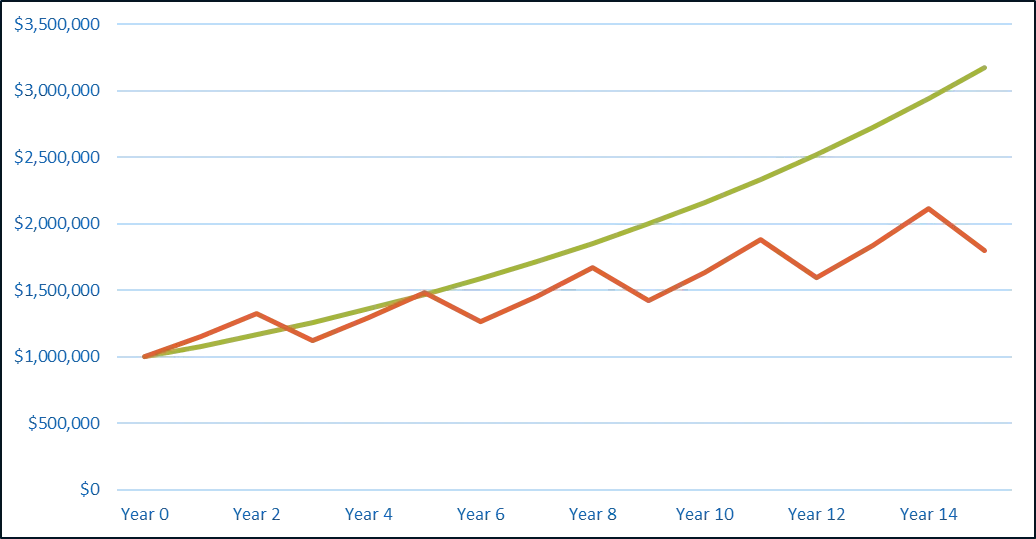

The importance of focusing on downside protection is illustrated in the following example of two $1 million portfolios. Please note this chart is hypothetical.

Portfolio 1, using an example of the aforementioned options-overlay equity index strategy, sees a steady 8% growth each year with no down years. Portfolio 2 is up 15% in each of the first two years and down 15% in year three, and then it repeats itself over 15 years. The long-term results are stunning: Portfolio 1 would have an estimated value of approximately $3.172 million versus $1.795 million for the second portfolio. That’s a $1.377 million, or 77%, difference just from managing volatility. We didn’t pick better stocks; we intentionally reduced the downside with a mathematical options program. This is achievable and repeatable, and it can produce more consistent results.

Remember the mantra—if you lose less money, you make more over the long term.