Everyone hates to lose money on an investment. But a thoughtful tax-loss harvesting strategy may help offset short and long-term gains, improve your bottom line, and help keep you positioned for long-term growth.

While tax-loss harvesting is often discussed as a year-end tactic for individuals seeking to potentially improve their current year’s taxes, at Lido it is often a core principle and ongoing behind-the-scenes tactic in portfolio management intended to improve tax efficiency or address specific portfolio challenges. Here’s how it can work:

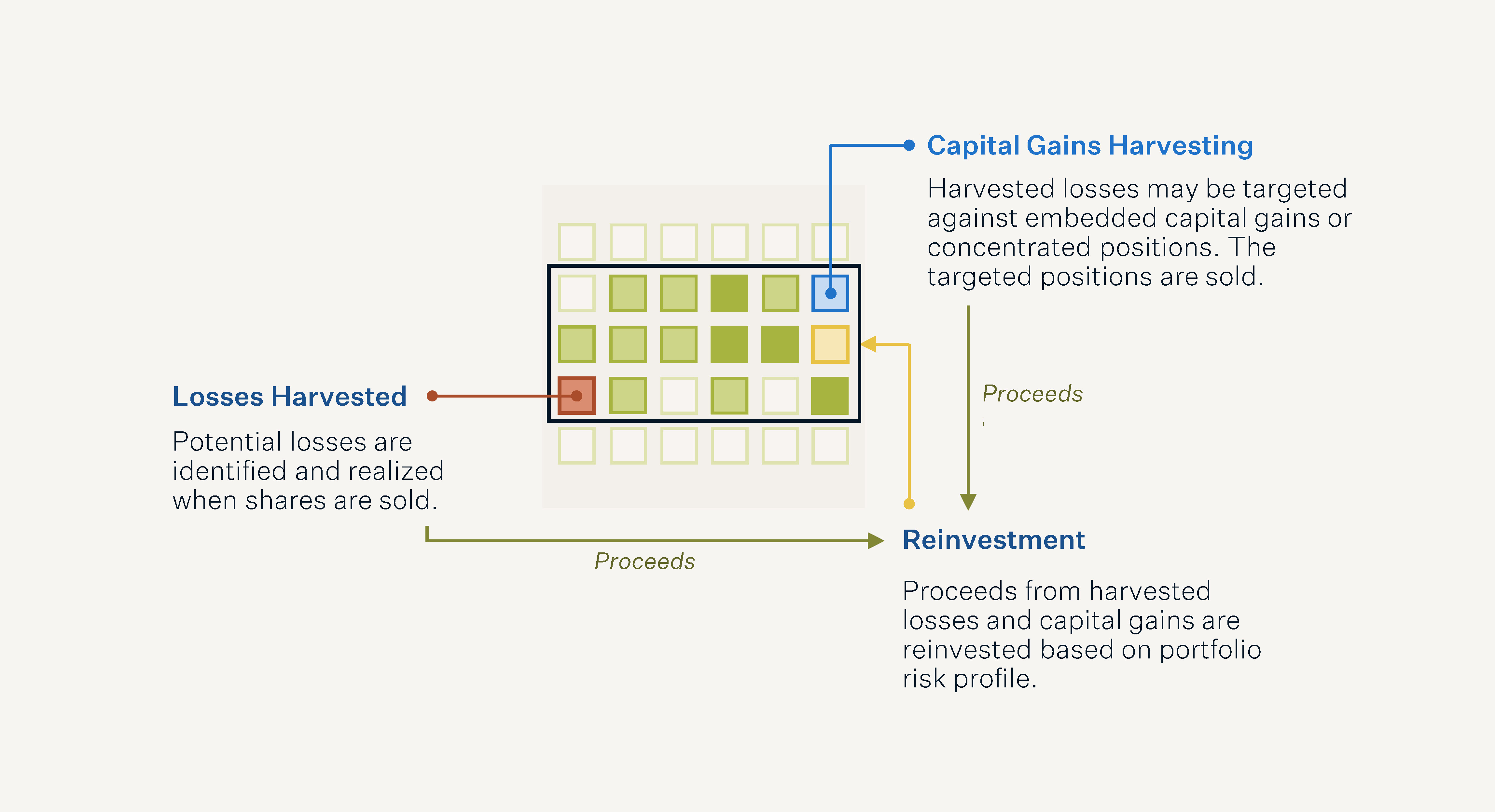

Sell. Offset. Reinvest.

Tax-loss harvesting is a flexible tool that can be used for a wide range of objectives. Let’s assume you have a substantial legacy position with considerable unrealized capital gains. Selling down the position to diversify your portfolio may be a good idea. Unfortunately, capital gains taxes may take a bite out of your profits.

Step 1: Identify losses to harvest

In addition to the concentrated legacy position, you also hold a broadly diversified portfolio such as an index. At any given time, you may be holding stocks that have a lower price than when you bought them. Tax loss harvesting begins by identifying potential losses and selling the position.

Step 2: Set a loss budget

Harvested losses give you a budget to target against embedded capital gains in the concentrated position. The positions are sold to offset the capital gains exposure.

Step 3: Reinvestment

The core of a thoughtful tax loss harvesting plan is to reinvest the proceeds of the harvested losses and realized capital gains into a diversified portfolio that keeps you on track toward your long-term objectives.

Stay positioned for growth

Completing the cycle of selling shares and reinvesting the proceeds is critical for staying on track toward long-term goals. Reinvestment may be based on either of two criteria:

- Closest match: Reinvestment in the closest matching stock in terms of sector or industry to maintain the targeted asset allocation.

- Factor analysis: Reinvestment may be targeted through factor analysis in terms of risk or according to ESG or other objectives.

Every market has a mix of gainers and decliners. Tax-loss harvesting can turn an unrealized loss to your potential advantage while keeping positioned to meet your objectives.

Lido does not provide legal or tax advice. Lido's affiliates, including, but not limited to, Lido Tax, LLC ("L-Tax") and affiliated third-party legal professionals will, from time to time, provide legal services or tax consulting services for Lido's clients. Prospects and clients are urged to seek the advice of their own independent lawyers or tax advisor in the event those services are required.